Good morning.

The Fast Five → JPMorgan Chase, BlackRock drop out of UN climate alliance, Rubio urges SEC to block Shein IPO on conditions, House won’t pass stopgap to avoid shutdown, Bezos sells more than $2B in Amazon stock for third time this month, and younger generations gained more wealth than older groups since 2019…

Calendar:

Today: Producer Price Index (PPI), 8:30a ET

Monday, 2/19: President’s Day (market closed)

Your 5-minute briefing for Friday, February 16:

BEFORE THE OPEN

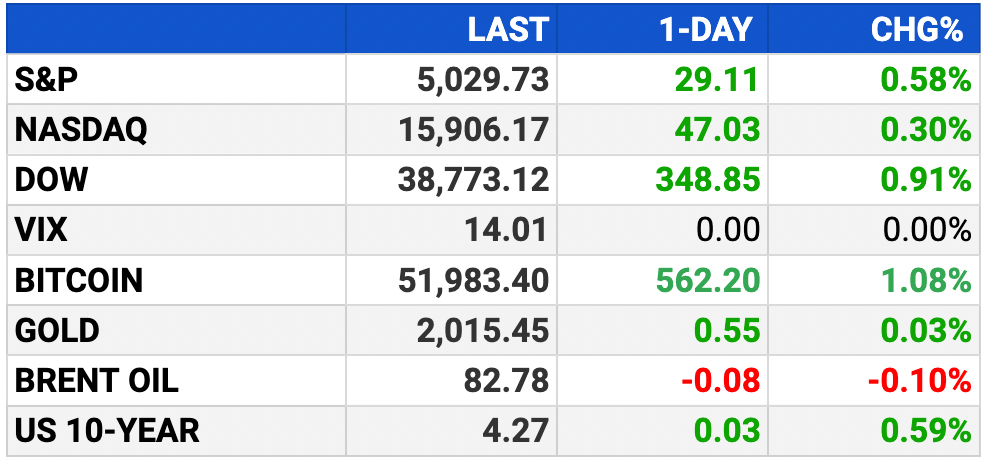

As of market close 2/15/2024.

Pre-Market:

Market Recap:

Stock futures stable Thurs. night amid strong market momentum.

Dow futures down 0.14%, S&P flat, Nasdaq up 0.15%.

DoorDash falls 8.5% post-hours on wider loss, Trade Desk surges 18.9% on Q4 beat.

Applied Materials soars 12% on positive earnings.

Investors weigh inflation data, retail sales dip.

S&P hits record high above 5,000.

Week's gains: S&P up <0.1%, Dow 0.3%, Nasdaq -0.53%.

Focus on Treasury yields, PPI data this morning.

EARNINGS

Full earnings calendar here

HEADLINES

Fed’s Powell to testify before congressional panels next month (more)

House won’t pass stopgap to avoid shutdown, key Republican says (more)

House votes to overturn Biden’s natural gas export approval freeze (more)

UK economy falls into recession, adding to Sunak's election challenge (more)

Younger generations gained more wealth than older groups since 2019, study says (more)

NYCB discloses over $18.7 bln in reciprocal deposit capacity, shares rise (more)

Wells Fargo says regulator has lifted a key penalty tied to its 2016 fake accounts scandal (more)

Nvidia holdings disclosure pumps up shares of small AI companies (more)

Jeff Bezos sells more than $2 billion in Amazon stock for third time this month (more)

Ford CEO says forget Tesla, ‘Pro’ unit is auto industry’s future (more)

ESG backlash on Wall Street spurs a jump in ETF closures (more)

Wawa billionaires bet on taking the convenience chain south (more)

Wealthy Saudi family is buying up failing Children’s Place (more)

PRESENTED BY TRADINGVIEW

Where the world does markets.

Come see what you’re missing! Join 50 million traders and investors taking the future into their own hands.

Try TradingView today and experience the supercharged, super-charting platform and social network for traders and investors.

