Good morning.

The Fast Five → Alarm bells for economic downturn are clanging, investors left to guess where stocks go next, Berkshire cuts Apple stake by half, sharp slowdown in job growth, and Musk says Fed foolish not to have cut rates …

➔ Free Book Reveals 4 Critical Steps to Withstand Economic Downturn

- Courtesy of Behind the Markets

Calendar: (all times ET) - Full calendar here

Today: ISM services, 10:00 AM

Tomorrow: US trade deficit, 8:30 AM

Your 5-minute briefing for Monday, August 5:

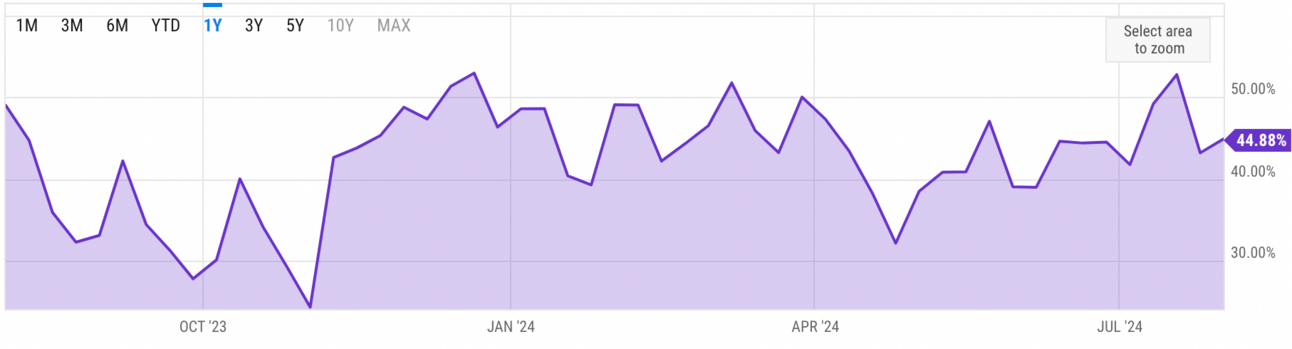

US Investor % Bullish Sentiment:

↑44.88% for Wk of August 01 2024

Last week: 43.17%. Updates every Friday.

Market Wrap:

Stocks fell sharply Friday on weak July jobs report, recession fears.

S&P -1.84%, Nasdaq -2.43% (10% below all-time high), Dow -1.51%

Nasdaq in correction; S&P and Dow 5.7% and 3.9% below highs

Unemployment rate: 4.3%

10-yr Treasury falls to lowest since December

Amazon -8.8%, Intel -26%, Nvidia -1.8% after previous day's 6% loss

Bank stocks hit: BofA -4.9%, Wells Fargo -6.4%

Investors believe Fed should have cut rates on Wednesday

EARNINGS

Here’s what we’re watching this week:

Tuesday: Airbnb (ABNB), Instacart (CART), iRobot (IRBT), Reddit (RDDT), Restaurant Brands Int'l (QSR), Rivian Automotive (RIVN), Uber Technologies (UBER), WK Kellogg Co (KLG), Yum! Brands (YUM)

Caterpillar (CAT) - earnings of $5.54 per share on $16.7B revenue (-3.7% YoY)

Wednesday: CVS Health (CVS), Duolingo (DUOL), Klaviyo (KVYO), Lyft (LYFT), Ralph Lauren (RL), Shopify (SHOP)

Robinhood Markets (HOOD) - earnings up $.15 per share on $634.2M revenue (+30.5% YoY)

Walt Disney (DIS) - earnings of $1.19 per share (+15.5% YoY) on $23.0B revenue (+3.1% YoY)

Full earnings calendar here.

TOGETHER WITH 1440

The Daily Newsletter for Intellectually Curious Readers

We scour 100+ sources daily

Read by CEOs, scientists, business owners and more

3.5 million subscribers

HEADLINES

The alarm bells for an economic downturn are clanging (more)

Why fear is sweeping markets everywhere (more)

Sharp slowdown in job growth boosts unemployment to 4.3% (more)

US sues TikTok over 'massive-scale' privacy violations of kids <13 (more)

Mortgage rates fall to 5-month low (more)

Gold taps all-time highs as weak jobs data raise recession fears (more)

Dollar path divides Goldman, Fidelity over emerging-market bonds (more)

Rate hike whipsaws Japan, investors take long-term view (more)

Musk says Fed foolish not to have cut interest rates (more)

Apple investors urged to stay calm after Buffett slashes stake (more)

Intel shares slump 26% as turnaround struggle deepens (more)

Chevron dumps California for Texas after 145 years (more)

Wall Street goes to the Olympics (more)

DEALFLOW

M+A | Investments

Snickers maker Mars explores buying Kellanov (more)

Iberdrola to buy Britain's ENWL in $5.4B deal (more)

Hartree to buy ED&F Man in soft commodities trade expansion (more)

Blue Yonder, a leader in digital supply chain transformations, acquired Farmers Branch, One Network Enterprises, valued at $839M (more)

Electronic Merchant Systems, a merchant and payments provider, received a majority investment from BharCap Partners (more)

ExecThread, Inc., exec-level career opportuny aggregator for a global network of professionals, secured growth funding from Decathlon Capital Partners (more)

VC

Bilt Rewards, a loyalty program for the home and neighborhood, raised an additional $150M in funding (more)

Type One Energy, a provider of sustainable fusion power, closed its $82.4M seed financing round (more)

Contextual AI, builder of customized language models for businesses to enhance AI applications, raised $80M Series A funding round (more)

GovWell, a provider of a govtech software platform, raised $4.5M in seed funding (more)

TS Conductor, a manufacturer of advanced electric power lines, closed a $60M growth funding round (more)

CRYPTO

BULLISH BITES

🚨 Free Download: How to Profit in a Collapsing Market *

📉 Daunting: The Intel CEO Pat Gelsinger’s dream job takes a nightmarish turn.

🔎 Inside Look: What Bill Ackman got wrong with his bungled IPO.

😎 Zuck’s New Image: Gold chains and gen-z curls.

🏅 Trending: Olympics viewership is up — and Snoop Dogg is part of the buzz.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.