Good morning.

The Fast Five → Palantir skyrockets 30% after revenue beat, NYCB’s credit grade is cut to junk, Tesla is downgraded, ESPN, Fox, Warner Bros. join forces for sports streaming service, and ousted WeWork co-founder/CEO is trying to buy it back…

Your 5-minute briefing for Wednesday, February 7:

BEFORE THE OPEN

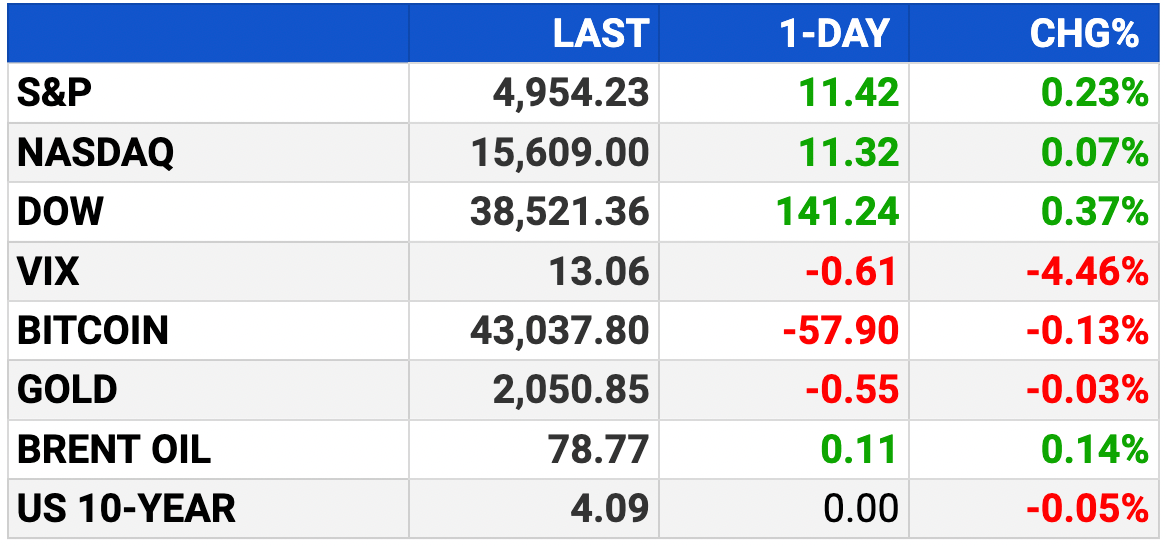

As of market close 2/6/2024

Pre-Market:

Market Recap:

S&P 500 up 0.23%, Nasdaq up 0.07%, Dow climbs 0.37%.

Palantir soars nearly 31% on Q4 revenue beat.

Spotify up nearly 4% with strong earnings and Premium subscriber growth.

Expectations for rate cuts push market higher, despite Powell's comments on delayed cuts.

Today marks around the halfway point of earnings season.

EARNINGS

What we’re watching this week:

Today: Roblox (RBLX)

Walt Disney (DIS) - expected: $1.04 per share (+5.1% YoY) on $23.8B revenue (+1.3% YoY)

Thursday: Affirm (AFRM), AstraZeneca (AZN), Spirit Airlines (SAVE)

Friday: PepsiCo (PEP)

Full earnings calendar here

HEADLINES

FAA chief 'confident' agency can keep aviation safe (more)

US safety board to release initial report on Boeing 737 MAX cabin blowout (more)

Hedge funds trading Treasuries set to be tagged as dealers by SEC (more)

Credit card delinquencies surged in 2023, indicating ‘financial stress,’ New York Fed says (more)

Red Sea trouble threatens US freight recovery (more)

Retailers sound alarm over shipping delays, price spikes (more)

Xi to discuss China stocks with regulators as rescue bets build (more)

Wall Street snubs China for India in a historic markets shift (more)

Vanguard quietly embraces AI in $13 Billion of stock funds (more)

'Big Short' investor Steve Eisman says Fed shouldn't cut rates now (more)

ESPN, Fox and Warner Bros. join for sports streaming service (more)

Tesla is downgraded (more)

Palantir shares rocket 30% after revenue beat, strong demand for AI (more)

DocuSign to lay off 6% of workforce (more)

Honda recalls 750,000 US vehicles over air bag defect (more)

Meta says it will identify more AI-generated images ahead of upcoming elections (more)

Microsoft in deal with Semafor to create news stories with aid of AI chatbot (more)

TOGETHER WITH INVESTOR’S BUSINESS DAILY

Experience IBD for just $1 —

Investor’s Business Daily has been helping people like you invest better for over 35 years. They’ve learned what it takes to outperform the market and prosper in any market condition. IBD Digital gives you an edge with one-of-a-kind investing tools and analysis designed for investors at every level.

