☕️ Good Morning.

Producer Price Index @ 8:30am ET

Fed rate decision @ 2pm ET

The Fast Five → Here’s everything the Fed is expected to do today, new COP28 draft demands swifter fossil fuel transition, Zelenskyy in Washington to discuss Ukraine aid impasse, Biden fires up price wars as inflation cools, and Argentina’s Milei devalues Peso by 54%…

Here’s your 5-min briefing for Wednesday:

BEFORE THE OPEN

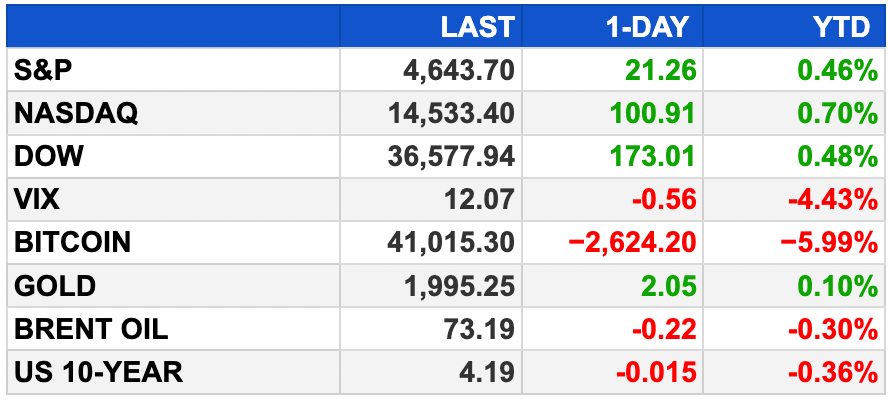

As of market close 12/12/2023.

MARKETS:

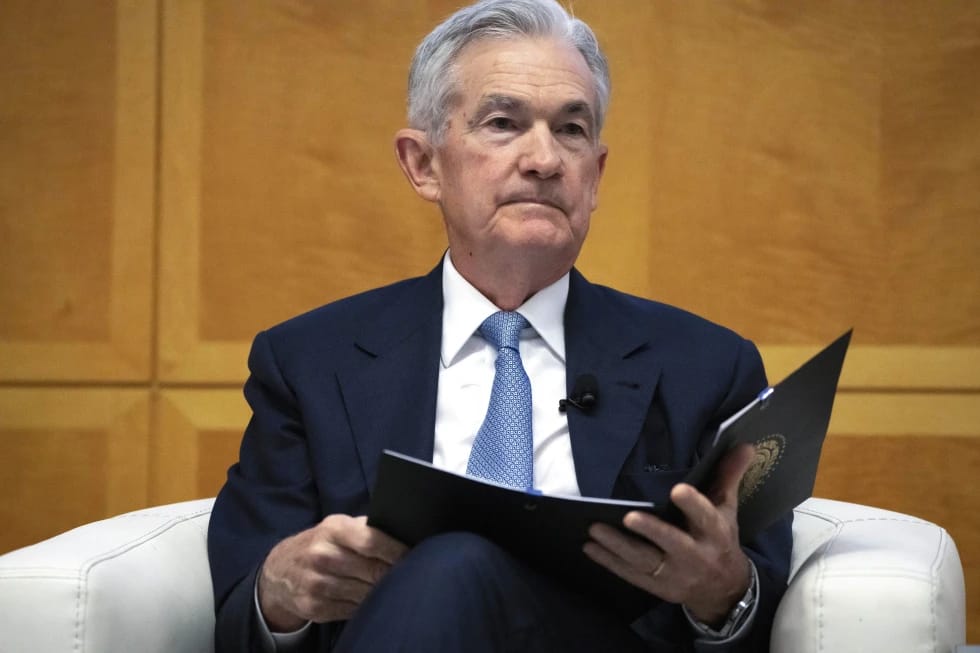

U.S. stock futures rise ahead of the Federal Reserve's policy decision.

Recent sessions saw the S&P 500 and Dow reaching their highest levels since January 2022.

Investors look to Fed Chair Jerome Powell's comments for insights into potential rate cuts.

Despite anticipation, markets remain uncertain about the timing of rate cuts, with odds of cuts beginning next spring.

The 10-year Treasury yield sits around 4.2%, down from its October peak.

Today: The November producer price index data will be closely watched before the Fed’s announcement.

