Good morning.

The Fast Five → Trump’s Day-One agenda, bond market sends warning to Trump, Apple has worst day since August, Tesla’s offering Cybertruck discounts, and BlackRock predicts another historic year for Bitcoin…

🚨 Market Warning: Is BTC Just the Start?

Missed out on the AI craze, or BTC's 40% jump? 50-year Wall Street veteran Marc Chaikin just detailed another way to play this market rally. Learn more here »

- a message from Chaikin Analytics

Calendar: (all times ET) - Full Calendar

Today:

Housing starts, 8:30A

Industrial production, 9:15A

Monday:

None scheduled, Martin Luther King Jr. holiday

Your 5-minute briefing for Friday, January 17:

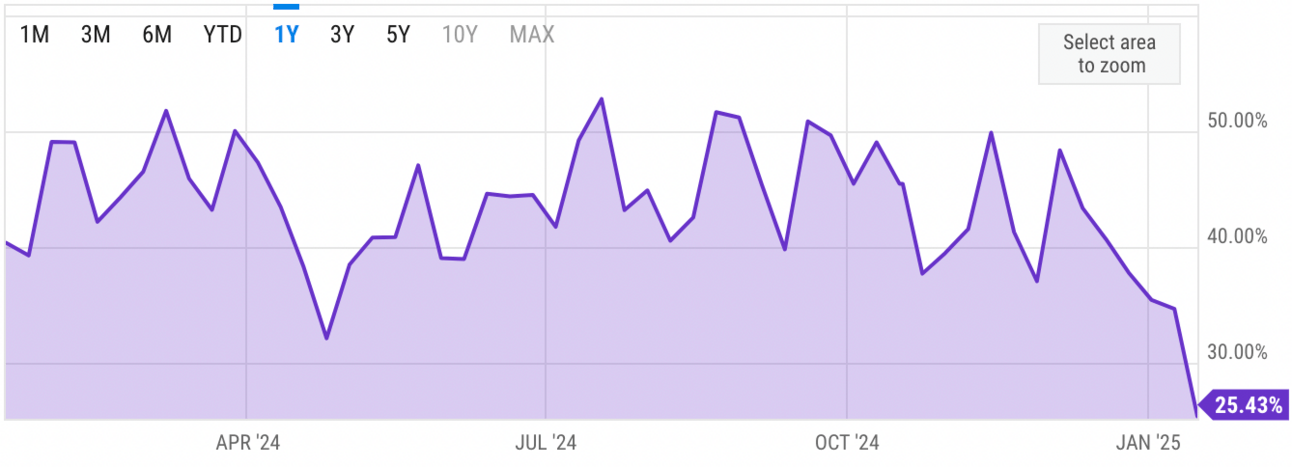

US Investor % Bullish Sentiment:

↓ 25.43% for Week of January 16 2025

Previous week: 34.67%. Updates every Friday.

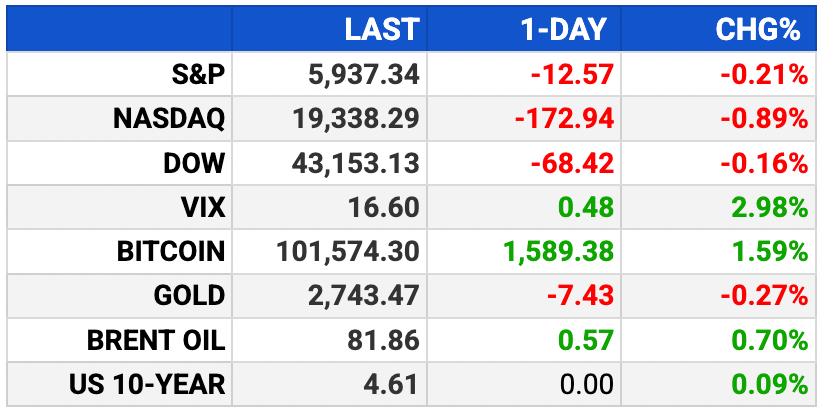

Market Wrap:

Futures dipped slightly after Dow, S&P ended 3-day losing streak.

