Good morning.

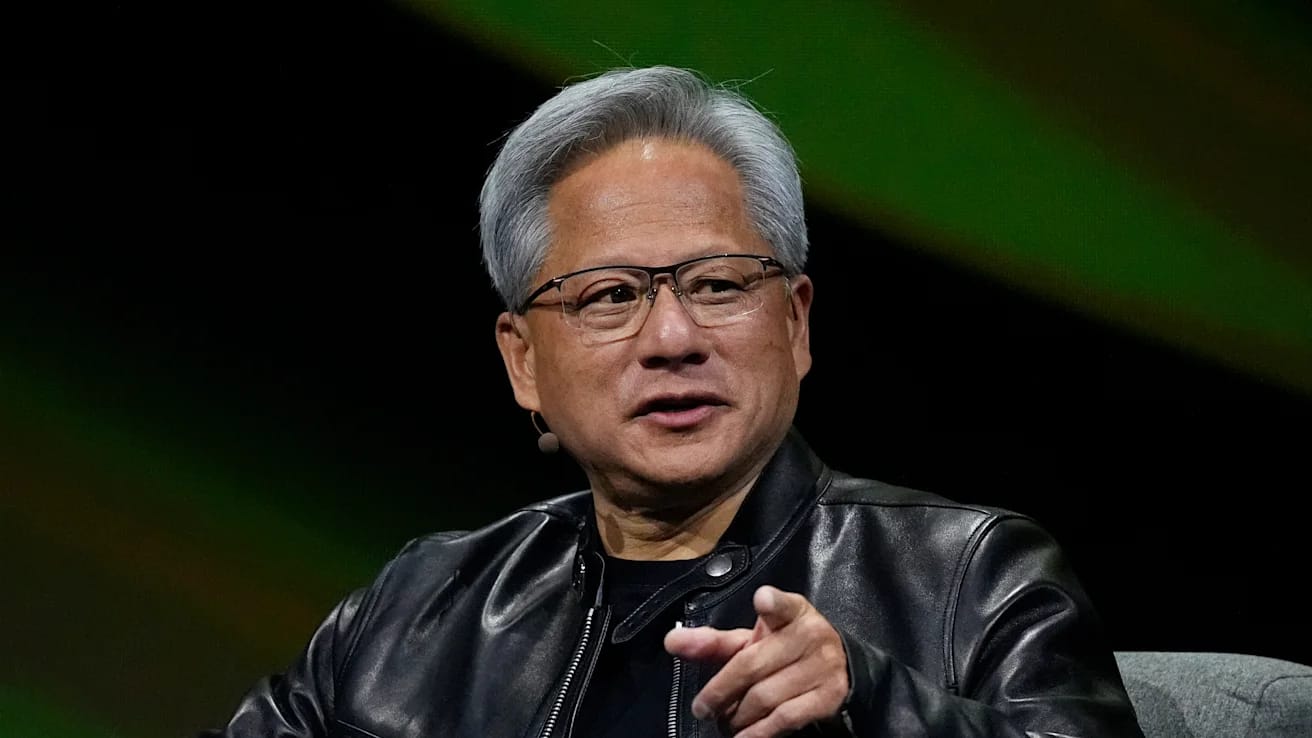

The Fast Five → CFTC to states: Hands off prediction markets, Nvidia to sell Meta millions of chips, Japan to invest $36B in US projects, private software companies release earnings early to calm AI nerves, and Berkshire trims Apple stake, buys NYTimes stock in Buffett’s last moves as CEO…

📌 $600B is flooding into ONE sector in 2026. Wall Street doesn't want you to see it →

(from InvestorPlace Digest)

Calendar: Full Calendar »

Today:

Durable Goods Orders, 8:30A

FOMC Meeting Minutes, 2:00P

Tomorrow:

Unemployment Claims, 8:30A

Your 5-minute briefing for Wednesday, Feb 18:

US Investor % Bullish Sentiment:

↓ 38.52% for Week of FEB 12 2026

Previous week: 39.67%

Market Wrap:

Futures flat Dow -18, S&P -0.03%, Nasdaq -0.06%

Tuesday saw slim gains S&P +0.1%, Nasdaq +0.1%, Dow +32

Software lagged with CrowdStrike -3.6% and ServiceNow -1.1%

Fed minutes land today, PCE inflation hits Friday

Today’s earnings include Booking, Carvana and DoorDash

EARNINGS

Here’s what we’re watching this week:

Today: DoorDash $DASH ( ▲ 6.8% )

THU: *Etsy $ETSY ( ▼ 0.7% ), *First Majestic Silver $AG ( ▲ 4.87% ) , *Wayfair $W ( ▲ 7.33% )

Deere $DE ( ▼ 1.26% ) - EPS of $2.10 (-51.9% YoY) on 7.5B revenue (-35.4% YoY)

Walmart $WMT ( ▼ 1.73% ) - EPS of 72 cents (+9.1% YoY) on $188.46B revenue (+9.9% YoY)

Billionaires Just Cashed Out of Tech.