✅ Unlimited access to IBD Digital across platforms and devices

✅ Access 14 exclusive IBD stock lists

✅.Proprietary investing tools & IBD ratings for 5,000+ stocks

✅ Best-in-class training webinars, podcasts, videos and more

Try IBD today for only $1. Don’t miss out on this limited-time offer you won’t find anywhere else!

~ please support our sponsors ~

DEALFLOW

M+A | Investments

Arglass, a glass container manufacturer, secured over $230M in capital (more)

Roofing billionaires in $50M talks for Graydon Carter’s glossy newsletter (more)

Juristat, a provider of patent analytics and workflow automation solutions, received a controlling investment from MBM Capital (more)

DaySmart Software, a provider of vertically-focused business management software, acquired Time To Pet, a provider of pet care software (more)

Audax-backed Chartis acquires HealthScape Advisors (more)

Braemont Capital purchases Loenbro (more)

Main Post Partners invests in Highland Arms Enterprises (more)

VC

NinjaOne, a provider of an IT platform for endpoint management, security, and visibility, raised $231.5M in Series C funding (more)

Ambience Healthcare, a provider of an AI operating system for healthcare organizations, raised $70M in Series B funding (more)

10Beauty announced it will launch at the end of this year, having secured $38M in equity financing (more)

Avnos, a company developing novel hybrid direct air capture technology for carbon dioxide removal, raised $36M in Series A funding (more)

Colossyan, an AI video for workplace learning company, raised $22M in funding (more)

Adroit Trading Technologies, a provider of a multi-asset front office EOMS solution, raised $15M in Series A funding (more)

Synthetaic, a provider of a dual-use model-independent classification and detection platform for image data, raised $15M in Series B funding (more)

Kin, a digital, direct-to-consumer home insurance company, raised $15M in funding (more)

Volta Insite announces the successful completion of its seed round funding (more)

Stellar Sleep, which provides first digital solution for chronic insomnia management, announced today a $6M seed round (more)

Dexa raises $6M in Seed Funding (more)

CAMB.AI, a speech AI company, raised $4M in Seed funding (more)

dataroomHQ, a provider of an operational metrics platform for SaaS companies, raised $3.5M in funding (more)

GigaStar, a startup focused on human creativity, raised $3M in additional funding (more)

ALT Sports Data, a provider of sports data and analytics solutions, raised $2.5M in Seed funding (more)

ActionStreamer, a media streaming platform for IoT devices, closed its $2.4M Series A funding round (more)

6AM City, a local daily newsletter company, raised an undisclosed amount in Series A funding (more)

Fundraising

IPO

ShipBob, an e-commerce startup seeks to hire banks for 2024 IPO (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

Treasury Secretary Yellen says US needs better stablecoin regulation (more)

Gemini says crypto lender Genesis moves to sell Grayscale Bitcoin Trust assets (more)

DCG says Genesis creditors may get unfair windfall under plan (more)

Bitcoin ETFs mean 'substitution' from gold into BTC will continue, says Cathie Wood (more)

BULLISH BITES

🏈 Investment: $7 million for 30 seconds? To advertisers, the Super Bowl is worth it.

🐲 Toys: Rolls-Royce isn't disclosing the prices of its limited "Year of the Dragon" line, but one look and you'll know why.

🔍 Feeling lost: First-generation social media users have nowhere to go.

🤔 End of pay wall? The great subscription news reversal.

📈 Experience IBD for just $1! Investor’s Business Daily has been helping people like you invest better for over 35 years. Try IBD Digital now for one full month » (cancel anytime)

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team. 2/6