Good morning.

The Fast Five → Wall Street jockeys for jobs as election nears, Americans growing worried about direction of economy, Senate grills Novo Nordisk drug pricing, DOJ slaps Visa with antitrust suit, and Boeing is raising its offer to end the strike…

📈 Ex-Wall Street CEO reveals “Millionaire-Maker” Superdrug » *

From Behind The Markets

Calendar: (all times ET) - Full calendar here

Today: New home sales, 10:00 am

Tomorrow:

Initial jobless claims, 8:30 am

Durable goods orders, 8:30 am

Your 5-minute briefing for Wednesday, September 25:

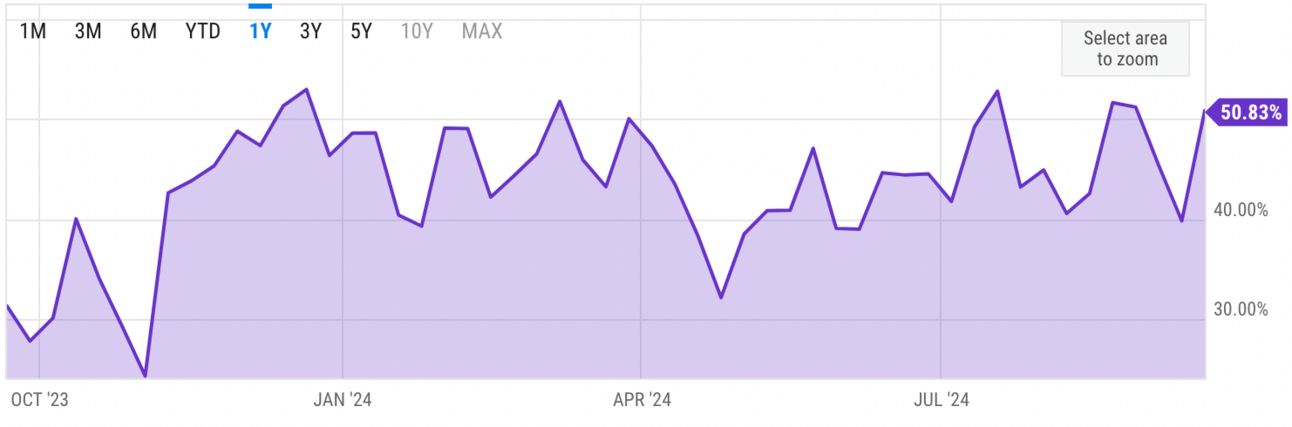

US Investor % Bullish Sentiment:

↑ 50.83% for Week of September 19 2024

Last week: 39.80%. Updates every Friday.

Market Wrap:

S&P +0.25%, Dow +83.57 points—both at record highs.

Nasdaq added 0.56%, closing at 18,074.52.

Nvidia jumped 4% after CEO halted stock sales.

Consumer confidence dropped to 98.7, the biggest fall in 3 years.

China stocks surged; Alibaba up 7.9%, JD.com 13.9%.

Dow up 1.6% in September, S&P 500 1.5%, Nasdaq 2%.

EARNINGS

Here are the earnings we’re watching this week.

Today: Jefferies (JEF)

Micron Technology (MU) - earnings of $1.13 per share (vs a per-share loss of $1.07 in the year-ago period). Revenue of $7.6B expected (+90% YoY)

Costco Wholesale (COST) - earnings of $5.08 per share (+4.5% YoY) on $79.9B revenue (+1.3%)

Friday: [none watched]

See full earnings calendar here.

