Good morning.

The Fast Five → Earnings kick into high gear, Tesla slides as EV makers slash prices amid fierce competition, Russia warns the world is on the brink of a ‘direct military clash’ between nuclear powers, US sues to block union of Coach and Michael Kors, and luxury real estate prices hit an all-time record…

Calendar - next week: (all times ET)

WED, 4/24: | Durable-goods orders, 8:30a |

THU, 4/25: | GDP - Q1, 8:30a |

FRI, 4/26: | PCE index, 8:30a |

Your 5-minute briefing for Tuesday, April 23:

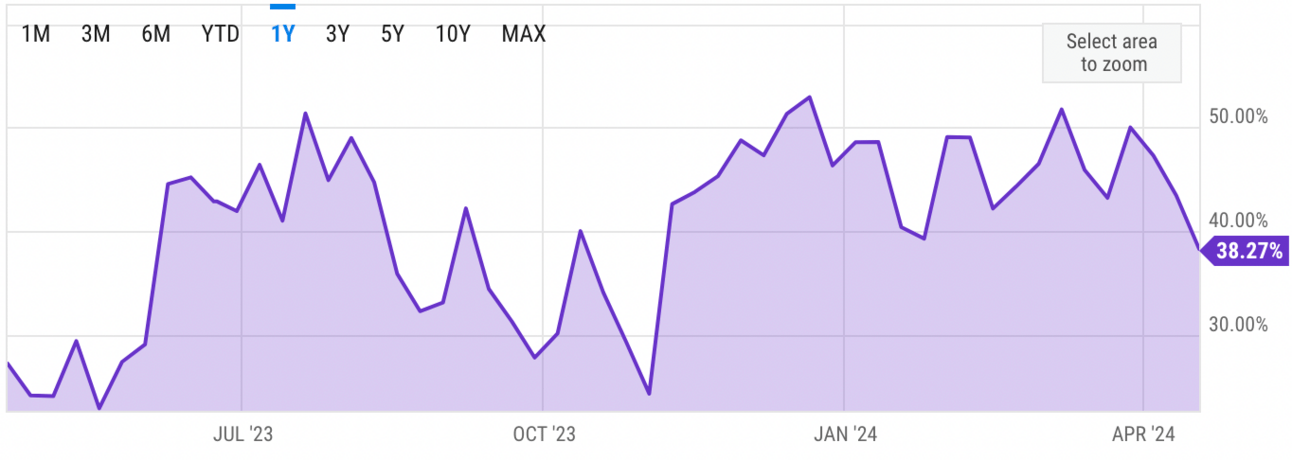

US Investor % Bullish Sentiment:

38.27% for Wk of Apr 18 2024 (Last week: 43.44%)

Market Recap:

U.S. stock futures stable after S&P 500 ends six-day slide.

Dow up 0.05%, S&P 500 futures rise 0.02%, Nasdaq dips 0.06%.

Tech rebound drives Monday's gains, Nvidia surges 4%.

Mega-cap earnings in focus: Tesla, Meta, Alphabet, Microsoft.

New home sales data eyed for Tuesday's economic update.

EARNINGS

What we’re watching this week:

Today: General Motors (GM), JetBlue Airways (JBLU), Kimberly-Clark (KMB), Lockheed Martin (LMT), Mattel (MAT), PepsiCo (PEP), Spotify (SPOT), United Parcel Service (UPS), Visa (V)

Tesla (TSLA) - $.51 EPS (-40% YoY) on $22.3B (+11.5% YoY)

Meta Platforms (META) - $4.31 EPS expected on revenue of $36.1B (+26.1% YoY)

Thursday: American Airlines (AAL), Caterpillar (CAT), Hertz Global (HTZ), Roku (ROKU), Teladoc (TDOC)

Alphabet (GOOGL) - $1.89 EPS expected on $69.78B revenue

Microsoft (MSFT) - $2.82 EPS (+15.1% YoY) on $60.8B revenue (+14.9% YoY)

Full earnings calendar here

TOGETHER WITH SIGNM

Every investor needs an edge.

Sharpen your edge with Al-powered financial news and social media analysis.