- please support our sponsors -

DEALFLOW

M+A | Investments

SEC clears Trump's social media deal worth as much as $10B (more)

DraftKings acquires Jackpocket for $750M (more)

KKR to acquire a stake in health tech firm Cotiviti (more)

True Religion explores a sale as maximalist, Y2K-era styles make a comeback (more)

Britain's The Independent in talks to take control of BuzzFeed UK (more)

Achmea in talks with NN Group, Athora to sell life insurance business (more)

Prysmian signs record $5.4B of deals with Germany's Amprion (more)

GSK completes acquisition of Aiolos Bio for up to $1.4B (more)

Swisscom sole remaining party in talks for Vodafone Italy (more)

Accenture (ACN) acquired Insight Sourcing, a provider of strategic sourcing and procurement services (more)

Vista Equity-backed Salesloft acquires Drift (more)

Stellex-backed Fenix Parts purchases Pacific Rim Auto Parts (more)

Shamrock invests in Carnegie (more)

Pathstone acquires Crestone Capital (more)

OEP-backed Armis buys AI cybersecurity company CTCI (more)

Capstreet buys ASR (more)

Cantaloupe acquires Cheq (more)

Chipmaker Renesas to buy software firm Altium for $6B (more)

Starwood Capital invests in Echelon Data Centres (more)

Clarion invests in Narrative Strategies (more)

Inyarek Partners, a private equity firm, launched to identify and cultivate compelling asset development opportunities in support of the energy transition (more)

VC

Lambda, a GPU cloud company, raised $320M in Series C, at over $1.5B valuation (more)

Freenome, a biotech company developing blood tests for early cancer detection, raised $254M in funding (more)

Lilac Solutions, a company which specializes in lithium extraction technology, raised $145M in Series C funding (more)

Duetti, a music financing platform, raised $90M in funding (more)

Higharc, a provider of a cloud platform for homebuilding operations, raised $53M in Series B funding (more)

NextPoint Therapeutics, a biotech company developing a new class of precision oncology therapeutics targeting the novel HHLA2 pathway, raised $42.5M in Series B extension funding (more)

LeoLabs, a space safety, security, and sustainability company, raised $29M in funding (more)

Scribe, a platform for documenting and sharing business processes, raised $25M in Series B funding (more)

Point2 Technology, a provider of ultra-low-power, low-latency mixed-signal SoC solutions for multi-terabit interconnect, raised additional $22.6M in Series B funding (more)

Upwards, a national childcare network and care benefits company, raised $21M in Series A funding (more)

Sage Geosystems, a provider of Geopressured Geothermal System (GGS) technologies, raised $17M in Series A funding (more)

Clarity, an AI cybersecurity startup, raised $16M in Seed funding (more)

Alembic, a provider of a holistic marketing attribution platform for enterprises, raised $14M in Series A funding (more)

Vatom, a provider of a customer engagement platform, raised $10M in Series B funding, at $125M valuation (more)

Arch, a data intelligence platform for HVAC contractors, raised $6.2M in Seed funding (more)

Celadyne, a decarbonization and hydrogen solution company, raised $4.5M in Seed funding (more)

Privy, a provider of a real estate investment software platform, raised $4M in Growth funding (more)

Merit Medicine, a health tech startup, raised $2M in Seed funding (more)

ScaleIP, a company helping enterprises identify high-intent target companies to monetize underutilized patents, raised $1.5M in funding (more)

Fundraising

406 Ventures, an early-stage venture capital firm, closed its fifth core fund, at $265M (more)

Was this forwarded to you?

Get tomorrow’s briefing here »

CRYPTO

BULLISH BITES

🔥 The ‘it’ list: Y Combinator lists 20 new startup ideas it will fund.

🎥 Game-changer: OpenAI’s new software lets you create realistic video by simply typing a descriptive sentence.

🌉 Comeback: Don't believe the haters—San Francisco is back.

😫 'Like a torture session': Apple Vision Pro users are returning their $3.5K headsets.

🚀 50 million can’t be wrong: Test-drive TradingView today and experience the supercharged, super-charting platform and social network millions of traders and investors rely on. Try it »

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.