☕️ Good Morning.

The Fast Five → Inflation ticks up to biggest jump since January, Wall Street shrugs, Kim meets Putin in Russia for rare summit, China’s iPhone ban appears to be retaliation, Citi to cut jobs - revamp top management, and Starbucks founder steps down from board…

Here’s your MarketBriefing for Thursday:

BEFORE THE OPEN

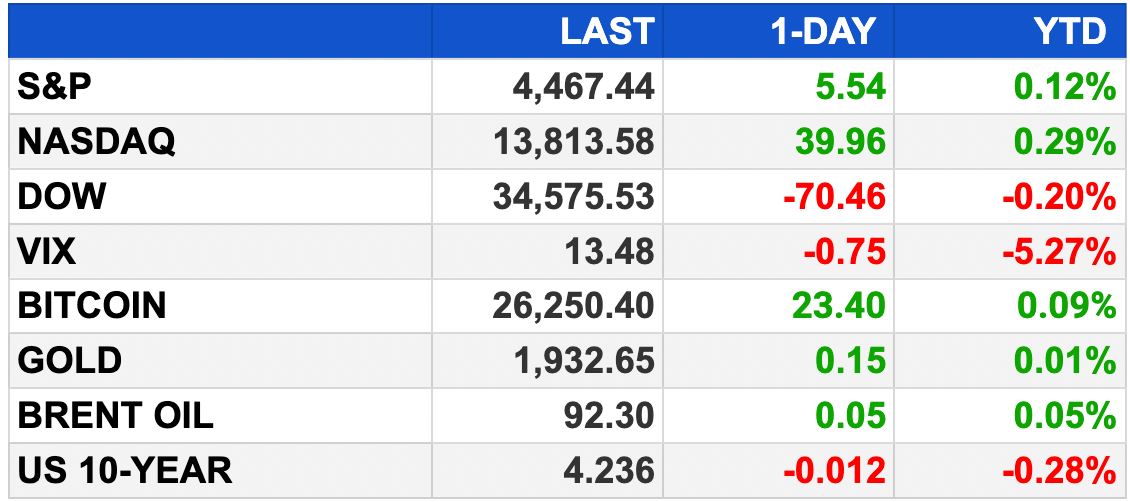

As of market close 9/13/2023.

MARKETS:

Stock futures near flat line ahead of August PPI

Dow futures up 0.03%, S&P 500 up 0.09%, Nasdaq 100 up 0.1%

Dow falls 0.2% in regular trading, Nasdaq up 0.3%, S&P 500 gains 0.1%

August core CPI beats estimates at 0.3% monthly and 4.3% annually

Fed expected to keep rates unchanged, 97% likelihood according to CME FedWatch Tool

Market volatility likely to persist despite unchanged rates

48% probability of rate hike at November meeting

Upcoming: August producer price index expected to rise 0.4%

Adobe earnings report expected after Thursday's market close

NEWS BRIEFING

Inflation ticks up to 3.7% - key takeaways from US August CPI report (more)

Apple and Huawai's smartphone rivalry divides China (more)

China’s Apple iPhone ban appears to be retaliation (more)

Bankers’ 40% pay cuts show the China dream fading in its richest cities (more)

Apple lodges confidentiality protest on Day 2 of Google antitrust trial (more)

New offer from Ford to UAW is 'most lucrative' in 80 years, CEO says (more)

Citi plans job cuts as It revamps top management structure (more)

Tesla unveils Powerwall 3, this time with a built-in solar inverter (more)

Starbucks founder Howard Schultz steps down from board (more)

JPMorgan, Bank of America dangle 14% field to get rid of risky M&A debt (more)

D1’s big bets on venture capital are weighing down its returns (more)

De Beers ends lab-grown engagement diamonds foray as prices drop (more)

H&M to sell second-hand clothes at London store (more)

Caesars Entertainment paid millions to hackers in recent attack (more)

Blackstone names new credit boss in bid to be $1 Trillion lender (more)

Was this briefing forwarded to you? (Sign up here.)

DEALFLOW

Denodo, a data management company, received a $336M investment From TPG Growth in a Series B preferred equity (more)

Sierra Ventures, a venture capital firm, closed its 13th fund, at $265M (more)

Lyten, a company specializing in 3D graphene decarbonizing supermaterials, raised $200M in Series B Equity funding (more)

VideoAmp, an adtech company providing measurement, data and software solutions, raised $150M in Series G funding (more)

Enfabrica, a silicon and software company, raised $125M in Series B funding (more)

Arialys Therapeutics, a biotechnology company advancing therapeutics for autoimmune neuropsychiatry, raised $58M in Seed funding (more)

Tarana, a fixed wireless access (ngFWA) technology company, raised $50M in funding (more)

Kin, a direct-to-consumer home insurance company, raised $33M in Series D extension funding (more)

Sempre Health, a provider of a solution for behavior-based healthcare pricing, raised $20M in additional funding (more)

Pulsora, a provider of a platform for enterprise sustainability management, raised $20M in Series A funding (more)

Performio, an incentive compensation-software company, received $13M in debt financing (more)

Sonera, a neural data company, raised $11M in Seed funding (more)

Deduce, a provider of a patented technology platform designed to prevent AI-generated identity fraud, raised $9M in funding (more)

Vaxess Technologies, Inc., a life sciences company developing a shelf-stable vaccine patch with potential for self-application, raised an additional $9M in venture capital funding (more)

AuthMind, an Identity SecOps company, raised over $8.5M in Seed funding (more)

DeLorean Artificial Intelligence, an AI technology development company, raised $7.55M in Series A funding (more)

Science On Call, a provider of an AI-powered help desk for restaurants, raised $2.6M in Seed funding (more)

Vieu, a provider of a B2B sales platform, raised $2M in seed funding (more)

Biodel, a regenerative agriculture company, raised an undisclosed amount in Series A funding (more)

Starc Systems, a company specializing in reusable temporary containment solutions for occupied renovations, received an investment from North Branch Capital (more)

Veza, an identity security company, received an investment from The Syndicate Group (more)

CRYPTO

Coinbase CEO confirms exchange will support lightning, which dramatically speeds up Bitcoin payments (more)

Mila Kunis and Ashton Kutcher’s ‘Stoner Cats’ NFTs get smoked by the SEC (more)

PayPal partner Paxos overpaid $510,750 in the largest USD Bitcoin transaction fee ever (more)

FTX approved to start selling its $3.4 Billion Crypto hoard (more)

BULLISH BITES

🤡 NFTs, Once Hyped as the Next Big Thing, Now Face ‘Worst Moment’

The market for NFTs has plummeted — and may have further to fall → Bloomberg

🎥 [Video] Alex Hormozi interviews Dave Ramsey on wealth creation and business advice 🔥 → YouTube

🤝 Goldman to spread $100M of its wealth across rural small businesses

Small businesses have struggled post-pandemic to adapt to multi-pronged pressures from costlier goods and services as well as acute worker shortages. Goldman Sachs announced plans to invest $100 million in rural U.S. communities, deepening its efforts to bolster small businesses. → Axios

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have any suggestions for MarketBriefing? We’d love to hear it.

Share your thoughts here -mb