Good morning.

The Fast Five → S&P 500 hits fresh record, Baltimore's Key Bridge will take years to rebuild, Amazon spends $2.75 billion on its largest venture investment yet, Paramount’s global debt rating cut to junk, and US businessmen participated in a 'Chinese Communist spectacle'…

Calendar:

Today: Initial jobless claims, 8:30am ET

Consumer sentiment, 10:00am ET

FRI 3/29: MARKET CLOSED (Good Friday)

PCE Index, 8:30am ET

Fed Chair Jerome Powell speaks, 11:30am ET

Your 5-minute briefing for Thursday, March 28🐰

US Investor % Bullish Sentiment:

43.20% for Wk of Mar 21 2024 (Last week: 45.90%)

Market Recap:

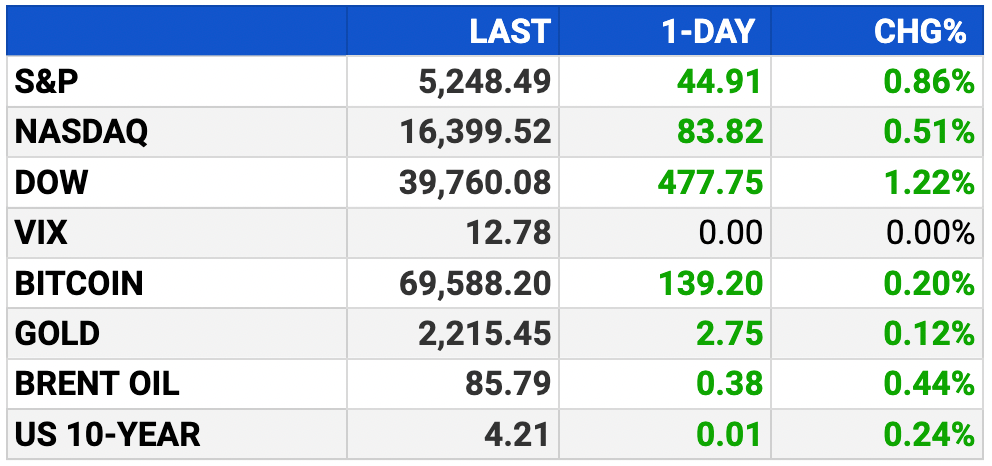

Stock futures flat as S&P 500 eyes best Q1 in 5 years.

RH jumps 8% despite missing estimates, hints at strong 2024 demand.

Wednesday's rally: S&P 500 up 0.86%, Dow +1.22%, Nasdaq +0.51%.

2nd winning quarter, 5th consecutive winning month.

S&P 500 up 10% in Q1, best since 2019; Dow +5.5%, Nasdaq +9.3%.

Monthly gains: S&P 500 up 3%, Nasdaq and Dow both over 1.9%.

Await jobless claims, GDP, consumer sentiment data Thursday.

Economic data on Good Friday: personal income, spending, consumption expenditures.

EARNINGS

What we’re watching:

Walgreens Boots Alliance (WBA) - earnings of $.82 per share (-29.3% YoY). Revenue forecast to fall 2.9% to $35.9B.

Full earnings calendar here

HEADLINES

Baltimore port crisis: Carriers put U.S. companies on hook for cargo pickup (more)

Rebuilding Baltimore's Key Bridge will likely take years (more)

Biden admin announces $1.5 billion loan for first reopening of a shuttered nuclear plant (more)

Yellen warns China against flood of cheap green energy exports (more)

Japan's yen dips to 34-year low against US dollar (more)

Paramount global credit rating cut to junk status by S&P (more)

Short sellers target Reddit shares as stock slips (more)

Fisker lost track of millions of dollars in customer payments for months (more)

BlackRock issued warning over 'misleading statements' tied to ESG funds (more)

Fast-food companies seeing low-income diners pare orders (more)

Disney agrees to settle Florida lawsuit with special district backed by DeSantis (more)

TOGETHER WITH RUNDOWN AI

The Rundown is the world’s fastest-growing AI newsletter, with over 500,000+ readers staying up-to-date with the latest AI news and learning how to apply it.

Our research team spends all day learning what’s new in AI, then distills the most important developments into one free email every morning.

DEALFLOW

M+A | Investments

UBS sells $8 billion of Credit Suisse assets to Apollo (more)

J&J in talks to buy Shockwave Medical (more)

SIX Group CEO rules out Allfunds bid amid M&A hunt (more)

Keysight to launch an offer for London-listed Spirent (more)

Spindrift explores strategic options including sale (more)

Ardian-backed lab chain Inovie considers €3 billion sale (more)

Euro freezer king Nomad Foods looks to US for acquisitions (more)

Louis Dreyfus to buy Brazil’s top instant coffee exporter (more)

Woolpert Acquires Murphy Geospatial (more)

ONE Group acquires owner of Benihana (more)

Further, a data, cloud, and AI company, acquired Pandata, a company specializing in AI design and development (more)

Flare, a threat exposure management company, acquired Foretrace, a data exposure company (more)

Davidson Kempner invests in Upchurch Companies (more)

Battery Ventures invests in Mobius Institute (more)

One Equity Partners invests in CBM (more)

VC

Avenzo Therapeutics, Inc., a clinical-stage biotech company, closed a $150M Series A-1 financing (more)

Observe, a SaaS observability company, raised $115M in Series B funding (more)

Aloha, a Climate Neutral Certified plant-based protein brand, received $68M investment from Semcap Food & Nutrition (more)

Nourish, a provider of a telenutrition platform that connects people to registered dietitians, raised $35M in Series A funding (more)

Brightside Health, a telemental health company, raised $33M in Series C funding (more)

Fireworks AI, a production AI platform helping developers build new AI solutions, raised $25M in Series A funding (more)

Evoloh, a cleantech company that manufactures electrolyzer stacks for hydrogen production, raised $20M in funding (more)

Gather AI, a provider of computer vision and AI-powered warehouse inventory monitoring, raised $17M in Series A-1 in funding (more)

Elixir Games, a web3 gaming distribution platform, closed a $14M Seed funding round (more)

Binarly, a provider of an AI-powered firmware and software supply chain security platform, raised $10.5M in Seed funding (more)

BOB (“Build on Bitcoin”), a hybrid Layer-2 powered by Bitcoin and Ethereum, closed a $10M seed funding (more)

Bedrock Security, a data security company, raised $10M in Seed funding (more)

Nominal, a company providing generative AI to bridge the gap between ERP systems and the financial management needs of modern businesses, raised $9.2M in Seed funding (more)

ValidMind, a provider of an AI and model risk management platform for financial services, raised $8.1M in Seed funding (more)

Evari, a developer of heat pump turbocompressors, raised $7.5M in funding (more)

Sertis, a managing general agency (MGA) focused on innovation in the insurance industry, raised $3.2M in funding (more)

Be Fulfilled, a full-service platform helping creators grow their businesses, received financing from Decathlon Capital Partners (more)

CRYPTO

Powered by MILKROAD - Get smarter about crypto in 5 min.

BULLISH BITES

💻 Work life: The ‘always on, always in’ era is over.

✈️ Inside: How Boeing's leadership was 'fired' by its own customers.

🤖 Stability AI: Inside the startup’s journey from AI darling to cautionary tale.

🥽 First adopters: The principles of wearable etiquette.

🪺 Limited edition: Fabergé is releasing new Fabergé eggs in honor of James Bond movies. The first can be yours for the very specific amount of $148,383. *

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here »

☀️ Get your briefings before everyone else, go PRO »

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

*from our sponsors

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.2