Good morning.

The Fast Five → Nvidia extends dominance unveiling successor to its all-conquering processor, Apple and Google in talks to let Gemini power iPhone, Fed likely to preach patience tomorrow, Audi reveals first next-generation EV, and Elon Musk suggests his ketamine use is good for investors…

Calendar:

WED 3/20: Fed interest-rate decision, 2:00pm ET

Fed Chair Powell press conference, 2:30pm ET

THU 3/21: Jobless claims, 8:30am ET

Your 5-minute briefing for Tuesday, March 19:

US Investor % Bullish Sentiment:

45.90% for Wk of Mar 14 2024 (Last week: 51.73%)

Market Recap:

Stocks rise on AI conference & Fed anticipation.

Dow up 0.2%, S&P 500 gains 0.63%, Nasdaq up 0.82%.

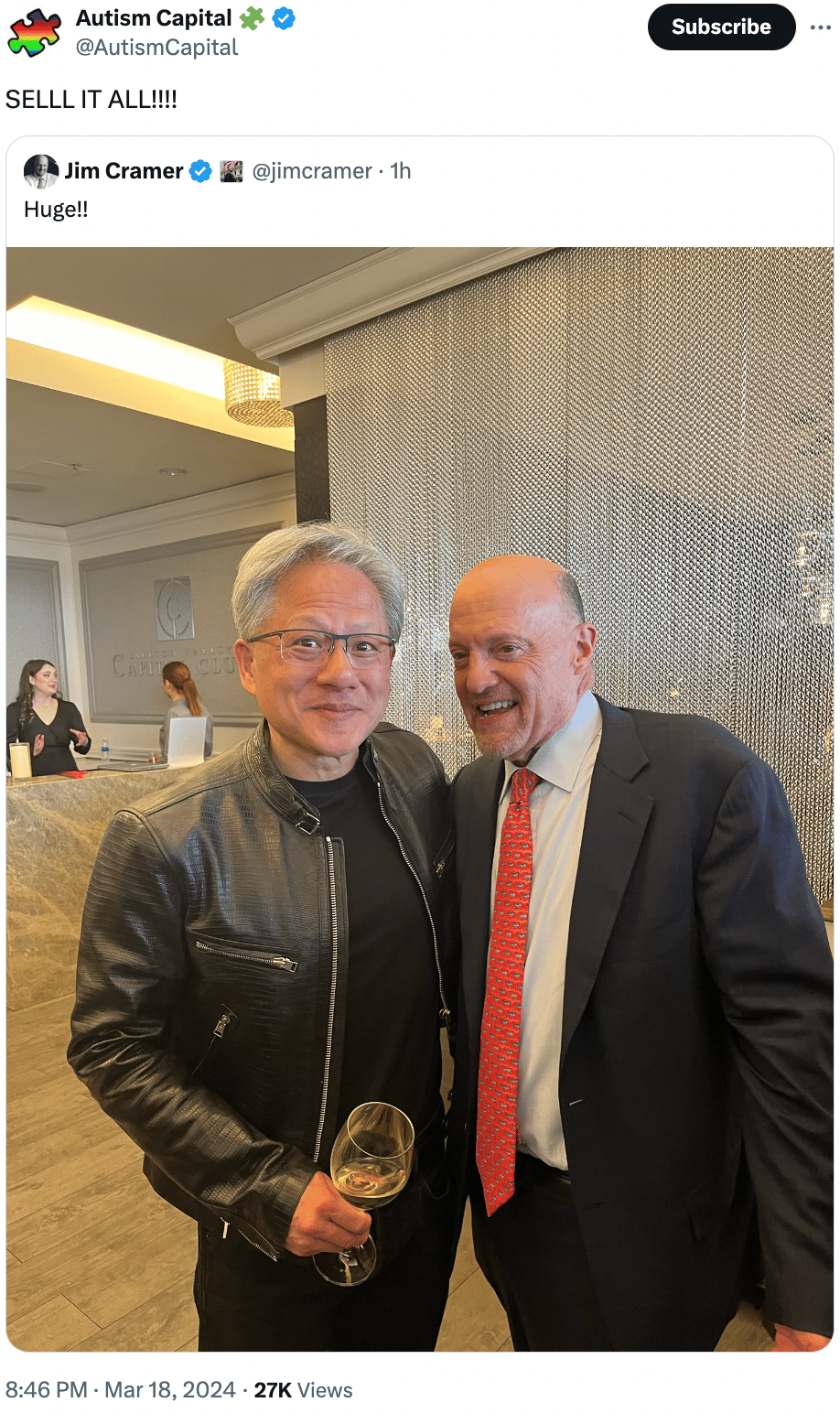

Nvidia climbs 0.7% at GTC Conference, analysts bullish.

Alphabet surges 4.6% on Apple-Google AI talks.

Tech recovers after recent losses.

Market rally expected in April with earnings season.

Fed's FOMC meeting starts today, announcement Wednesday.

Fed funds futures show 99% chance of unchanged rates.

February's high inflation data sparks rate hike concerns.