EARNINGS

What we’re watching this week:

Wednesday:

Adobe (ADBE) - expected: $4.14 per share (+15% YoY) on $5.0 billion revenue (+11.2% YoY)

Thursday: Lennar (LEN)

Costco Wholesale (COST) - expected: $3.41 per share (+11.1% YoY) on $57.7 billion revenue (+8.1% YoY)

Friday:

Darden Restaurants (DRI) - expected: $1.73 per share (+13.8% YoY) on $2.7 billion revenue (+8.0% YoY)

Full earnings calendar here

NEWS BRIEFING

Zelenskyy in Washington to discuss Ukraine aid impasse with Biden (more)

‘Too many things unaffordable:’ Biden fires up price wars as inflation cools (more)

Inflation data in line with expectations at 3.1% year-over-year (more)

Oil holds soft tone on oversupply concerns, markets await Fed (more)

Argentina’s Milei devalues Peso by 54% (more)

Japan's business mood hits near 2-year high, keeps BOJ exit in focus (more)

Developing Asia to end 2023 on brighter note as China's economy recovers (more)

JPMorgan to outsource $500 billion custody business in Hong Kong, Taiwan (more)

Hedge fund groups sue US SEC in bid to vacate short-selling rules (more)

Adani to invest $100 billion over 10 years in green transition (more)

Goldman trader who was paid $100 million since 2020 to step down (more)

Netflix posts viewer data on every show, film for first time (more)

Temu was the most-downloaded iPhone app in the US in 2023 (more)

Google loses monopoly case to Fortnite maker Epic Games (more)

Bezos’ Blue Origin aiming to make long-awaited return to launch next week (more)

Harvard board backs university president after congressional remarks (more)

Valued at $86B, OpenAI’s latest revenue filing shows how its financials are a mystery (more)

SBF’s lawyer says his client was the ‘worst’ ever under cross examination (more)

DEALFLOW

M & A | INVESTMENTS:

Choice Hotels launches hostile $8 billion takeover bid for Wyndham (more)

AstraZeneca purchases Icosavax (more)

Pfizer gets OK for $43-billion Seagen deal after donating cancer drug rights (more)

Codorus Valley to merge with Orrstown Financial in all-stock deal (more)

Disney, Reliance discuss India Entertainment merger (more)

RØDE Microphones buys Mackie (more)

RedBird IMI in talks to buy UK's All3Media in $1.3 billion deal (more)

Vontas, an intelligent transit technology company, acquired Orion Labs, a company delivering instant and secure voice, location, and data messaging across connected devices and applications (more)

Formstack, a SaaS company that provides a no-code suite to create and orchestrate workflow with custom forms, documents, and eSignatures, acquired Formsite, an online forms and surveys platform provider (more)

Ncontracts, a provider of integrated compliance, risk, and vendor management solutions to the financial services industry, acquired Quantivate, a provider of governance, risk, and compliance (“GRC”) solutions for banks and credit unions (more)

Nova buys A&R Bulk-Pak (more)

Blue Point-backed TAS acquires ECS (more)

Harvest Partners purchases Road Safety Services (more)

Genstar capital-backed Prometheus Group acquires MobilOps (more)

VC

True Anomaly, a technology company developing advanced hardware and software systems, raised $100M in Series B funding (more)

Essential AI, a company specializing in building partnerships between humans and computers, raised $56.5M in Series A funding (more)

Shinobi Therapeutics, a biotechnology company developing a new class of immune evasive iPS-T cell therapies, closed a $51M Series A financing (more)

Calyxo, a medical device company developing next-generation treatment solutions for patients with kidney stones, raised $50M in Series D funding (more)

Freya Biosciences, a biotech company specializing in women’s health, raised $38M Series A financing (more)

Laza Medical, a portfolio company advancing AI-powered robotically-assisted imaging solution for cardiovascular interventions, raised $36M in Series A funding (more)

Fourth Power, a provider of utility-scale thermal battery solutions, raised $19M in Series A funding (more)

Origin AI, a WiFi Sensing technology company, closed its latest $15.9M Series B extension (more)

Noetica AI, a provider of an AI software platform that benchmarks corporate debt transactions, raised $6M in funding (more)

Magma, a provider of a collaborative browser-based art creation and project management platform, raised $5M in Seed funding (more)

Xeol, a cybersecurity startup, raised $3.2M in Seed funding (more)

VirtualZ Computing, a provider of a solution to connect mainframes to hybrid cloud for bi-directional data access, raised $2.2M in funding (more)

Signum.AI, an AI startup specializing in automating B2B customer insights research, raised an undisclosed amount in Seed funding (more)

Simplifield E-Solutions, a zero waste to landfill material processing and management company, received an investment from HCAP (more)

Geo-Solutions, a provider of geotechnical and environmental remediation services, received an investment from Blue Sage Capital (more)

FUNDRAISING

Falfurrias Management Partners, a lower middle-market private equity firm, closed Falfurrias Growth Partners I, at $400M (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

🧀 WTF: Doritos thinks we want nacho cheese-flavored booze.

🗝 Members only: A secret WhatsApp group with over 100 CEOs as members comes to light after Sam Altman crisis.

🧳 Get packing: The world’s top city destinations for 2023 revealed.

📊 Spreadsheeting: Some people go to Vegas to gamble. Others go to watch the World Excel Championships.

💎 True classics: There are 125 songs in history that have been certified diamond — here they all are…

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.