Good morning.

The Fast Five → World economy fault lines shift from prices to debt, US budget deficit tops $1.8 trillion in fiscal 2024, S&P set to grind higher toward 6,000 milestone, Boeing seeks to sell off assets in desperate attempt to stay afloat, and Trump doubles down on tariff plan…

📈 Why Every AI Company Relies on This $16 Stock

A message from Dylan Jovine

Calendar: (all times ET) - Full calendar here

Today: US leading economic indicators, 10:00 am

Tomorrow: no notable

Your 5-minute briefing for Monday, October 21:

US Investor % Bullish Sentiment:

↓ 45.45% for Week of October 18 2024

Last week: 49.01%. Updates every Friday.

Market Wrap:

Stock futures edge up after Dow & S&P 500 post best 2024 weekly streaks.

S&P & Dow hit all-time highs Friday, each up nearly 1% for the week.

Earnings season heats up; 20% of S&P 500 to report.

79% of S&P companies beat Q3 estimates, but gains are smaller.

Optimism tempered by election & geopolitical risks.

EARNINGS

What we’re watching this week:

GE Aerospace (GE) - earnings of $1.14 per share (+34.1% YoY) on $9.0B revenue (-48% YoY)

Verizon (VZ) - earnings of $1.18 per share (+6.3% YoY). Revenue is forecast to arrive at $33.5 billion (+9.7% YoY)

Tesla (TSLA) - earnings of $.58 cents per share (-2.1% from the year-ago period) on $25.3B revenue (+14.7% YoY)

See full earnings calendar here.

HEADLINES

S&P 500 set to grind higher toward 6,000 milestone (more)

This stock rotation is bull market’s ‘lifeblood’ as S&P logs record peak (more)

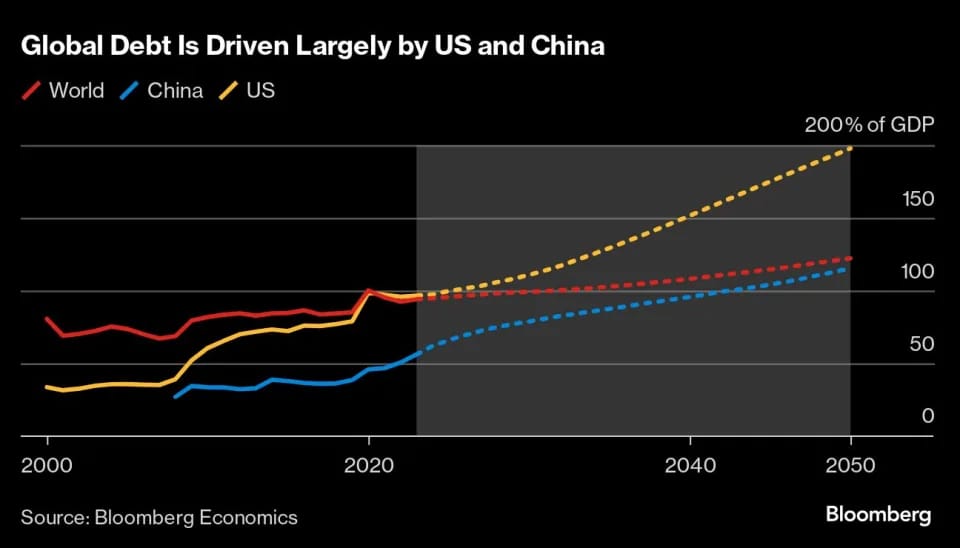

US budget deficit tops $1.8 trillion in fiscal 2024, third-largest on record (more)

SEC gives green light for options listing for spot bitcoin ETFs to NYSE (more)

China cuts benchmark lending rates by 25 basis points (more)

Oil prices show how numb traders have become to US sanctions (more)

Trump doubles down on tariff plan (more)

Boeing seeks to sell off assets in desperate attempt to stay aloft (more)

Southwest, activist Elliott to begin settlement discussions (more)

Perplexity AI in funding talks to more than double valuation to $8 billion (more)

Elon Musk is offering people $1 million to vote (more)

TOGETHER WITH VINOVEST

Whiskey: The Tangible Asset for Your Portfolio

Most people fail to diversify their investments.

They invest all their money in intangible assets like stocks, bonds, and crypto.

The solution - fine whiskey.

Whiskey is a tangible asset, providing a unique appeal compared to other investments. Casks of whiskey have measurable attributes like size, age, and weight, making their value indisputable. This physical nature allows for clear identification of issues and adjustments to safeguard future value.

Vinovest’s expertise in managing these tangible assets ensures your whiskey casks are stored and insured to the highest standards, enhancing their worth over time. Discover how this tangible, appreciating asset can enhance your investment portfolio.

- We’re on a short break -

The Dealflow, Crypto & Bullish sections will be

back on Tuesday 10/22/24. Thank you for reading!

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.