Good Morning.

The US is on track for June 1 default, Buffett sells stakes and raises a bet, Musk must approve Tesla staff, Wells Fargo agrees to pay $1 billion, and Sam Altman will testify on Capitol Hill…

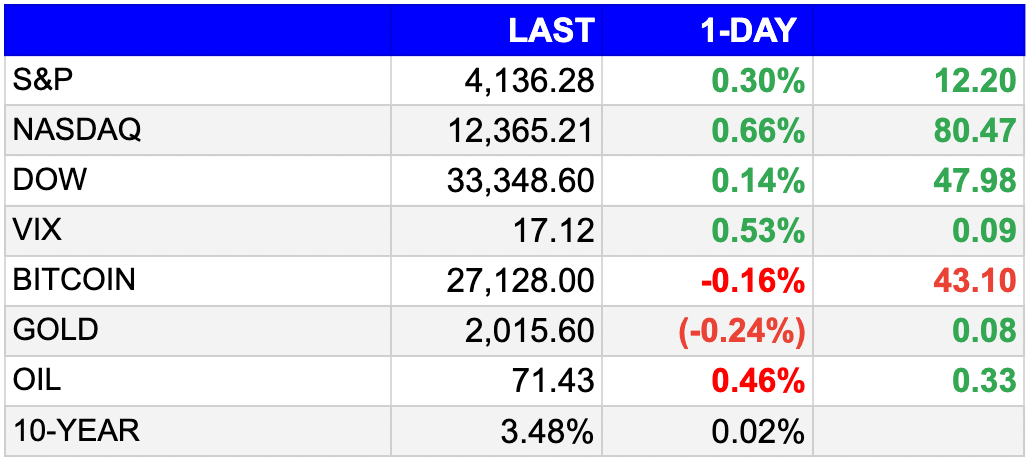

Here's your market briefing for today…

BEFORE THE OPEN

As of market close 5/15/2023

Markets:

The S&P 500 ended Monday on a positive note, closing higher.

The broader index had a nice boost, trading 0.3% higher at 4136.28.

The Dow Jones Industrial Average managed to break its five-day losing streak and gained 47.98 points, or 0.14%, reaching 33,348.60.

Impressive performance from the tech-heavy Nasdaq Composite, which outperformed with a 0.66% rise, reaching 12,365.21.

EARNINGS

What MB is watching this week:

Today: Home Depot, Baidu

Tomorrow: Cisco Systems, Target

Thursday: Walmart, Alibaba

NEWS BRIEFING

The biggest startup flameouts of the last decade (more)

Warren Buffett sells stakes in two banks, and raises a bet (more)

Argentina raises interest rate to 97% to tackle inflation (more)

Amazon is changing its deliveries to cut shipping times (more)

The man behind ChatGPT is about to have his moment on Capitol Hill (more)

Tepper's Appaloosa hedge fund raises Uber stake, bets on Cathie Wood (more)

ZestMoney founders resign in struggle to raise funds (more)

Small caps lead market, Dow Jones lags; debt talks stall (more)

Asia stocks steady despite China data miss, weak dollar helped (more)

Berkshire invests in Capital One, sheds four stocks (more)

Musk tells Tesla staff he must approve all hiring (more)

US on track for June 1 default without debt ceiling hike (more)

Michael Burry doubles Alibaba stake in big bet on China tech (more)

Amgen’s $28 billion Horizon purchase challenged by FTC (more)

Lilly on track for blockbuster alzheimer's drug (more)

Wells Fargo agrees to pay shareholders $1 billion (more)

Tech CEO explains what's causing mass layoffs (more)

Why this is such a dangerous market (more)

Fintech unicorn Tipalti raises $150 million in credit (more)

CRYPTO

Crypto companies are playing poker with the SEC as agency cracks down on the industry (more)

GREED Token Is Not a Crypto Scam, but a Lesson on How to Get Scammed Amid Meme Coin Mania (more)

Crypto Mining Data Center Soluna Stock Surges After $14M Investment Deal (more)

DeFi Project Hector Mulls Legal Wrapper to Shield DAO (more)

Matrixport Integrates With Copper’s ClearLoop on Prime Brokerage Offerings (more)

SEC seeks denial of Coinbase petition for imminent crypto rules (more)

Crypto companies are playing poker with the SEC as agency cracks down on the industry (more)

SHARES