Good morning.

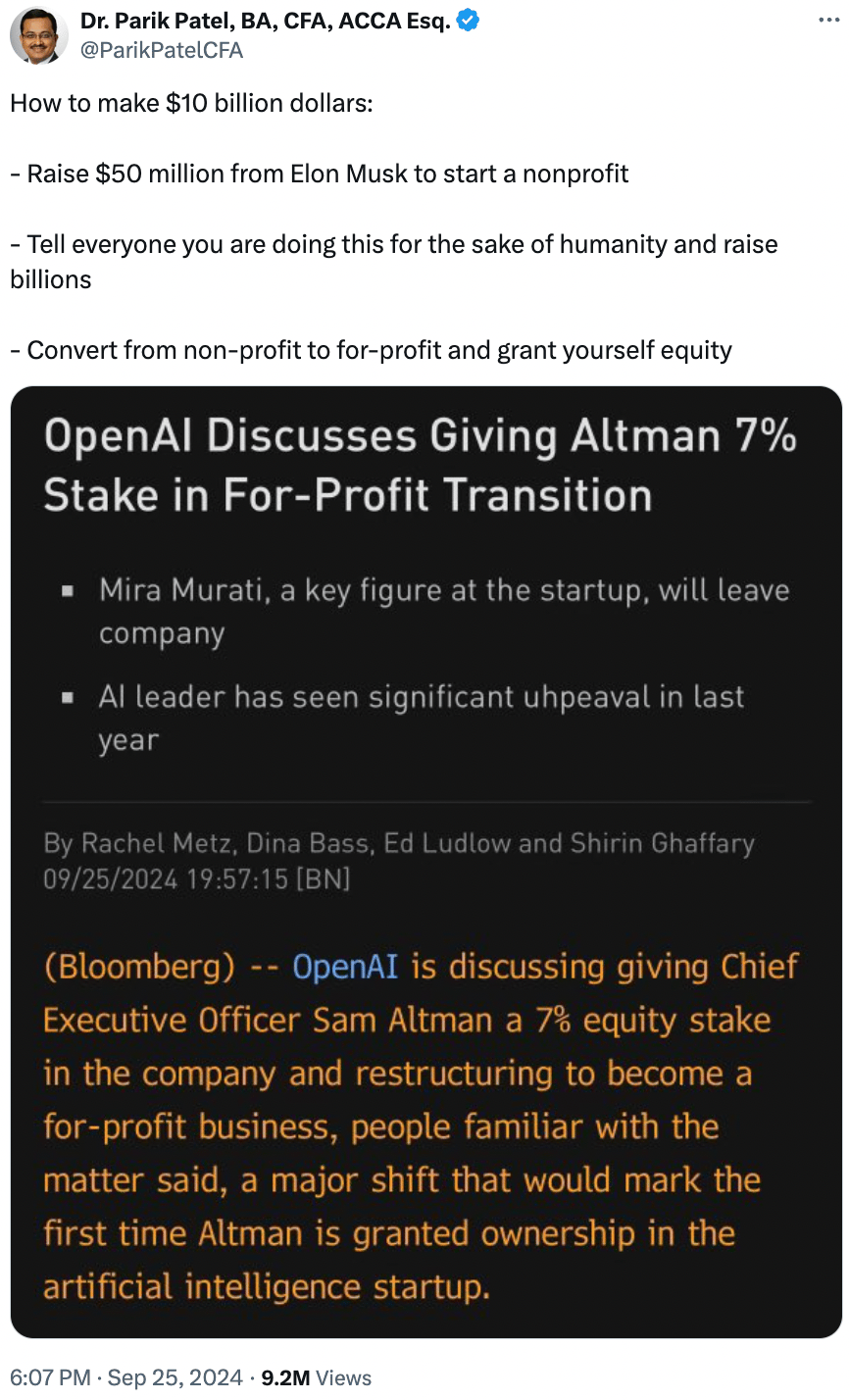

The Fast Five → OpenAI to give Altman 7% stake in for-profit shift- top execs exit, China weighs $142 billion capital injection into top banks, mortgage refinance demand surges 20%, FTC cracks down on deceptive AI, and Meta unveils cheaper $299 Quest 3S VR headset…

🚨 Protect Your Retirement: Five Economic Cracks You Can’t Ignore » *

A message from BTM

Calendar: (all times ET) - Full calendar here

Today:

Initial jobless claims, 8:30 am

Durable goods orders, 8:30 amTomorrow:

PCE index, 8:30 amConsumer sentiment, 10:00 am

Your 5-minute briefing for Thursday, September 26:

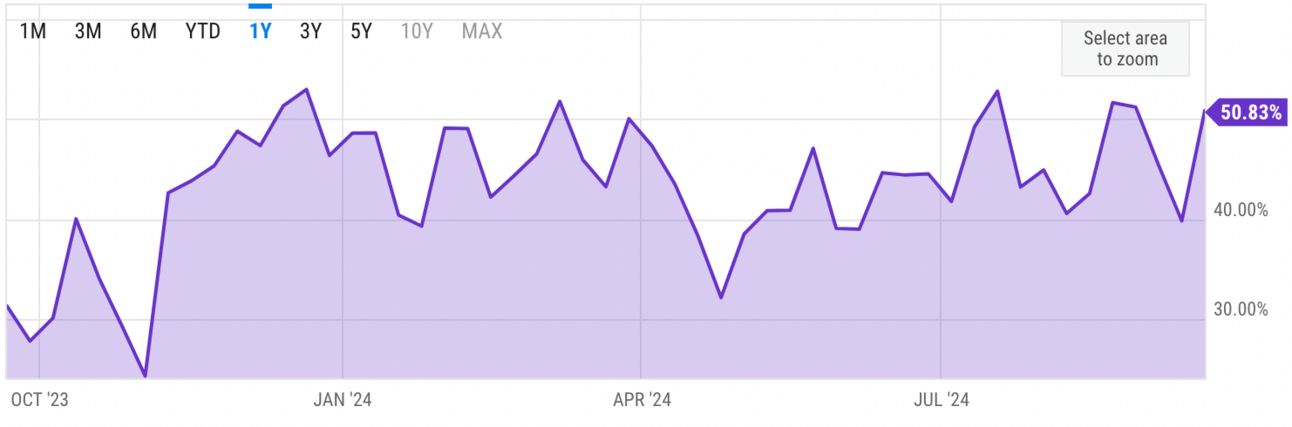

US Investor % Bullish Sentiment:

↑ 50.83% for Week of September 19 2024

Last week: 39.80%. Updates every Friday.

Market Wrap:

Dow futures down 20 pts; S&P +0.09%, Nasdaq +0.3% w/ Micron rising 14%.

Micron's strong guidance boosts Applied Materials, Lam Research (+4%).

S&P and Dow fell after hitting records; Nasdaq up slightly.

Tom Lee links market volatility to election uncertainty.

CarMax, Accenture, Costco to report earnings.

EARNINGS

Here are the earnings we’re watching this week.

Costco Wholesale (COST) - earnings of $5.08 per share (+4.5% YoY) on $79.9B revenue (+1.3%)

Friday: [none watched]

See full earnings calendar here.

HEADLINES

US confidence wobble weighs, China buoyed (more)

Fed's bumper rate cut revives 'reflation specter' in bond market (more)

Mortgage refinance boom takes hold, as weekly demand surges 20% (more)

FTC announces crackdown on deceptive AI claims and schemes (more)

Holiday spending on buy now, pay later to hit record due to debt-laden shoppers (more)

Arbitration board gives green light to US Steel-Nippon Steel merger over union's objections (more)

Meta unveils cheaper $299 Quest 3S VR headset (more)

Ford, GM slips following Morgan Stanley downgrade (more)

Shippers scramble for workarounds ahead of looming port strike (more)

Private equity calls in experts to fix companies they can’t sell (more)

M&A seen slowing ahead of election after uneven third quarter (more)

American Eagle sues Amazon over alleged ‘knock-offs’ (more)

A MESSAGE FROM BTM

Five Economic Cracks Threatening Your Retirement Savings

Dylan Jovine was laughed out of the room when he predicted the 2008 financial crisis - over a year in advance.

But he was proven right...

And his readers had a chance to walk away with gains like 459%... 646%... even 700%...

All while the average investor saw their retirement savings get cut in half.

He sees five cracks forming in the US economy, which could have catastrophic consequences for retirement-aged investors.

If he's right again - it doesn't matter who wins this election in November...

Millions of Americans could be left behind.

Simmy Adelman, Publisher

Behind the Markets

- sponsored message -

DEALFLOW

M+A | Investments

Buyout firm L Catterton acquires majority stake in pilates chain Solidcore (more)

Lexmark owners weigh $2 billion sale of printer maker (more)

Miami multifamily office acquired by Brazil’s BTG in global push (more)

Dotmatics, a company specializing in R&D scientific software, acquired Virscidian, a provider of analytical chemistry solutions (more)

Oak Essential, a beauty brand, received an investment from Silas Capital and Unilever Ventures (more)

ATIS receives investment from Thompson Street Capital Partners (more)

VC

Zing Health, a Medicare Advantage insurer, raised an incremental $140M in funding (more)

Whatfix, a global digital adoption platform, secured $125M in Series E funding (more)

Crisp, a retail data platform for granular sales and supply chain intelligence, closed a $72M Series B equity funding round (more)

Wrapbook raises $20M equity financing at a $750M valuation (more)

Ujet, AI-powered cloud contact center solutions, closed its latest round bringing the total raised in Series D funding to $76M (more)

Cyclic Materials, a recycling company creating a circular supply chain for rare earth elements, raised $53M in Series B Funding (more)

Helaina, a biotech company developing human equivalent bioactive proteins, raised $45M in Series B funding (more)

OxeFit, an AI-driven health and fitness experiences, raised $17.5M in funding, bringing the total to over $70M, to date (more)

Arcade, an AI product creation platform, raised $17M in total funding (more)

Outgo, a freight payments platform provider, raised $15M in funding (more)

Tamnoon, a company specializing in managed cloud security remediation, raised $12M in Series A funding (more)

Seen, a haircare brand, closed a $9M Series A funding (more)

Feno, a healthtech company specializing in at-home oral health technology, raised $6M in Seed funding (more)

Brisk Teaching, an AI-powered Chrome extension for educators, schools, and districts, raised $5M in Seed funding (more)

DeepLook Medical, a visual enhancement company for medical application, raised an undisclosed amount in Series A funding (more)

ReSync Bio, a scientific software provider accelerating preclinical R&D, raised an undisclosed amount in funding (more)

CRYPTO

BULLISH BITES

⚠️ Investor Alert: The five economic cracks you can't ignore *

🔎 It’s Over: Mark Zuckerberg is done with politics.

🦄 Defender: A Land Rover prepared for the end of the world.

➗ Questionable: Your phone’s ‘5G’ icon and signal bars are lying to you.

🗽 Trending: How birria took over restaurant menus across the country.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.