EARNINGS

What we’re watching this week:

Wednesday: General Mills (GIS)

Micron (MU) - anticipating a loss of $.26 per share (a vast improvement over its year-ago loss of $1.91 per share). Revenue forecast to arrive at $5.3Bn(+43.2% YoY)

FedEX (FDX) - earnings of $3.53 per share (+3.5% YoY) on revenue of $22.1B (-0.5% YoY)

Nike (NKE) - earnings of $.74 per share for Nike's fiscal Q3 (-6.3% YoY), on $12.3B revenue (-0.8% YoY)

Full earnings calendar here

HEADLINES

Companies considering AI deal that would build on search pact. Apple also recently held discussions with OpenAI about deal.

US lawmakers reach deal to keep government open through Sept. 30 (more)

Fed likely to preach patience as consumers and markets look ahead to rate cuts (more)

SEC fires 'AI washing' warning shot (more)

IRS chief sees workforce topping 100,000 within three years (more)

Oil prices continue to advance as bullish sentiment takes hold (more)

Homebuilder sentiment turns positive for first time since July (more)

Exxon is not trying to acquire Hess in dispute with Chevron over Guyana oil assets, CEO says (more)

Exxon chief goes on the offensive as Wall Street sours on ESG (more)

Shell plans to divest 1,000 retail sites in shift to EV charging (more)

Glass Lewis backs Disney in proxy fight with activists (more)

United CEO tries to reassure customers following multiple safety incidents (more)

Hertz CEO out following electric car ‘horror show’ (more)

Crafts retailer Joann files for bankruptcy after 81 years (more)

UBS powers past $100B, one year after Credit Suisse takeover (more)

UnitedHealth Group has paid more than $2 billion to providers following cyberattack (more)

PRESENTED BY SELL IT LIKE SERHANT

Get sales training that works.

Elevate your individual or team sales to Serhant levels with the "Sell It Like Serhant" training.

Access Ryan Serhant's proven strategies that build empires... from creating magnetic personal brands to mastering negotiations with the CODO Method...

...the playbook for winning in sales (beyond just real estate!).

Starting right now, MB readers can SAVE 10% with code MARCH10

(limited time only)

This isn't just training; it's transformation. Whatever your business or expertise, Sell It Like Serhant will make everyone a master at sales.

Will you be the next success story everyone talks about? Don’t just watch the winners—JOIN them!

DEALFLOW

M+A | Investments

Cisco completes $28 Billion Splunk acquisition (more)

HashiCorp rises 12% as software provider said to weigh sale (more)

Fosun open to sale of Portuguese bank stake (more)

Aviva sells Singlife joint venture stake for $1.2B (more)

Australia's Boral urges shareholders to reject Seven Group's $1.3B offer (more)

Sensor Tower, a provider of data on the digital economy, acquires Data.ai for an undisclosed amount (more)

GTCR completes acquisition of Cloudbreak Health (more)

PAI acquires Beautynova (more)

OceanSound-backed Gannett Fleming purchases DEC (more)

PE-backed RefrigiWear buys 100% stake in Flexitog (more)

Tishman Speyer acquires Jersey City waterfront lot from Goldman Sachs (more)

PE-backed Groome Industrial Service Group purchases W-S Companies (more)

Grant Thornton, a provider of audit and assurance, tax, and advisory services, received an investment from New Mountain Capital (more)

Shake Smart Holdings, a healthy fast-casual concept company, received an investment from NewSpring Franchise (more)

VC

Ballistic Ventures, a venture capital firm dedicated to early-stage cybersecurity and cyber-related companies, closed its second fund, at $360M (more)

Westbound Equity Partners, an early stage venture capital firm, closed its second fund, at $100M (more)

BigID, an AI-augmented data security company, raised $60M in Growth funding (more)

Carlsmed, an AI-enabled personalized surgery medtech company, raised $52.5M in Series C funding (more)

FlexPoint, provider of a payments automation platform for managed service providers, raised $35M in funding (more)

Sealed, a residential energy efficiency startup, raised $30M in funding (more)

Superlinked, a provider of a solution for turning complex data into vector embeddings, raised $9.5M in seed funding (more)

Cache, a brokerage specifically created for large stock positions, raised $8.5M in seed funding (more)

OpenMeter, a provider of a data source platform for AI monetization, raised $3M in seed funding (more)

Synch, a provider of an integrated Global Trade Management solution to unify company revenue stacks, raised $3M in Seed funding (more)

ConKay Medical Systems, a medtech company, raised $1.8M in Seed funding (more)

CRYPTO

Powered by MILKROAD - Get smarter about crypto in 5 min.

BULLISH BITES

🤖 Big Tech: Silicon Valley's next great fraud trial begins.

🎬 Next level: YouTuber MrBeast teams up with Amazon’s MGM Studios for ‘biggest reality competition series ever’.

🏚 Perfect timing: When to sell your home — this time last year, listings sold for $7,700 more.

👊 Not so tough: ‘Very few have balls’: How American news lost its nerve.

🔥 #1 AI stock? Artificial intelligence stocks are carrying the market. But which one should you buy and when? » *

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

☀️ Get your briefings before everyone else, go PRO »

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

*from our sponsors

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.