J.B. Hunt fell 10% post-earnings miss; Old Dominion Freight -2%.

Apple -4%, dragging Nasdaq down 0.89%; Dow -68 points.

Markets face uncertainty with Treasury swings, Trump tariffs, unclear Fed path.

Bank earnings, housing data on deck before Friday’s open.

EARNINGS

Here’s what we’re watching:

Today:

SLB (SLB) - earnings of $.90 per share (+4.7% YoY) on $9.2B revenue (+2.2% YoY)

HEADLINES

Inflation revival persists as market risk despite CPI-fueled rally (more)

Oil heads for fourth weekly advance as market girds for Trump (more)

Investor interest in defense grows (more)

Trump team readies oil sanctions plan for Russia deal, Iran squeeze (more)

Trump's Treasury pick to tout "new economic golden age" (more)

Wall St banks had a great quarter, and the boom times are just starting (more)

Banks hand $100 bln to shareholders, most since 2021 (more)

Apple has worst day since Aug following reports of China, AI struggles (more)

Microsoft CEO dined with Trump, Musk at Mar-a-Lago (more)

EV sales up 25% globally, 20% US in record 2024 (more)

Tesla is offering Cybertruck discounts as EV market gets crowded (more)

BlackRock predicts another historic year for crypto (more)

Goldman Sachs’ David Solomon tells startups to reconsider going public (more)

TOGETHER WITH 6AM CITY

Reasons you should be a Locked On NBA insider

What’s up, NBA fans! From our expert hosts who cover your team every day on our podcasts, we offer a free daily newsletter delivered right to your email so you don’t miss any of the action on the court. Get expert analysis, game previews, post-game breakdowns, trade talk, draft coverage, and more. We curate your daily ticket to everything NBA, giving you the rundown for each NBA team and the league news you need to know. Be one of thousands of fans who are already insiders - fast and easy.

DEALFLOW

M+A | Investments

Rio Tinto and Glencore discuss potential merger (more)

Doorvest, a real estate investing platform designed for the process of owning passive income rental homes, acquired Rubik, a company specializing in off-market single-family rental deals (more)

Enable, an AI-powered rebate management company, acquired Flintfox, an Auckland, New Zealand-based company developing a pricing engine (more)

Xuron, a healthcare technology company, received an investment from 3LS Ventures (more)

CH4 Global, a metha ne-reducing company, received an investment from Chipotle Mexican Grill (more)

Plantible, an integrated biology company developing plant-based protein, received an investment from Chipotle Mexican Grill (more)

VC

Netradyne, a SaaS provider of AI and edge computing solutions, raised $90M Series D funding (more)

Prophecy, a data copilot company, raised $47M in Series B extension funding (more)

Eve, an AI platform for plaintiff law firms, raised $47M in Series A funding (more)

GT Medical Technologies, a medical device company, raised $37M in Series D funding (more)

1Money, a company developing a purpose-built Layer 1 designed for stablecoins payments, raised over $20M in funding (more)

Micron Biomedical, a life science company developing needle-free tech for drugs and vaccines, raised $16M extending its Series A funding to $33M (more)

Truewind, a company providing digital accounting services for personnel, raised $13M in Series A funding (more)

Upward Health, an in-home, multidisciplinary medical group providing 24/7 care, raised $12.5M in debt funding from Trinity Capital (more)

Guidesly, a software platform for outdoor recreation guides, raised $9.5M in Series A funding (more)

Alium, a buyer intelligence company, raised $7M in Seed funding (more)

VisiRose, a clinical-stage biotech company, raised $3M in Seed funding (more)

CRYPTO

BULLISH BITES

🇺🇸 A dealmaker is back in the White House. Will the deals follow?

💰 Mark Cuban is ready to fund a TikTok alternative.

🚁 NYC commuters get new way to dodge traffic: $95 helicopter rides.

🍩 SF pastry lovers are standing in 90-minute lines for gourmet doughnuts.

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.