Good morning.

The Fast Five → Inflation picks up hotter than expected, traders shrug it off, voters blame businesses more than Biden, Boeing Max crisis forces airlines to cut flights, and an organized crime ring plaguing retailers -busted…

Calendar:

THU 3/14: Producer price index (PPI), 8:30am ET

Your 5-minute briefing for Wednesday, March 13:

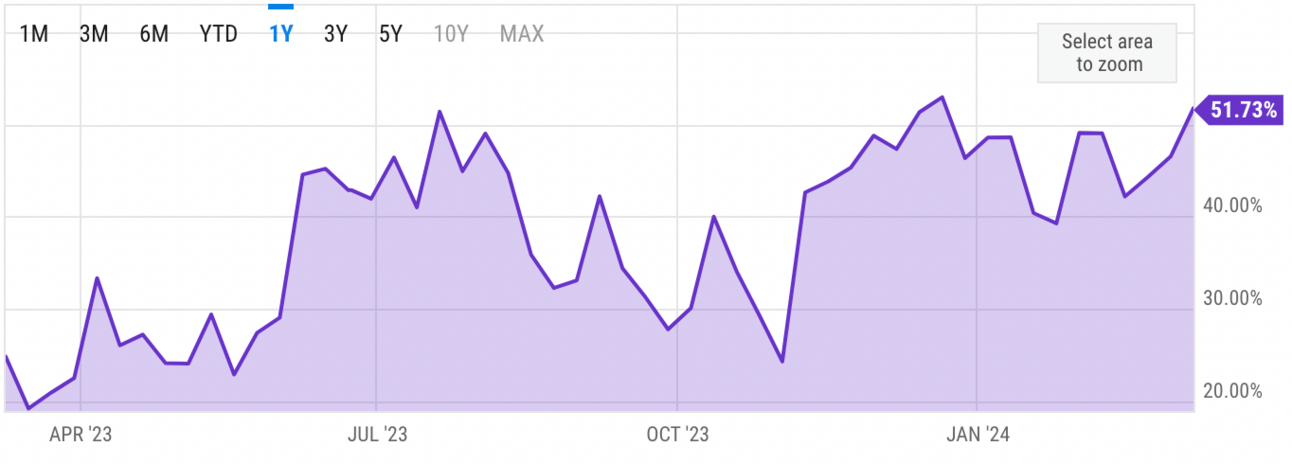

US Investor % Bullish Sentiment:

51.73% for Wk of Mar 07 2024 (Last week: 46.50%)

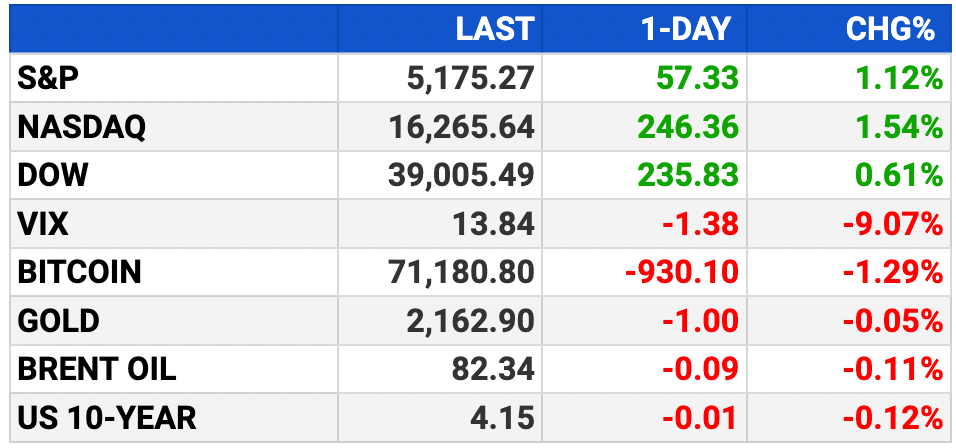

Market Recap:

Stock futures steady Tuesday night after S&P 500 hits new high

Dow futures down 10 points, S&P 500, Nasdaq 100 flat

Markets rally Tuesday despite mild inflation rise in Feb

Nvidia stock up 7%, key indicator in broadening market

Dollar Tree reports this morning, Lennar after close

EARNINGS

What we’re watching this week:

Today: Lennar LEN, Williams-Sonoma (WSM)

Dollar Tree (DLTR) - earnings of $2.65 per share (+29.9% YoY) on $8.7B in revenue (+12.3% YoY)

