Good morning.

The Fast Five → Jamie Dimon Issues an economic warning, Yellen says US won’t accept Chinese imports decimating new industries, Wells Fargo boosts year-end S&P 500 target to 5,535, Gold prices due for a correction, and Tesla shares jump on Musk’s robotaxi hype…

Calendar: (all times ET)

WED 4/10: | Consumer Price Index (CPI), 8:30am |

THU 4/11: | Producer Price Index (PPI), 8:30am |

FRI 4/12: | Consumer Sentiment, 10:00am |

Your 5-minute briefing for Tuesday, April 9:

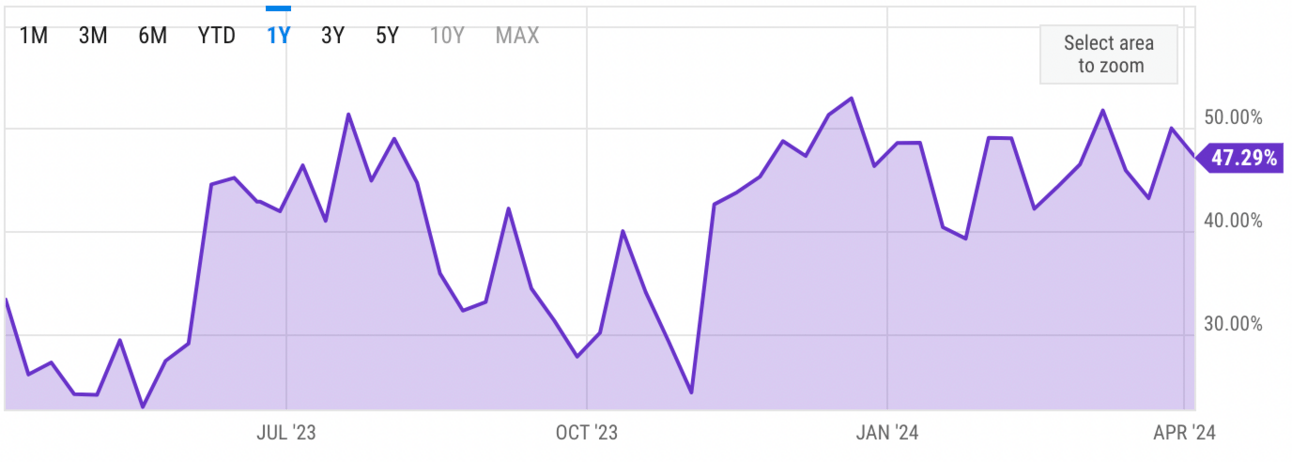

US Investor % Bullish Sentiment:

47.29% for Wk of Apr 04 2024 (Last week: 50.00%)

Market Recap:

Stocks end Monday flat amid rising rates.

Dow down 0.03%, S&P 500 0.04% lower, Nasdaq up 0.03%.

Tesla jumps 4.9% on robotaxi news.

Treasury yields rise to 4.42%.

Tomorrow: Iinvestors await March CPI data.

Dow, S&P 500 saw worst weekly losses since March 2023.

Friday’s positive jobs report boosts optimism.

EARNINGS

What we’re watching this week:

Today: Tilray (TLRY)

Wednesday:

Delta (DAL) - earnings of $.35 per share (+40% YoY) on $12.6B revenue (+6.0% YoY)

JP Morgan Chase (JPM) - earnings of $3.88 per share (-5.4% YoY) on $38.8B revenue (-1.4% YoY)

Full earnings calendar here

HEADLINES

US inflation expectations stabilize, but debt concerns pick up (more)

US ready to sanction Chinese banks if they aid Russia’s war machine, Yellen says (more)

Wells Fargo boosts end-2024 target on S&P 500 to Street-high of 5,535 (more)

Stock moves suggest belief in 'no landing' economy, Morgan Stanley says (more)

Gold prices due for a correction, silver gets support from both investors and industry (more)

China says innovations, not subsidies, are powering EV edge (more)

China's Shimao, another big Chinese property developer, faces a liquidation suit (more)

US awards TSMC $6.6B in grants, $5B in loans to step up chip manufacturing in Arizona (more)

Major food companies offering deals, new sizes as low-income Americans spend less (more)

Burger King, In-N-Out and other chains in California raise prices after min. wage increase (more)

Tesla shares jump as investors buy into Musk’s robotaxi hype (more)

Google's mega deal would prompt new fight with regulators (more)

Spirit Airlines will defer Airbus orders, furlough 260 pilots (more)

99 Cents Only liquidates in bankruptcy (more)

TikTok's popularity among European politicians rises despite security fears (more)

PRESENTED BY THE RUNDOWN AI

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join early adopters reading The Rundown– the free newsletter that makes you smarter on AI with just a 5-minute read per day.

DEALFLOW

M+A | Investments

Blackstone to take Apartment Income REIT private in $10B deal (more)

Honeywell CFO Greg Lewis talks asset sales, avoiding tiny M&A (more)

Tradeweb to buy investment tech firm ICD for $785M (more)

Vivendi's Canal+ makes mandatory buyout offer for South Africa's MultiChoice (more)

Novo Nordisk parent refiles US application on Catalent deal (more)

Investcorp-backed Shearer Supply acquires Climatic Comfort Products (more)

Motive reportedly weighs joining Fray for Allfunds buyout (more)

KPS Capital buys Sport Group TopCo (more)

VC

Flip, a provider of a shopping social network, raised $144M in Series C funding, bringing the company’s valuation to $1.05B (more)

Alterome Therapeutics, a biopharmaceutical company developing small molecule targeted therapies for cancer treatment, raised $132M in Series B funding (more)

Grow Therapy, a mental health technology company, raised $88M in Series C funding (more)

Windfall Bio, a company specializing in methane-to-value solutions, raised $28M Series A funding (more)

Prem Labs, a research lab focused on enhancing and advancing open-source AI technologies, raised $14M in Seed funding (more)

Kryptos Biotechnologies, a company that uses light to generate heat and control temperature, raised $10M in Series A funding (more)

Zinclusive, a financially inclusive company, raised $10M in funding (more)

Leash Biosciences, an AI and machine learning -native biotech company, raised $9.3M in Seed funding (more)

Summer, a provider of an end-to-end workplace student loan solution, raised $9M in funding (more)

Lockchain.ai, a provider of an AI-powered blockchain risk management platform, raised $4.6M in Seed funding (more)

Pierrepont Therapeutics, a company focused on treatments for mitochondrial and rare diseases, raised $500K in funding (more)

Astek Diagnostics, a developer of a urine-based diagnostic tool, received a Pre-Series A investment from She’s Independent (more)

CRYPTO

Powered by MILKROAD - Get smarter about crypto in 5 min.

BULLISH BITES

👀 Watching: Iger won the battle — but Disney’s ‘woke’ war isn’t over.

🤖 Stumbling: How Google lost ground in the AI race

🎓 Pursuits: Ivy league college costs soar to more than $90,000 a year.

🇫🇷 Next-level: Michelin picks 24 top hotels in France in first-ever ranking.

🚨 They warned us: It’s the biggest financial risk facing America in 2024. See why America's richest investors are sounding the alarm »

What did you think about today's briefing?

☀️ Get your briefings before everyone else, go PRO »

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

*from our sponsors

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.