Good morning.

The Fast Five → Big price hikes undercut Trump bet China will absorb tariffs, Nvidia warns China ‘not behind’ in AI, US economy shrank 0.3% in the first quarter, EU to present new trade proposals to US next week, and Amazon to spend $4 billion on small town delivery expansion…

Major Buy Alert

This rapidly developing story involves President Trump, trillions of dollars, practically every member of the Silicon Valley elite... Not to mention a potentially major upgrade to America's power grid.

See why one former $200 billion hedge fund manager says, "If you make one investment in 2025, I recommend making it this one."

-from Stansbery Research

Calendar: (all times ET) - Full Calendar

Today:

Initial jobless claims, 8:30A

Auto sales, TBA

Tomorrow:

Unemployment report, 8:30A

Factory orders, 10:00A

Your 5-minute briefing for Thursday, May 1:

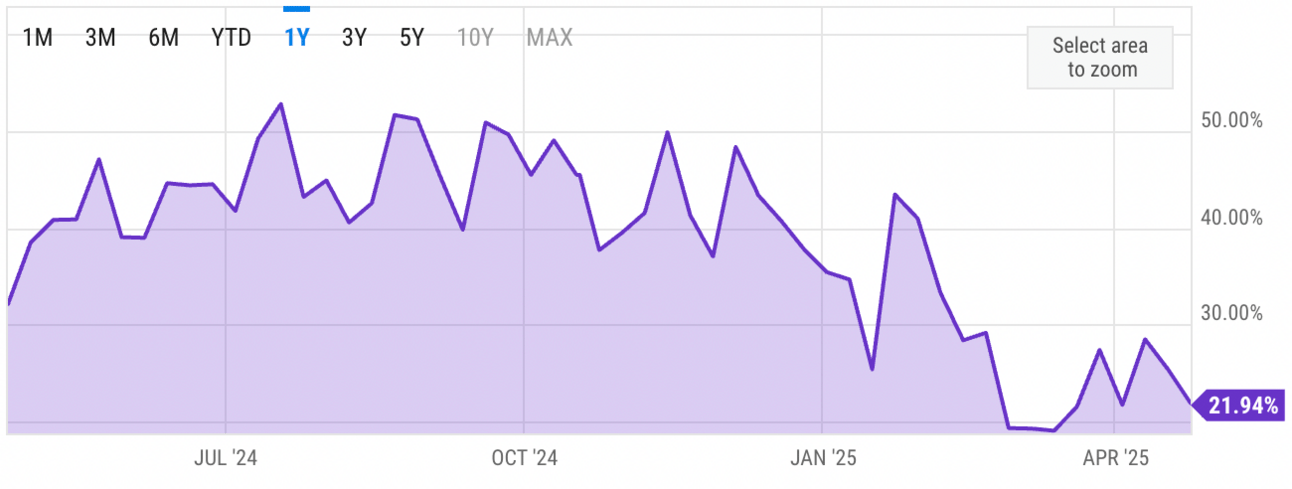

US Investor % Bullish Sentiment:

↓ 21.94% for Week of April 24 2025

Previous week: 24.44%. Updates every Friday.

Market Wrap:

Futures up: Dow +138 pts (0.3%), S&P +0.8%, Nasdaq +1.3%.

Meta +5%, MSFT +7% on strong quarterly results.

Markets rebounded after volatile session; GDP fell -0.3% vs. +0.4% forecast.

April MTD: S&P -0.8%, Dow -3.2%, Nasdaq +0.9%.

