☕️ Good Morning.

The Fast Five → Henry Kissinger dies at age 100, Elon Musk curses out ‘blackmailing’ advertisers, Nvidia CEO: US chipmakers a decade away from China supply chain independence, nobody wants Treasury bonds, and Microsoft secures a board seat at OpenAI…

Your 5-minute briefing for Thursday:

BEFORE THE OPEN

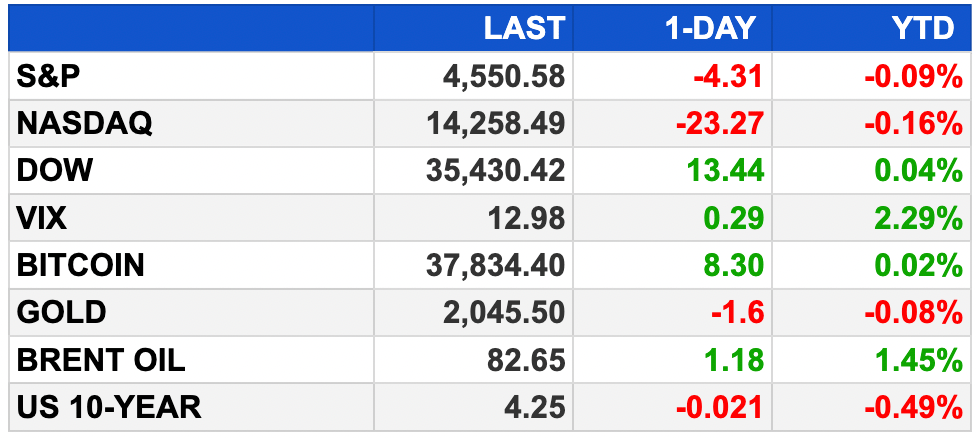

As of market close 11/29/2023.

MARKETS:

U.S. stock futures rise, capping off a positive November.

Dow up 99 points (0.28%), S&P 500 and Nasdaq 100 futures gain.

Salesforce, Snowflake, and Nutanix surge on strong earnings.

Major indexes near year-to-date and 2023 highs.

November delivers strong gains, breaking a three-month losing streak.

S&P 500 up 8.5%, Nasdaq rises nearly 11%, Dow gains 7.2%.

Strategist Jay Woods remains bullish despite higher rates.

Earnings reports from Big Lots, Express, Kroger, and October consumption and weekly jobless claims data to watch.

EARNINGS

Here’s what we’re watching this week:

Today:

Ulta Beauty (ULTA) - expected: $4.96 per share (-7.7% YoY) on $2.5 billion revenue (+6.0% YoY)

Full earnings calendar here

NEWS BRIEFING

Henry Kissinger, the towering American diplomat, dies at age 100 (more)

A $30 billion meltdown in clean energy puts Biden’s climate goals at risk (more)

US third-quarter growth revised higher; corporate profits rise strongly (more)

Treasury seeks expanded sanctions powers in digital space (more)

US Supreme Court weighs legality of SEC in-house enforcement (more)

The $7 trillion ETF boom bets blamed again for dumb stock moves (more)

More Americans are ‘doom spending’ (more)

OPEC+ talks continue with prospect for deeper oil cuts unclear (more)

Elon Musk claims advertisers are trying to ‘blackmail’ him, says ‘Go f--- yourself’ (more)

Microsoft secures non-voting board seat at OpenAI (more)

Disney CEO Iger promises 2026 exit, says ABC not for sale (more)

After Munger's death, Berkshire succession comes into focus (more)

Walmart shifts to India from China for cheaper imports (more)

GM sees $9.3 billion hit from labor deals, outlines $10 billion stock buyback (more)

GM to slash spending at Cruise by ‘hundreds of millions of dollars’ (more)

Apple and Google avoid naming ChatGPT as their ‘app of the year,’ picking AllTrails and Imprint instead (more)

The Cybertruck made a mark but missed its moment (more)

TOGETHER WITH TRADINGVIEW

Where the world charts, chats, and trades markets —

- Please support our sponsors -

DEALFLOW

US health insurers Humana, Cigna in talks to merge (more)

Broadcom to review strategic options for two VMware units (more)

Cartier owner Richemont won't inject cash into Farfetch (more)

Alter Domus owners pursue stake sale in fund administrator (more)

KKR to buy remaining stake in insurer Global Atlantic for $2.7 billion (more)

Ardian acquires 15 percent stake in Heathrow (more)

PE-backed Lineage Logistics eyes over $30B valuation in IPO (more)

Tola Capital, a venture capital firm investing in the next generation of enterprise software enabled by AI, closed Tola Capital III, at $230M (more)

Candex, a vendor management and tail spend solutions provider, raised $45M in Series B funding (more)

Arrivo BioVentures, a biopharmaceutical company, raised $45M in Series B funding (more)

Kahuna Workforce Solutions, a provider of operational skills and competency management software, raised $21M in Series B funding (more)

Biolexis, a clinical stage AI-driven drug discovery company, raised $10M in Series A funding (more)

Every.io, a provider of a back office stack for startups, raised $9.5M in Seed funding (more)

Revela, a provider of a property management solution, raised $9M in Series A funding (more)

Aperiam Bio, a protein engineering company, raised $9M in Seed funding (more)

Mummolin, a Bitcoin mining software company, raised $6.2M in Seed funding (more)

Savage Medical, a clinical-stage medical technology company, raised over $3M in total funding (more)

Quantum Simulation Technologies, a quantum simulation technology company focused on drug discovery and other industry research and development, raised $2.5M in funding (more)

Yard Stick PBC, a soil carbon measurement technology company, closed its final Series A tranche of $1.4M (more)

Letterhead, an AI email newsletter software platform provider, raised a seed funding round of undisclosed amount (more)

Nanochon, a company provider of solutions for sports medicine physicians, received an investment from cultivate(MD) Capital Funds (more)

Inszone Insurance Services, an insurance brokerage firm, received an investment from Lightyear Capital (more)

Entrepreneur Media, publisher of Entrepreneur magazine and Entrepreneur.com, launched a new venture capital fund called Entrepreneur Ventures (more)

M & A:

Was this briefing forwarded to you? (Sign up here.)

CRYPTO

BULLISH BITES

⏳ Timeless: The Charlie Munger principles to invest and live by.

🤷🏻♂️ Nowhere man: It looks like Mark Cuban doesn't want to be Mark Cuban anymore.

👌 Tech's New Normal: Microcuts over growth at all costs.

🙈 Hall Of Shame: The 10 most dubious people ever to make the 30 under 30 list.

📚 Match-maker: Connect with the best financial advisor for your needs from WiserAdvisor.com - a free, independent and unbiased matching service. Just answer a few questions and get matched with 2-3 advisors in your area.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

Send us your message -mb