Good morning.

The Fast Five → Lutnick: One trade deal is done, Eric Trump: Banks may be extinct in ten years, Hedge funds lose market conviction, Super Micro shares dive after weak financials, and Walmart pledges low prices despite tariffs…

Will May Start the Next Depression?

Did you know that Billionaires like Warren Buffett are holding on to record amounts of cash and fleeing from their positions?

What do they know that you don't?

Well they know that there are five cracks in America's foundation….cracks that may lead to a real estate and market crash like you haven't seen in your lifetime.

Calendar: (all times ET) - Full Calendar

Today:

PCE index, 8:30A

Tomorrow:

Initial jobless claims, 8:30A

Auto sales, TBA

Your 5-minute briefing for Wednesday, April 30:

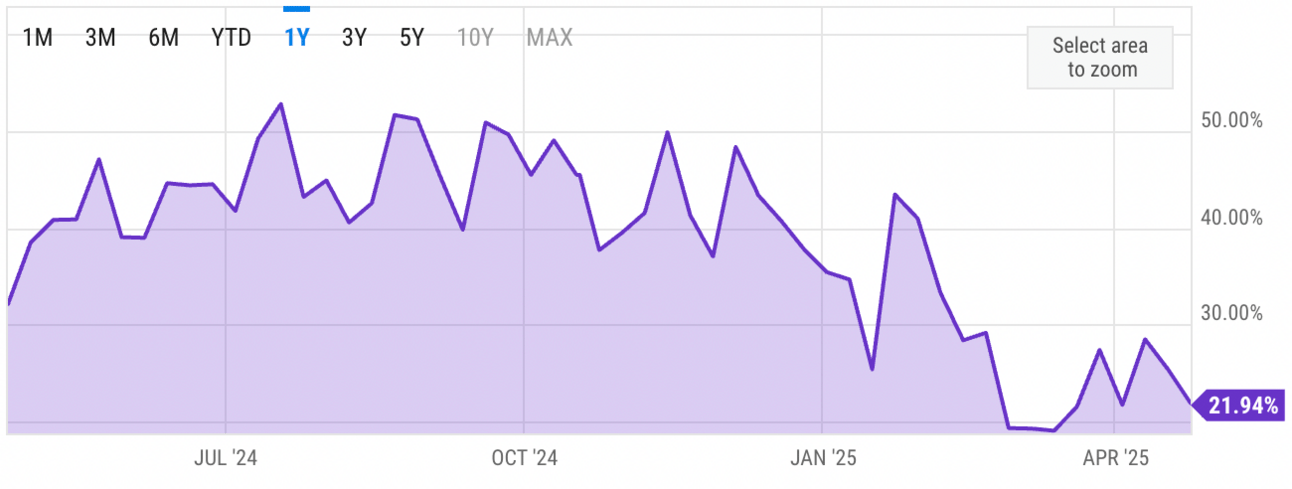

US Investor % Bullish Sentiment:

↓ 21.94% for Week of April 24 2025

Previous week: 24.44%. Updates every Friday.

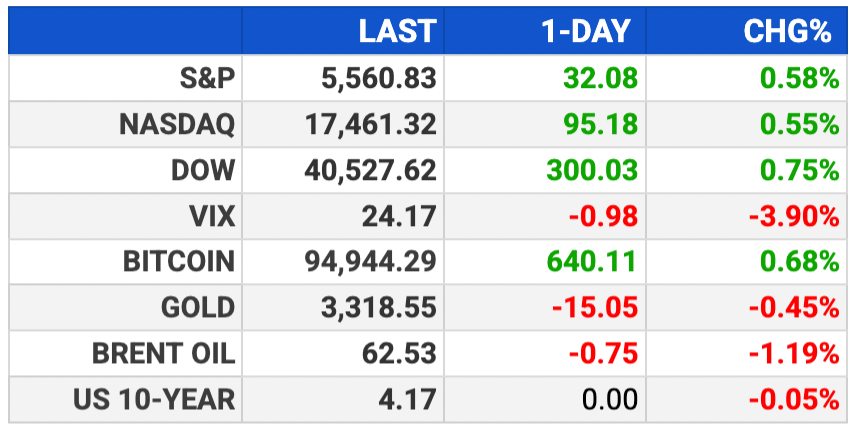

Market Wrap:

Futures: S&P -0.4%, Nasdaq -0.6%, Dow +71 pts (+0.2%).

Tues: Dow +300, S&P +0.6%, Nasdaq +0.6%; 6-day win streak.

Trump: India trade deal “coming along great”; deal “close,” says Lutnick.

April: S&P -0.9% MTD, Dow -3.5%, Nasdaq +0.9%.

GDP est: +0.4%; PCE inflation est: flat M/M, +2.2% Y/Y.