EARNINGS

Big earnings week. We’ll be posting in two-day increments:

TODAY:

➤ Amazon $AMZN ( ▼ 1.59% ) - $1.36 eps (+38.8% YoY) on $155.1B revenue (+8.2% YoY)➤ Apple $AAPL ( ▲ 0.61% ) - $1.61 eps (+5.2% YoY) on $94.1B revenue (+3.6% YoY)

Airbnb $ABNB ( ▼ 2.85% )

Eli Lilly $LLY ( ▲ 1.55% )

Estee Lauder $EL ( ▲ 0.62% )

Instacart $CART ( ▲ 0.18% )

KKR $KKR ( ▼ 0.07% )

Mastercard $MA ( ▲ 1.55% )

McDonald’s $MCD ( ▲ 1.64% )

Roblox $RBLX ( ▲ 0.98% )

Wayfair $W ( ▼ 3.27% )

FRIDAY:

Chevron $CVX ( ▼ 2.33% )

Exxon $XOM ( ▼ 2.52% )

Wendy’s $WEN ( ▼ 0.72% )

Where to Invest $1,000 Right Now

I recently scoured the financial filings of one of the world's largest firms...

And based on what I found there, I'm prepared to put my reputation on the line.

I've found 19 stocks that went on to soar by 1,000% or more.

That's not normal. Few investors ever see anything close to a 1,000% gain.

It involves President Trump, trillions of dollars, practically every member of the Silicon Valley elite.

Not to mention a potentially MAJOR upgrade to America's power grid.

If you buy one stock in 2025, I recommend making it this one.

Whitney Tilson

Editor, Stansberry Research

HEADLINES

“China is right behind us,” Huang said. “We are very close. Remember this is a long-term, infinite race.”

Dow rises more than 100 pts, S&P books third straight losing month (more)

US economy shrank 0.3% in Q1 as tariffs unleash flood of imports (more)

US has reached out to China to initiate tariff talks, CCTV says (more)

EU to present new trade proposals to US negotiators next week (more)

Surge in imports drives US GDP down as businesses navigate tariffs (more)

BlackRock: Investors can profit from diversifying beyond the 60/40 amid volatility (more)

Meta, Microsoft reports lift AI-related stocks (more)

Microsoft shares jump on earnings, revenue beat as cloud business grows 33% (more)

Meta shares rise on stronger-than-expected revenue (more)

Robinhood beats Q1 estimates despite revenue, crypto trading dip (more)

Amazon to spend $4 billion on small town delivery expansion (more)

DEALFLOW

M+A | Investments

Novartis to acquire Regulus Therapeutics for up to $1.7B

Alimentation Couche-Tard signs NDA for takeover talks with Japan's Seven & i

LendingClub Corporation acquired the AI-powered spending intelligence platform Cushion

AQM Technologies, a provider of software testing for financial institutions, acquired TRaiCE, AI-driven business risk monitoring solutions

Sun Nuclear, a Mirion Medical company, acquired Oncospace, AI-powered solutions for the radiation oncology community

VC

True Anomaly, a space security company, raised $260M in Series C funding

Canopy, a firm-wide operating system for accounting, raised $70M in Series C funding

Plenful, an AI workflow automation platform modernizing healthcare operations, raised $50M in Series B funding

Nuvo, a network accelerating modern B2B trade, raised $45M in funding

Glacier, a maker of recycling robots, raised $16M in Series A funding

Spark Biomedical, a company specializing in wearable neurostimulation technology, raised $15M in Series A funding

InventWood, a creator of SUPERWOOD material, raised $15M in the first close of its Series A funding round

Manifest, a cybersecurity startup, raised $15M in Series A funding

Field Materials, an AI platform for material and equipment procurement in construction, raised $10.5M in Series A funding

Queens Carbon, a developer of new cement technology, raised $10M in Seed funding

TeamOhana, headcount management and compensation planning software, raised $7.5M in Seed funding

Swivel, a no-code AI workflow automation platform for advertising operations, raised $5.8M in Series A funding

Noma Therapy, a mental health tech startup, raised $4.25M in funding

Structify, a company that turns data into customized, structured datasets, raised $4.1M in Seed funding

CRYPTO

BULLISH BITES

🚨 Jeff Bezos quietly backing world-changing tech (not AI) *’

🤖 Meet the companies racing to build quantum chips.

💔 OpenAI co-founder and CEO Sam Altman and Microsoft CEO Satya Nadella are splitsville.

📰 Scoop: White House launches Drudge-style website to promote Trump.

😫 The Temu community is in shambles.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.