Good morning.

The Fast Five → Wall Street goes old school for growth in 2026, Wall Street betting on what pops AI bubble, Trump's approval rating on economy hits record low, SpaceX share sale sets $800 billion valuation, and Oracle’s $300B AI bet has fast become a bubble barometer…

📌 What Do President Trump and Silicon Valley's Elite Have in Common? The Wall Street Journal reports "a high-tech race is underway" as tech giants and President Trump all rush to back a technology (not AI) that could change our daily lives forever. Don't be caught off guard - find out what's going on right here before Jan. 1. (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

None watched

Tomorrow:

Non-Farm Employment, 8:30A

Retail Sales, 8:30A

Unemployment Rate, 8:30A

Your 5-minute briefing for Monday, Dec 15:

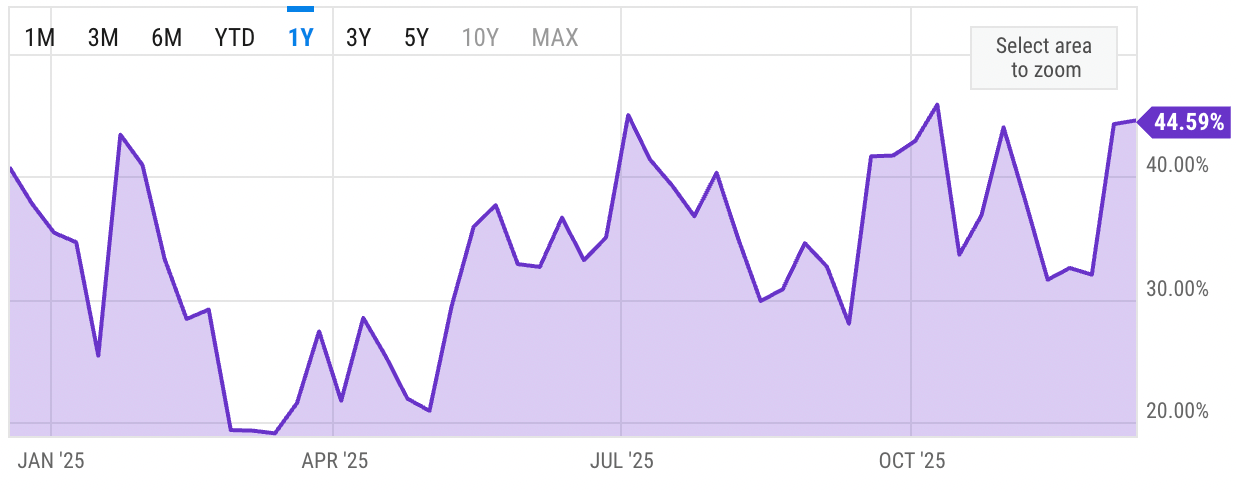

US Investor % Bullish Sentiment:

↑ 44.59% for Week of DEC 11 2025

Previous week: 44.29%

Market Wrap:

Futures slightly lower after mixed week and tech rotation

S&P -0.6%, Nasdaq -1.7%; Dow +1.1% on lower tech exposure

Oracle -12.7%, Broadcom -7% fuel AI pullback

S&P tech sector down 2.3% last week

Rotation favors cheaper, non-AI names

Key data ahead: payrolls, retail sales, CPI

EARNINGS

Here’s what we’re watching this week:

WED: General Mills $GIS ( ▼ 0.4% )

Micron Technology $MU ( ▲ 2.59% ) - $3.75 EPS (+ $1.79 YoY), on $12.5B revenue

THU: Darden Restaurants $DRI ( ▲ 2.01% )

FedEx $FDX ( ▲ 1.39% ) - earnings of $4.08 per share on $22.8B revenue

Nike $NKE ( ▼ 0.32% ) - $.37 EPS (-52.6% YoY) on $12.2B revenue (-1.2% YoY)

A MESSAGE FROM STANSBERRY RESEARCH

Did This Oil Company Just Kill the

Fossil Fuel Industry?

On September 22, a Big Oil firm invested $1 billion in a technology that could - according to Live Science - "make oil obsolete." In fact, ExxonMobil, Chevron, Eni, and Shell are ALL locked in a race to harness a breakthrough that could spell the end for Oil & Gas.

Why are they taking on this apparent suicide mission?

And what does it mean for your money?

- a message from Stansberry Research -

HEADLINES

Not 'very hawkish at all': Wall Street optimistic for 2026 market rally (more)

Trump's approval rating on the economy hits record low 31% (more)

Corporate-bond investors party as hangover looms (more)

Rich world’s rate-cut momentum is fading away (more)

Currencies on guard ahead of major central bank decisions (more)

China's factory output, retail sales weaken in November (more)

Oil rises on fears of supply disruption as tensions escalate (more)

Oracle’s $300B AI bet has fast become a bubble barometer (more)

SpaceX share sale sets $800 billion valuation (more)

Transportation stocks are hitting their stride, a good sign for investors (more)

Bitcoin hoarding company Strategy remains in Nasdaq 100 (more)

Nomura seeking private debt acquisitions in alternatives push (more)

How a Quiet Project Sparked a Gold Rush

It started as a whisper - an obscure technology buried in research labs. Then Sam Altman made his largest personal investment. Bill Gates doubled down. Even the White House stepped in.

And now a January 1st deadline could flip the switch. The story is bigger than anyone realizes.

- a message from Stansberry Research -

DEALFLOW

M+A | Investments

Adobe agreed to acquire Runway Systems

Salesforce agreed to acquire PromptLayer

PayPal acquired Loop Returns

Intuit acquired GridPay

Workday acquired TalentSignal

ServiceNow agreed to acquire Aisera

VC

Helix Carbon, a carbon-capture technology startup, raised $34M in Series B funding

NovaGen Health, an AI-enabled clinical trials platform, raised $28M in Series A funding

BrightPeak Energy, a distributed energy software company, raised $22M in growth funding

Atlas Grid, a grid-scale battery optimization software company, raised $19M in Series A funding

Stackwise AI, an enterprise AI cost-optimization startup, raised $15M in Series A funding

CarePilot, an AI care-coordination platform for health systems, raised $12M in Seed funding

LumaForge Bio, a synthetic bio company, raised $11M in Seed funding

ForgeOps AI, a DevOps automation startup, raised $9M in Seed funding

Railbird AI, a sports analytics and betting intelligence company, raised $8.5M in Seed funding

ClarityEd, an AI-powered student assessment platform, raised $6M in Seed funding

CRYPTO

Barclays sees ‘down-year’ for crypto in 2026 without big catalysts (more)

Crypto winter could spur 'Darwinian phase' for digital asset treasury firms (more)

BOJ set to hike rates to 30-year high, posing another threat to Bitcoin (more)

Crypto’s biggest players troop to Abu Dhabi, looking for a financial boost (more)

BULLISH BITES

🤔 Making sense of the risky Netflix-Warner Bros. deal.

🤖 The eerie parallels between AI mania and the dot-com bubble.’

👉 Merry Christmas, you're fired! The holiday layoff comeback.

🎄 It's beginning to look a lot like (AI) Christmas.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.