EARNINGS

Big earnings week. We’ll be posting in two-day increments:

WEDNESDAY:

➤ Meta $META ( ▲ 0.45% ) - expected $5.20 eps (+10.4% YoY) on $41.4B revenue (+13.4% YoY)

Caterpillar $CAT ( ▲ 0.2% )

eBay $EBAY ( ▼ 2.23% )

Etsy $ETSY ( ▲ 0.04% )

Robinhood $HOOD ( ▼ 1.05% )

Yum! Brands $YUMC ( ▲ 2.57% )

THURSDAY:

➤ Amazon $AMZN ( ▼ 0.17% ) - $1.36 eps (+38.8% YoY) on $155.1B revenue (+8.2% YoY)

➤ Apple $AAPL ( ▲ 0.51% ) - $1.61 eps (+5.2% YoY) on $94.1B revenue (+3.6% YoY)

Airbnb $ABNB ( ▲ 1.78% )

Eli Lilly $LLY ( ▲ 0.9% )

Estee Lauder $EL ( ▲ 0.76% )

Instacart $CART ( ▼ 0.25% )

KKR $KKR ( ▲ 0.37% )

Mastercard $MA ( ▲ 0.97% )

McDonald’s $MCD ( ▼ 0.73% )

Roblox $RBLX ( ▼ 0.05% )

Wayfair $W ( ▲ 0.52% )

SIGNAL | From OUR RESEARCH PARTNERS

Trump’s Final Reset

Exposed: the economic plot to “reset” the US economy and redistribute trillions of dollars in wealth. Get the full story.

Millions of Americans are about to be wiped out, while others could make a fortune… make sure you’re on the right side »

Why Silicon Valley & Trump Are Backing This New Breakthrough

It's not AI, crypto, EV’s, or anything like that... In fact, Bloomberg estimates this will be 10 times bigger than all of them combined.

Bill Gates, Jeff Bezos, and Sam Altman are all piling into it. Trump put his seal of approval on it on his first day in office.

HEADLINES

S&P futures slip after index posts longest win streak since November (more)

US corporate bond markets betray caution behind recent rebound (more)

Investors turn to emerging market debt after tariffs hit US Treasurys (more)

Hedge funds lose market conviction, except for shorting US stocks (more)

Trump officials eye changes to Biden's AI chip export rule (more)

Gold falls as trade tensions soften (more)

Oil set for historic April selloff on darkened outlook(more)

Apple investors seek clarity on tariffs, AI strategy as iPhone sales decline (more)

Walmart won't break out tariff costs and pledges low prices (more)

Super Micro shares dive after weak preliminary financials (more)

Starbucks stock falls as sales disappoint, turnaround pressures earnings (more)

Snap plunges 13% on ‘headwinds’ to start quarter, inability to offer guidance (more)

DEALFLOW

M+A | Investments

Investcorp sells Resa Power to Kohlberg & Co.

Avathon Capital, a PE firm specializing in investing in lower middle-market companies, acquired OculusIT, a provider of MSP for education institutions

Intuit Inc., a global fintech platform, acquires GoCo, a provider of modern HR and benefits solutions for SMB’s

VC

Apex, a spacecraft manufacturer offering productized and configurable satellite bus platforms, raised $200M in Series C funding

Utilidata, a company specializing in edge AI tech, raised $60.3M in Series C funding

indiGOtech, a new mobility tech company, closed a $54Mn Series BB funding round

Villa, an off-site homebuilding platform provider, raised $40M in funding

Forge Nano, a tech company developing domestic battery and semiconductor solutions, raised $40M in new funding

Blooming Health, a social care tech platform, raised $26M in Series A funding

Growers Edge, a company providing financial products for agricultural retailers, manufacturers, and lenders, raised $25M in funding

GORGIE, an energy drink brand, raised $24.5M in Series A funding

P-1, a company building engineering AGI for the physical world, raised $23M in Seed funding

Near Space Labs, a stratospheric remote sensing company, raised $20M in Series B funding

Basil Systems, an AI-powered SaaS platform for the pharma and medical device industry, raised $11.5M in funding

Eden, a provider of a digital sales enablement platform for contractors, raised $3.7M in funding

ColdVentures, a maker of rapid core body cooling product ColdVest, raised an undisclosed amount in a Seed round at a $2.5M valuation

CRYPTO

BULLISH BITES

💰 Warren Buffett is hoarding cash—here’s why you should too *

🛍 What to know about Amazon Haul, the Temu and Shein competitor.

🪙 Stablecoins' trillion-dollar "Game of Thrones" is afoot.

🍿 Why ‘Margin Call’ remains Wall Street’s favorite movie - and the best indictment of it.

⛳️ The short-term rental hosts spending big to trick out their vacation properties.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.