HEADLINES

Stock rally propped up by Nvidia’s climb (more)

Record stock market defies election uncertainty (more)

Silver surges by 5%, gold hits another historic record high (more)

Most banks expect gold's bull run to persist into 2025 (more)

‘Stop ripping us off’: Senate grills Novo Nordisk CEO on drug pricing (more)

DOJ slaps Visa with antitrust suit over debit card dominance (more)

Goldman Sachs shifts view on economy, Fed rate cuts (more)

Fed's rate cut offers limited relief for US factories facing China competition (more)

Boeing is raising its offer to end the strike (more)

A looming port strike threatens to shake the economy (more)

Trump floats expanded R&D business tax credits (more)

The commercial-property market is coming back to life (more)

A MESSAGE FROM BEHIND THE MARKETS

The $8 Stock That Could Slash Healthcare Costs by $1.7 Trillion

Science Magazine called it the "breakthrough of the year"...

A brand-new superdrug that is so lucrative...

Some expect it to become the best-selling drug EVER...

With projections of 8,966% growth in the next four years.

It could slash healthcare costs by $1.7 trillion in the US alone...

And ONE tiny firm (trading for only $8) holds a key patent on it.

- sponsored message -

DEALFLOW

M+A | Investments

Smartsheet to go private in $8.4B deal with PE firms Vista and Blackstone (more)

UK's NewRiver REIT to buy Capital & Regional in $196M deal (more)

Macquarie to acquire stake in D.E. Shaw Renewable Investments (more)

Brilliant, impactful corporate gifting and branded merchandise solutions, received a majority investment from New Heritage Capital (more)

VC

Harmonic, an AI platform for the development of mathematical superintelligence, raised $75M in Series A funding at a $325M valuation (more)

Centivo, a company making high-quality healthcare more affordable for employers and their employees, secured $75M in equity and debt financing (more)

Torq, an AI security hyperautomation company, raised $70M in Series C funding (more)

Route 92 Medical, a company developing solutions for neurovascular interventional procedures, received $50M in Series F extension equity funding (more)

Dandelion Energy, a home geothermal company, raised $40M Series C funding (more)

HyperLight Corporation, a provider of thin film lithium niobate photonic integrated circuits (PICs), raised $37M in funding (more)

Campfire Interactive, enterprise software solutions for manufacturing companies and automotive suppliers, received a $37M majority investment from Growth Partners (more)

StrataPT, a billing-aware practice management platform for outpatient therapy clinics, secured $25M in financing (more)

LiveFlow, an intelligent finance and accounting automation platform, raised $13.5M in Series A funding (more)

Mesa, a homeowner membership platform, raised $9.2M in Seed funding (more)

GenLogs, a network of roadside sensors collecting data on truck movements, raised over $6M in Seed funding (more)

Reframe, a startup redefining the human-computer relationship, raised $5M in Seed funding (more)

VerImmune, a biotech company developing ViP™ platform technology, raised $4.5M in first closing of Pre-Series A funding (more)

Sandgarden, an enterprise AI runtime engine, raised $4.5M in funding (more)

Platformatic, a cloud-native Node.js application platform, raised additional $4.3M in Seed funding (more)

Knownwell, an AIaaS company, raised $4M in funding (more)

Arya Health, a healthcare workforce automation platform, raised $4.0M in Seed funding (more)

Eion, a carbon removal company, raised $3M in Series A extension funding (more)

Atomicwork, a modern service management platform, raised $3M in funding (more)

CRYPTO

Drop in Bitcoin dominance and bullish altcoin market structure have traders predicting altseason (more)

BlackRock Bitcoin ETF options to set stage for GameStop-like 'Gamma Squeeze' rally, Bitwise predicts (more)

Crypto’s correlation with US stocks nears record in Fed fallout (more)

US SEC, Coinbase clash in court over crypto rulemaking (more)

BULLISH BITES

📈 Investor Alert: Why this $8 stock could be the best investment of 2025 *

🔎 Inside Look: Don’t count on a megadeal to save Intel.

🦄 Takeover: This unicorn is taking on Adobe. Can it fly?

➗ System Check: Is math the path to chatbots that don’t make stuff up?

🗽 Prime Digs: You can now secure your own Goldman Sachs corner office by renting an apartment in the building that once served as the megabank's Wall Street HQ.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.