Good morning.

The Fast Five → Trump signs sweeping reciprocal tariffs, talk of revaluing US Gold is drawing Wall St. attention, Nissan and Honda ditch $60 bln merger talks, Arm is launching a chip with Meta as a customer, and Airbnb co-founder Joe Gebbia to join Musk’s DOGE…

Porter Stansberry: These Are Trump’s 10 Secret Stocks

Ten investments secretly owned by Trump’s biggest backers.

Ten investments intrinsically tied to the policies Trump will put in place.

Ten investments with the potential to return 10x or more… but only if you act right now.

Calendar: (all times ET) - Full Calendar

Today:

US retail sales, 8:30A

Monday:

President’s Day

Your 5-minute briefing for Friday, February 14 ♥️

US Investor % Bullish Sentiment:

↓ 28.42% for Week of February 13 2025

Previous week: 33.33%. Updates every Friday.

🤫 Porter Stansberry just leaked key new information on Trump’s second term…

- from Porter & Co

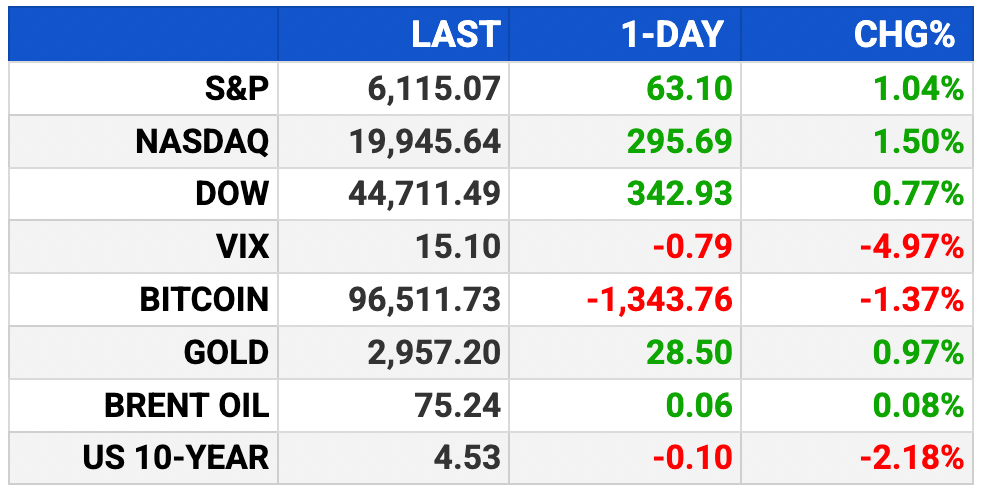

Market Wrap:

Futures flat after Trump delayed reciprocal tariffs; Nasdaq dipped 0.1%.

S&P 500 rose 1.04%, Nasdaq 1.5%, Dow 0.77% after tariff pause.

Inflation fears eased as PPI, CPI hinted at softer PCE data.

Markets on track for weekly gains; Nasdaq up 2.2% so far.

Moderna earnings, retail sales data due Friday.

EARNINGS

No earnings watched today. See full calendar here »

HEADLINES

Rates will consider non-tariff barriers, including EU’s VAT. President reiterated plan to tax auto, chip and drug imports.

US weekly jobless claims decline amid stable labor market (more)

US producer inflation trends higher (more)

Americans' credit card debt reaches new record high (more)

Apple plans to overhaul China iPhones with AI by middle of year (more)

Arm shares rise on report that Meta will buy its first chip (more)

Defense stocks drop after Trump says Pentagon spending could be halved (more)

Nissan and Honda ditch $60 billion merger talks (more)

State Dept says Tesla was not awarded $400M contract for 'armored' cars (more)

Musk will pull OpenAI bid if ChatGPT maker remains non-profit (more)

Hermes posts better-than-expected jump in fourth-quarter sales (more)

Airbnb co-founder Joe Gebbia to join Musk’s DOGE (more)

TOGETHER WITH HUEL

You’re Doing Breakfast Wrong

Discover Huel Black Edition—complete nutrition without compromise.

With 40g of protein and 27 essential vitamins, it’s the perfect meal for your busy life. Whether at home or on the go, fuel up in seconds with a high-protein meal.

Even better? New customers get a bundle of savings to kickstart their Huel journey. Use code BEHUEL15 for 15% off your first order, plus a FREE t-shirt and shaker.

DEALFLOW

M+A | Investments

KKR is said to weigh Nissan investment after Honda talks end (more)

Qatari-backed investor eyes Papa Johns takeover (more)

Steve Madden to buy UK shoe brand Kurt Geiger for $360M (more)

Vouch, an insurance provider for companies, acquired StartSure Insurance Services, Inc., an insurance provider improving how small businesses get insurance, and raised an undisclosed amount in Series D funding (more)

JETSET Pilates, a pilates franchise combining DJ’s with fitness for an immersive experience, received a strategic investment from Purchase Capital (more)

VC

Abcuro, a clinical-stage biotech company, raised $200M in Series C funding (more)

K2 Space, a company developing a satellite bus platform, raised $110M in Series B funding (more)

Eudia, an augmented intelligence platform for Fortune 500 legal teams, closed a Series A funding round for up to $105M (more)

Liberty Company, an insurance broker handling the insurance needs of businesses, non-profits, and individuals, raised $100M in funding (more)

EnCharge AI, a startup developing analog in-memory-computing AI chips, raised $100M in Series B funding (more)

Newleos Therapeutics, Inc., a clinical stage neuroscience company, closed $93.5M Series A financing (more)

Candid Health, an autonomous revenue cycle automation platform for healthcare providers, raised $52.5M in Series C funding (more)

fal, an infrastructure platform for AI-driven media creation, raised $49M in Series B funding (more)

SGNL, an identity-first security startup, raised $30M in Series A funding (more)

Circuit, an electric shuttle solutions company, raised $17M in Series B funding (more)

Tofu, a unified AI platform for B2B marketing teams, raised $12M in Series (more)

Junevity, a biotechnology cell reset therapeutics company, raised $10M in seed funding (more)

Integrail, an Agentic AI startup, raised $10M in seed funding (more)

Vitalchat, AI-powered ambient solutions for in-patient virtual nursing and procedural telehealth, raised $6M in Series A funding (more)

Oso Semiconductor, a developer of chipsets for wireless communication and sensing applications, raised $5.2M in Seed funding (more)

Cerula Care, an oncology behavioral health and care navigation company, raised in Seed funding (more)

CRYPTO

BULLISH BITES

🤔 How Silicon Valley swung from Obama to Trump.

📊 How Trump might lower long-term rates.

🗽 The top 10 US cities New Yorkers want to move to most, according to StreetEasy.

🌴 Elite travel agents are using AI to sell vibes, not destinations

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.