Good morning.

The Fast Five → 'Buy the dip' gets tested, AI's self-investment spree sets off bubble alarms, Broadcom surges on custom chip deal with OpenAI, silver prices hit historic high, and JPMorgan announces $1.5 trillion US investment initiative…

📌 While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months. I want to give you the name, ticker, and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Get all the details here » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar

Today:

None watched

Tomorrow:

Consumer Price Index (CPI), 8:30A

Your 5-minute briefing for Tuesday, Oct 14:

US Investor % Bullish Sentiment:

↑ 45.87% for Week of OCT 09 2025

Previous week: 42.92%

Market Wrap:

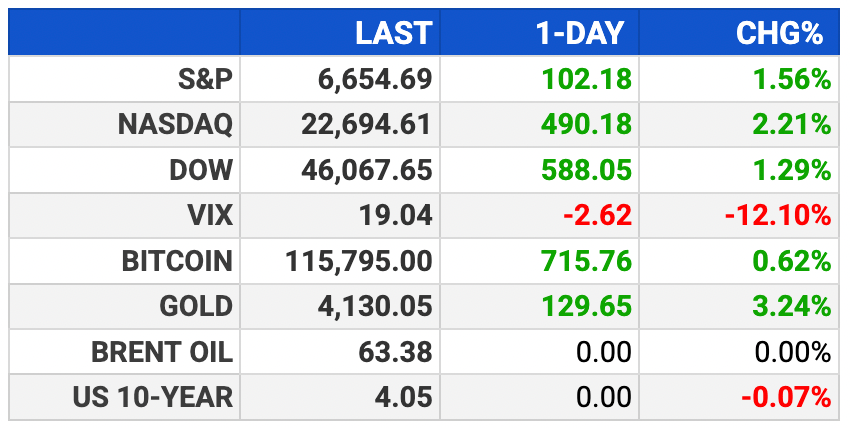

Stocks rebounded: Dow +588 (1.29%), S&P +1.6%, Nasdaq +2.2%.

Trump eased tariff fears, saying China trade “will all be fine.”

Friday’s $2T sell-off retraced more than halfway.

Broadcom +10% after OpenAI deal; Oracle +5%, Nvidia +3%.

Nearly 80% of S&P stocks rose; Russell 2000 +2.8%.

Shutdown drags on as Oct 15 federal payroll deadline nears.

Bank earnings kick off today/tmrw (JPM, GS, C, BAC, MS).

EARNINGS

Here’s what we’re watching this week:

Today: *BlackRock $BLK ( ▲ 1.14% ), *Citigroup $C ( ▲ 0.39% ), *GoldmanSachs $GS ( ▲ 0.61% ), *Johnson & Johnson $JNJ ( ▼ 1.79% ), *Wells Fargo $WFC ( ▲ 1.29% )

*JPMorgan Chase $JPM ( ▲ 0.89% ) - earnings of $4.87 per share (+11.4% YoY), on $45.6B revenue (+6.8% YoY)

*Domino's $DPZ ( ▼ 0.14% ) - earnings of $3.96 per share (-5.5% YoY) on $1.14B revenue (+5.2% YoY)

WED: *BofA $BAC ( ▲ 0.55% ), *Morgan Stanley $MS ( ▲ 0.6% ), *Progressive $PGR ( ▲ 1.15% ), United Airlines $UAL ( ▲ 2.71% )

Get This Stock Now —

This company is the lifeblood of AI data centers, yet almost no one has caught up with the story. Their hardware is so essential that the data center industry uses enough of it to stretch around the world 8 times – in a single building! So, if you own Nvidia stock now, you might be well-served to sell those shares and check out this under-the-radar play instead. Or if you missed the boat on Nvidia, this is a rare second chance to target tremendous profit potential as AI data centers spring up in every corner of the world.

- sponsored message from InvestorPlace -

HEADLINES

Stocks soar as Wall Street rebounds from tariff-fueled rout (more)

Economists see stronger US growth, but weak job gains, stickier inflation (more)

US retailers brace for impact as Trump's 100% China tariffs loom (more)

US supply chain faces another tariff headwind ahead of new port fees (more)

JPMorgan announces $1.5 trillion US investment initiative (more)

Quantum stocks surge after JPMorgan investing push into tech (more)

Gold tops $4,100/oz on US-China trade tensions, Fed rate cut bets (more)

Silver prices hit historic high as short squeeze rocks London market (more)

Rare earth stocks surge on US-China trade dispute over critical minerals (more)

Broadcom surges on custom chip deal with OpenAI (more)

Tesla stock rebounds, announces Shanghai factory ramp-up (more)

Robinhood open to deals to grow prediction markets business (more)

Goldman Sachs agrees to acquire $7 bln VC firm Industry Ventures (more)

Salesforce to invest $15B in San Francisco as AI race heats up (more)

Bitcoin climbs after Trump says trade relations with China will be fine (more)

Saylor’s strategy resumes Bitcoin splurge at highest price ever (more)

- We’re on a short break this week -

The sections: Dealflow, Crypto & Bullish will be back

on Monday, 10/20/25. Thank you for reading!

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.