Good morning.

The Fast Five → Fed cuts rates with three dissents, Trump: Fed should have 'at least doubled' cut, Oracle knocks stocks, Emirates’ Gulf ambitions stir rivalries on Wall Street, and Cisco shares finally top dot-com record after more than 25 years…

📌 Former Goldman VP Reveals Mysterious Gold Stock With Huge Upside Potential — He says the gains in this should be far greater than just bullion or mining stocks. Some folks had the chance to see 995% the last time we shared this exact gold stock. Most people know nothing about it (except the elite). See more details about his No. 1 gold stock right here » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Unemployment Claims, 8:30A

Tomorrow:

None watched

Your 5-minute briefing for Thursday, Dec 11:

US Investor % Bullish Sentiment:

↑ 44.29% for Week of DEC 04 2025

Previous week: 32.03%

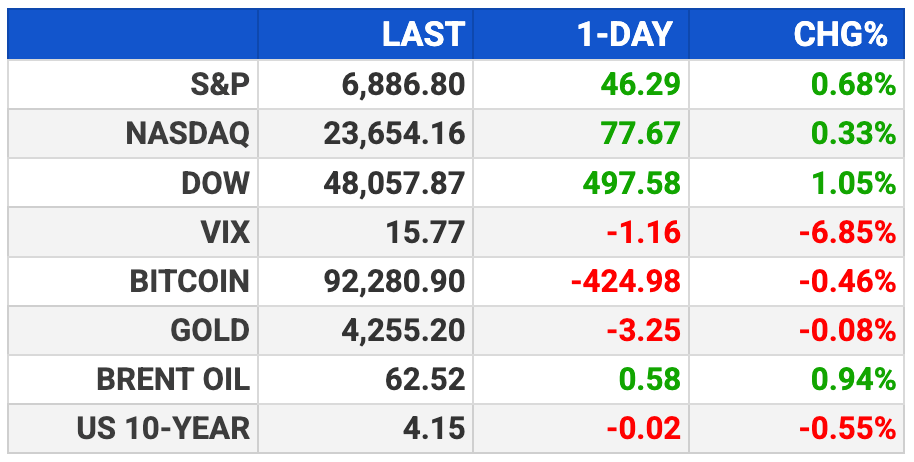

Market Wrap:

S&P and Nasdaq futures fall; Dow futures +0.1%.

Oracle plunges 11% on weak revenue, higher spending.

Stocks rallied soon after Fed delivered its 3rd cut this year.

Powell: Fed “well positioned to wait,” cites Trump tariffs as inflation driver.

Dow +497; Russell hit record as small caps benefit most from lower rates.

Strategists warn optimism may fade as future cuts look less certain.

Rising uncertainty on rates and economic signals may increase 2026 volatility.

EARNINGS

Here’s what we’re watching this week:

Today: Costco $COST ( ▼ 0.26% ), Lululemon $LULU ( ▲ 2.42% )

Broadcom $AVGO ( ▼ 0.4% ) - EPS of $1.87 (+31.7% YoY) on $17.46B revenue (+24.2% YoY)

The Three Key Men Who Could Ignite The

Biggest Gold Bull Run in Over 50 Years

According to Dr. David Eifrig, a former Goldman Sachs VP, three powerful men inside the highest levels of the U.S. government are advancing a strange plan that could impact your wealth in a MAJOR way.

And in the process, it could spark the biggest gold frenzy in over half a century.

Dr. Eifrig urges you to move your money to his No. 1 gold stock immediately (1,000% upside potential). He warns if you wait any longer, you could get priced out.

- a message from Stansberry Research -

HEADLINES

Wall Street indexes rally after Fed cuts interest rates (more)

Trump: Fed should have 'at least doubled' cut (more)

US investors are going big on China AI despite concerns in Congress (more)

Big global investors see gold in AI but don't buy the rush (more)

Dollar posts its worst day since September after Fed rates cuts (more)

Oil little changed as investor focus returns to Ukraine peace talks (more)

Small-business owners are losing confidence (more)

Emirates’ Gulf ambitions stir rivalries on Wall Street (more)

Cisco shares finally top dot-com record after more than 25 years (more)

Nvidia supplier SK Hynix eyes US listing as it expands on the AI boom (more)

Coca-Cola names a company veteran as its new CEO (more)

TOGETHER WITH ROKU

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

DEALFLOW

M+A | Investments

NVIDIA acquires Run:AI

Atlassian acquires Arctype

Adobe acquires Re:Vision AI

VC

ClearWave Bio, a biotech platform using AI for protein modeling, raised $42M

Nebulon, a server-integrated cloud data services company, raised $25M in funding

Zenith Robotics, a warehouse automation robotics company, raised $18M in Series A funding

Flecto, a sustainable materials AI company, raised $12M in Seed funding

Pattern Labs, an AI-native DevTools company, raised $9.2M in Seed funding

Wavely, an AI-powered hearing screening startup, raised $7M in Series A funding

Mint Medical AI, a medical imaging AI startup, raised $4.5M

RouteLogic, a logistics optimization AI startup, raised $3.2M

CRYPTO

BULLISH BITES

🤑 Abu Dhabi is the future of capitalism.

🇮🇳 Why Big Tech is doubling down on investing in India.

🤷🏻♂️ Experts: US taking 25% cut of Nvidia chip sales “makes no sense.”

💼 The one word that sums up the job market in 2025.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.