Good morning.

The Fast Five → Fed rate decision on deck, Nvidia CEO rebuts fears of AI bubble, Apple is now worth $4,000,000,000,000, UPS discloses 48,000 layoffs, and Nvidia's $1B stake sends Nokia to decade-high…

📌 Tesla's About to Prove Everyone Wrong... Again — Back in 2018, when Jeff Brown told everyone to buy Tesla… The "experts" said Elon was finished and Tesla was headed for bankruptcy. Now they're saying the same thing, but Jeff has uncovered Tesla's next breakthrough. Click here to see why Tesla's about to prove everyone wrong... again → (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Fed Interest-Rate Decision, 2:00P

Powell Press Conference, 2:30P

Tomorrow:

Unemployment Claims (tentative)

GDP (tentative)

Your 5-minute briefing for Wednesday, Oct 29:

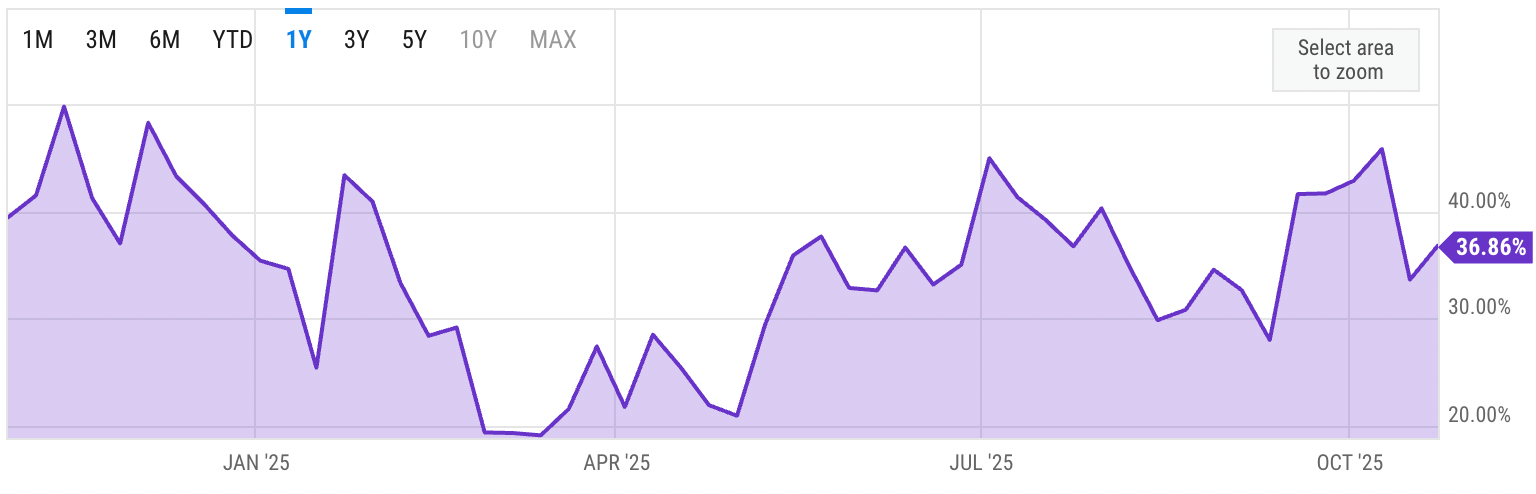

US Investor % Bullish Sentiment:

↑33.86% for Week of OCT 23 2025

Previous week: 33.66%

Market Wrap:

Futures steady: Dow –33 (-0.07%), S&P flat, Nasdaq +0.02%.

S&P hit 6,900 intraday; Dow +162; Nasdaq +0.8%.

Fed expected to cut 25 bps Wednesday; Powell’s tone in focus.

Markets still pricing in a December cut.

“Mag 7” earnings up next: Alphabet/Meta/Microsoft Wed; Apple/Amazon Thu.

Trump–Xi meeting may further ease tariff overhang.

Risks persist: high valuations + ongoing shutdown.

