Good morning.

Note: No briefing on Veterans Day (Monday, 11/11.) Market Briefing will resume on Tuesday, 11/12.

The Fast Five → Fed cuts rates again, key takeaways from Fed decision, stocks keep climbing as postelection rally rolls on, Amazon mulls multi-billion dollar investment in Anthropic, and Nvidia surpasses $3.6 trillion market value…

📈 What Trump’s victory means for GOLD »

From Stansberry Research

Calendar: (all times ET) - Full calendar here

Today:

Consumer sentiment, 10:00 am

Monday:

Veteran's Day holiday, bond market closed.

Your 5-minute briefing for Friday, November 8:

US Investor % Bullish Sentiment:

↑ 41.54% for Week of November 07 2024

Last week: 39.48%. Updates every Friday.

Market Wrap:

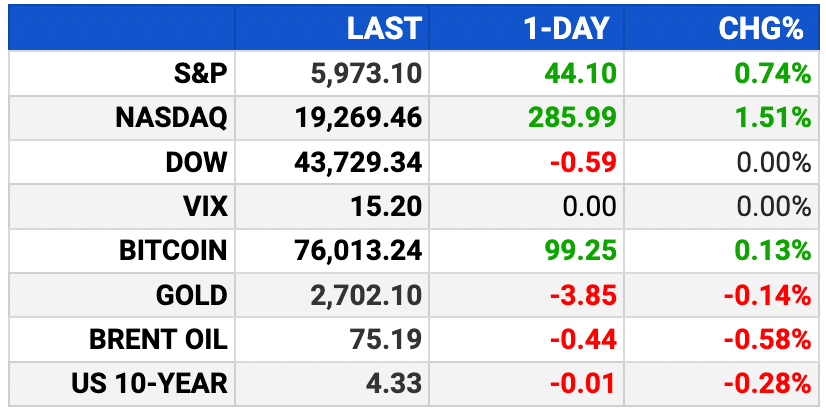

Futures edge up as S&P, Nasdaq hit record highs in postelection rally

Yesterday: S&P up 0.7%, Nasdaq tops 19,000; Dow slightly down

Fed cuts rates 0.25%, Powell “feeling good” on economy

Market upbeat on Trump’s growth, deregulation stance; inflation fears linger

Weekly gains: S&P +4.3%, Dow +4%, Nasdaq +5.6%

EARNINGS

Here’s what we’re watching this week.

DraftKings (DKNG) - expect loss of $.42 per share on $1.1 bln (+39.2% YoY)

See full calendar here.

HEADLINES

Key takeaways from Fed decision to cut rate by quarter point (more)

US weekly jobless claims up slightly; unit labor costs stir inflation fears (more)

US wholesale inventories revised lower in September (more)

30-yr fixed-rate mortgage rise to four-month high of 6.79% (more)

Asian stocks climb on Wall Street's lead; dollar sags after Fed cut (more)

Central banks around the world grapple with the return of Trump (more)

Trump’s top priorities will include tax cuts and tariffs, says Mnuchin (more)

Top trader Vitol eyes metals market as oil demand set to peak in 10 years (more)

Nvidia surpasses $3.6 trillion market value after Trump win (more)

Amazon mulls new multi-billion dollar investment in Anthropic (more)

Wall Street expects Trump presidency will unlock deal-making (more)

TOGETHER WITH THE MODE MOBILE

Today’s Fastest Growing Company Might Surprise You

🚨 No, it's not the publicly traded tech giant you might expect… Meet $MODE, the disruptor turning phones into potential income generators.

Mode saw 32,481% revenue growth, ranking them the #1 software company on Deloitte’s 2023 fastest-growing companies list.

📲 They’re pioneering "Privatized Universal Basic Income" powered by technology — not government, and their EarnPhone, has already helped consumers earn over $325M!

Their pre-IPO offering is live at just $0.26/share – don’t miss it.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

DEALFLOW

M+A | Investments

AT&T buys US Cellular sells Spectrum assets for $1 Billion (more)

BlackRock in talks about a strategic tie-up with Millennium (more)

Hollywood superagent Emanuel looks to buy tennis tournaments, art fair (more)

SocGen's car leasing unit Ayvens attracting buyout interest (more)

IonQ, a quantum computing company, acquired Qubitekk, Inc., a quantum networking company (more)

XRHealth, a provider of therapeutic VR and extended reality XR solutions, acquired NeuroReality, a VR games company (more)

UtilityInnovation Group, a company specializing in utility systems and decentralized energy solutions, received an investment from Volvo Penta (more)

VC

Boston Materials, a manufacturer of advanced materials for semiconductors and aircraft platforms, raised $13.5M in funding (more)

Parallel Fluidics, a microfluidic device manufacturer, raised $7M in Seed funding (more)

Embed Security, an agentic security platform, raised $6M in funding (more)

Acai Travel, a software platform using AI for travel operations, raised $4M in Seed funding (more)

Thesys, a user interface startup focused on AI apps, raised $4M in seed funding (more)

Symbiotic Security, a company providing real-time security for software development, raised $3M in Seed funding (more)

Cloverleaf AI, a provider of solutions for government contractors, raised $2.8M in Seed funding (more)

Corgea, a cybersecurity startup providing an AI-powered security platform, raised $2.6M in Seed funding (more)

Pibox, an audio collaboration platform, raised $1.2M in funding (more)

CRYPTO

BULLISH BITES

🚀 Investor Alert: Election results could send gold to even higher highs *

🤖 Too Late? How Samsung fell behind in the AI boom leading to a $126 billion wipeout.

👑 ‘The King Is Back’: Binance billionaire CZ plots life after prison.

🛰 First Ever: Japanese scientists have just launched a wooden satellite into space.

🎙 Trust Issues: Shorting the "All In" podcast.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.