Thursday: Dick's Sporting Goods (DKS), Ulta Beauty (ULTA)

Adobe (ADBE) - earnings of $4.38 per share (+15.3% YoY) on $5.1B in revenue (+10.3%)

Full earnings calendar here

HEADLINES

Inflation picks up to 3.2%, slightly hotter than expected (more)

Here’s the inflation breakdown for February 2024 (more)

Inverted yield curve no longer reliable recession flag, strategists say (more)

Gasoline, shelter costs boost US prices; inflation still slowing (more)

Voters blame businesses more than Biden for sticky inflation (more)

US budget gap hits $828B in five months on interest costs (more)

IBM is slashing jobs in marketing and communications (more)

CVC’s beauty chain Douglas sets terms for $991M IPO (more)

Goldman Sachs seeks to expand private credit portfolio to $300 billion in five years (more)

Boeing whistleblower found dead of apparent suicide (more)

Intel survived bid to halt millions in sales to China's Huawei, sources say (more)

Thomson Reuters has $8 Billion war chest for AI-focused deals (more)

Most subscription mobile apps don’t make money, new report shows (more)

TOGETHER WITH BETTERMENT

Make Your Money a Multitasker.

With Betterment's expert-built ETF portfolios, you’re automatically diversified across thousands of stocks and bonds at once. These expert-built portfolios are designed to help reduce risk, regardless of what’s happening in the market.

- please support our sponsors -

DEALFLOW

M+A | Investments

ArcelorMittal to buy 28.4% stake in Vallourec for about $1B (more)

Hg said to kick off $1 bln sale of Telematics firm track unit (more)

Scholastic to buy kids’ content Studio 9 Story for $185M (more)

Immedica’s owners consider sale of Swedish pharma firm (more)

National Bank of Canada weighs options for Cambodian unit (more)

KKR to invest $400M in Philippine telecoms tower business (more)

Civo, a pure-play cloud-native service provider, acquired Kubefirst, an open-source GitOps platform for Kubernetes, from Kubeshop (more)

Linden Capital Partners purchases Alcresta (more)

BlackRock buys portfolio of solar energy and solar plus storage projects from Excelsior (more)

VC

Applied Intuition, a vehicle software supplier for automotive, trucking, construction, and other industries, raised $250M in Series E funding, at $6B valuation (more)

LactaLogics, a company specializing in human milk-based nutrition, raised $92M in funding (more)

Bear Robotics, a company specializing in service robotics and artificial intelligence solutions, raised $60M in Series C funding (more)

Eclipse Labs, a software firm contributing to the development of the first Ethereum layer-2 using the Solana Virtual Machine, raised $50M in Series A funding (more)

Ocient, a data analytics software solutions company, raised $49.4M in funding (more)

Empathy, a company providing a support system for loss, raised $47M in Series B funding (more)

CodeMatrix, a company providing an AI solution for healthcare revenue management, raised $40M in Series B funding (more)

Nanonets, a provider of an AI-based workflow automation platform for business processes, raised $29M in Series B funding (more)

Quaise Energy, a terawatt-scale geothermal company, raised $21M in Series A1 funding (more)

Adaptive ML, a startup enabling companies to improve generative AI models on users’ interactions, raised $20M in seed funding (more)

Tavus, a generative AI video research company, raised $18M in Series A funding (more)

Axion Ray, a provider of an AI-powered observability command center, raised $12.5M in Series A funding (more)

Prescient AI, a company specializing in AI media measurement and optimization, raised $10M in Series A funding (more)

Pienso, a company offering an interactive AI platform to turn text data into insights, raised $10M in new funding (more)

Loop, a SaaS provider enabling restaurants to maximize their third-party delivery service profitability, raised $6M in Seed funding (more)

Foundation Health, a healthcare technology company, raised $6M in Seed funding (more)

Legends, a provider of a confidence-training platform for kids, raised $6M in Seed funding (more)

Milu Health, a health tech company using AI for cost savings in healthcare, raised $4.8M in Seed funding (more)

CRYPTO

BULLISH BITES

💄 Criminal: Inside the organized crime rings plaguing retailers including Ulta, T.J. Maxx and Walgreens.

🛑 Roadblock: A top auto safety group tested 14 partial automated systems — only one passed.

🏆 Pay to play: Dating apps have hit a wall. Can they turn things around?

🚙 Toys: Electric broncos.

💰 Don’t put if off: Make a date with your money and compare top financial advisors in your area, matched to your specific needs -for Free. Try it » *

*from our sponsor

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.