EARNINGS

Here’s what we’re watching this week:

Today: *Boeing $BA ( ▼ 0.72% ), Chipotle $CMG ( ▼ 1.13% ), Meta $META ( ▲ 1.69% ), Microsoft $MSFT ( ▼ 0.31% ), Starbucks $SBUX ( ▲ 1.76% ), *Verizon $VZ ( ▲ 1.25% )

*Alphabet $GOOGL ( ▲ 4.01% ) - $2.28 EPS (+7.5% YoY) on $100B revenue (+13.2% YoY)

THU: *Eli Lilly $LLY ( ▼ 1.34% ), Estee Lauder $EL ( ▲ 2.23% ), Reddit $RDDT ( ▲ 2.77% ), *Roblox $RBLX ( ▼ 3.79% ), *Roku $ROKU ( ▼ 0.61% ), Shake Shack $SHAK ( ▲ 0.41% ), *SiriusXM $SIRI ( ▲ 0.1% )

Amazon $AMZN ( ▲ 2.56% ) - $1.56 EPS (+9.1% YoY) on $177.7B revenue (+11.8% YoY)

Apple $AAPL ( ▲ 1.54% ) - $1.76 EPS (+81.4% YoY) on $102.1B revenue (+7.6% YoY)

FRI: *Chevron $CVX ( ▼ 0.46% ), *Exxon $XOM ( ▼ 2.44% )

While headlines scream "Tesla is doomed"...

Jeff Brown has uncovered a revolutionary AI breakthrough buried inside Tesla's labs.

One that is helping AI escape from our computer screens and manifest itself here in the real world all while creating a 25,000% growth market explosion starting as early as January 29.

- a message from Browstone Research -

HEADLINES

Wall St indexes post records as Nvidia jumps, megacap earnings ahead (more)

The Fed's decision is on deck. Here's what to expect (more)

Wall Street shrugs off credit worries even as more cracks emerge (more)

Americans are starting to get fed up with the shutdown (more)

Consumer confidence slips to 6-mo low; worries over job availability rising (more)

Gold hits three-week low amid US-China trade progress (more)

Oil steady after three-day drop with focus on Russia, stockpiles (more)

Ark Invest CEO Cathie Wood flags AI market correction risk (more)

Nvidia shines, nears $5B market cap after flurry of moves at GTC (more)

Nvidia's $1B stake sends Nokia to decade-high (more)

Tesla eyes internal CEO candidates if Musk leaves over pay vote (more)

Microsoft shares once again surpass $4 trillion valuation, joining Nvidia (more)

OpenAI completes restructure, solidifying Microsoft as a major shareholder (more)

UPS stock rallies after company discloses 48,000 layoffs (more)

DEALFLOW

M+A | Investments

Apple suppliers Skyworks Solutions and Qorvo agree to create $22B radio-chip giant

Microsoft & OpenAI reach restructuring deal, removing fundraising constraints

Cygnet Energy to acquire Kiwetinohk Energy in ~$1 billion deal

Barclays to buy US personal-loan firm Best Egg for $800M

Indico Data receives strategic investment from Aviva Ventures

VC

Fireworks AI, an AI inference cloud powering production AI applications for tech companies, raised $250M in a Series C funding round

Sublime Security, an agentic email-security platform, raised $150M in Series C funding

ConductorOne, an AI-native identity security platform provider, raised $79M in Series B funding

CoreStory, a code intelligence company, raised $32M in Series A funding

Syllo, a litigation workspace, raised $30M in growth funding

Agtonomy, a software and services company specializing in AI solutions for agriculture and land management, raised $18M in Series B funding

Uptiq.ai, an AI infrastructure for financial services, raised $12M in funding

Sweatpals, a fitness platform enabling people to build meaningful connections through movement, raised $12M in Seed funding

WideField Security, a platform offering complete visibility and protection for the entire identity lifecycle, raised $11.3M in Series A funding

Spacial, an AI-powered platform automating residential engineering and design workflows, raised $10M in Seed funding

Wild Moose, an AI-powered SRE platform acting as a first responder for production incidents, raised $7M in Seed funding

Cylerity, a healthcare fintech company, raised $4M in equity Seed funding

Flamingo, a platform for IT service providers, launched from stealth with $2.2M in pre-Seed funding

iPNOTE, a legal tech platform that streamlines intellectual-property management workflows, raised $1M in Deed funding

CRYPTO

BULLISH BITES

💼 What Amazon’s mass layoffs are really about.

📚 Elon Musk challenges Wikipedia with his own AI encyclopedia.

🤖 OpenAI’s less-flashy rival might have a better business model.

🎵 The website reshaping live music, one set list at a time.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.