SIGNM gives you access to actionable insights EARLY by knowing what others are thinking:

✔️ Easily monitor millions of opinions daily about the market

✔️ See what's trending, gaining or losing momentum

✔️ Bullish and bearish sentiment summary

✔️ Millions of social media posts analyzed daily

✔️ View over 1,000+ stocks profiled

✔️ And much more.

Dip into AI today with SIGNM’s market insights.

~ please support our sponsors ~

HEADLINES

Russia warns the world is on the brink of a ‘direct military clash’ between nuclear powers (more)

'Overdue' pullback in US stocks to test dip-buyers' resolve (more)

Geopolitical tensions are US credit investors' top concern, BofA survey says (more)

Heavy price pressure on gold, silver as risk aversion recedes (more)

Luxury real estate prices just hit an all-time record (more)

US consumers on lower incomes face loan stress while banks pull back (more)

US sues to block $8.5 Billion union of Coach, Michael Kors (more)

High global food prices may finally see a bottom in 2024, says Oxford Economics (more)

Delta Air Lines gives staff another 5% raise, hikes starting wages to $19/hour (more)

Ex-JetBlue CEO Robin Hayes to run Airbus North America (more)

Express files for Chapter 11 bankruptcy protection, announces store closures, possible sale (more)

Lululemon to shutter Washington warehouse, lay off 128 employees (more)

Construction starting on bullet train rail between Las Vegas and SoCal (more)

DEALFLOW

M+A | Investments

Activist Jana, in letter, urges Wolfspeed to eye sale, other strategic alternatives (more)

Informatica says it’s not for sale, following Salesforce’s reported interest in $10 billion deal (more)

Kroger, Albertsons to sell 166 more stores seeking approval of $25 billion merger (more)

Public, a provider of an investing platform where members can invest in stocks, options, bonds, crypto, and alternative assets, acquired the TradeApp investment accounts from Stocktwits (more)

West Lane purchases Mented Cosmetics Brand (more)

Cyber Advisors buys S&L Computer Services (more)

VC

Rippling, a workforce management startup, raised $200M in new financing (more)

Givebutter, a provider go a nonprofit fundraising and CRM platform, raised $50M in funding (more)

Rubedo Life Sciences, a biopharmaceutical company committed to developing first-in-class therapies targeting senescent cells diseases, closed a $40M Series A financing round (more)

Salubris Biotherapeutics, a clinical-stage biotechnology company developing novel biologic therapeutics, raised $35M in funding (more)

Pomelo, a consumer fintech enabling international money movement with consumer credit, raised $35M in Series A in venture capital and a $75M expansion of its warehouse facility (more)

AccessHope, a cancer benefit company, raised $33M in Series B funding (more)

iVEAcare, a development stage medical device company, raised $27.5M in Series A funding (more)

Exowatt, a renewable energy company, raised $20M in seed funding (more)

Curio Legacy Ventures, a tech development company dedicated to advancing a closed fuel cycle, raised $14M in Seed funding (more)

Homium, a home equity mortgage lender and provider of a securitization platform, raised $10M in Series A funding (more)

Clarity Pediatrics, a digital health company, raised $10M in funding (more)

Auxa Health, a provider of an AI-powered benefit navigation technology solution, raised $5.2M in Seed funding (more)

VulnCheck, an exploit intelligence company, closed its seed funding round at a total of $7.95M, with $4.75M in new funding (more)

Pelvital USA, Inc., a women’s health company, closed an additional $2.32M in its seed-plus funding round (more)

First time reading? Get tomorrow’s briefing here »

CRYPTO

Powered by MILKROAD - Get smarter about crypto in 5 min.

BULLISH BITES

💍 Pursuits: Here’s the lab-grown diamond startup that’s attracted a16z’s attention.

🎪 Cicus: Trump’s trial is the reality show he never wanted.

🩺 Speed-dial: Meet the private doctor to the wealthy (at $40K a year).

☕️ The buzz: Coffee drinking hits record high in the US.

📈 Invest Smarter: Get your investing edge with Al-powered emerging trends and social sentiment analysis. Save up to 69% for a limited time » *

What did you think about today's briefing?

☀️ Get your briefings before everyone else, go PRO »

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.