Here’s Where They’re Cashing In.

$16 billion pulled out of AI stocks by the people who RUN the companies.

But that money didn't sit in a mattress.

Louis Navellier – 46 years on Wall Street, built the grading system firms paid $24,000/yr for him to evaluate stocks with – says it moved into a sector most investors have never looked at. One stock there: up 170% in less than a year.

His system is now showing institutional accumulation across the entire sector.

He calls it "the great cash in." And he says you have weeks, not months, to get positioned.

- a sponsored message from InvestorPlace Digest -

HEADLINES

The CFTC filed a legal brief in support of Crypto.com, which alongside Kalshi and Polymarket is being sued by Nevada for allegedly operating unlicensed sportsbooks.

Equities close with slight gains as tech shares recover (more)

Japan to invest $36B in US projects under Trump deal (more)

'Exports to China look dismal,' leader of busiest US seaport says (more)

Oil prices fall as Iran sees progress in nuclear talks with US (more)

Homebuilder sentiment remains subdued amid affordability challenges (more)

Private software companies release earnings early to calm AI nerves (more)

Retail investors to get access to SpaceX, Anthropic with new fund (more)

Berkshire Hathaway trims Apple stake, buys NYTimes stock in Buffett’s last moves as CEO (more)

Adage Capital trims stakes in AI heavyweights (more)

Ford to follow Tesla Cybertruck with electrical tech in new EV pickup (more)

Figma, Anthropic partner to turn AI generated code into editable designs (more)

Palantir shifts headquarters to Miami from Denver after protests (more)

Bayer offers $7.25B to settle weedkiller cancer claims (more)

Mamdani plans to hike NYC property tax to fill budget hole (more)

DEALFLOW

M+A | Investments

Danaher to buy Masimo in $9.9B deal in diagnostics push

Hapag-Lloyd buys Israel's ZIM for $4.2B in global shipping tie-up

Exa Capital acquired StaffReady

Nakamoto to acquire BTC Inc and UTXO Management

FancyAI receives investment from The Shipyard

VC

Josh Kushner’s Thrive Capital raises $10B in new funding

Databricks, a data and AI company, is completing Series L investments in excess of $7B

Stoke Space Technologies, a rocket company developing reusable medium-lift launch vehicles, extended its Series D funding to $860M

Temporal, an open-source platform for reliable agentic applications, raised $300M in Series D funding

Render, a cloud for application developers, raised $100M in Series C extension funding

Utility Global, a global economic industrial decarbonization company, raised a first close of $100M of Series D funding

ChipAgents, an agentic AI platform for the semiconductor design industry, raised $50M in Series A1 funding

Codoxo, a provider of AI healthcare payment integrity solutions, raised $35M in Series C funding

VulnCheck, an exploit intelligence company, raised $25M in Series B funding

Seasats, a company specializing in small uncrewed surface vehicles, raised $20M in Series A funding

Daffodil Health, an AI-powered platform for US health plan admin and claims processing, raised $16.3M in Series A funding

Moab, a software company building operating systems for equipment rental and dealerships, raised $16M in funding across Seed and Series A rounds

Dataro, an AI-driven fundraising intelligence platform, raised $14.28M in Series A funding

GelMEDIX, a biotech company developing regenerative therapies to restore vision, raised $13M in Seed funding

Realta Fusion, a developer of magnetic mirror fusion technology, received a $9.5M growth capital facility

QuadSci, a predictive and prescriptive AI for customer intelligence, raised $8M in Series A funding

Sphinx, browser-native compliance agents for financial institutions, raised a $7.1M in Seed funding

Breaker, a defense technology startup, raised $6M in Seed funding

Certivo, an AI-powered supply chain compliance management platform, raised $4M in Seed funding

Autosana, an agentic QA platform for iOS, Android, and web apps, raised $3.2M in funding

CRYPTO

BULLISH BITES

💰 The AI gold rush is breaking a Silicon Valley taboo: Cashing out before the IPO.

🍸 JPMorgan opened a bar for employees. If only they could get in.

💤 No views, no hikes, just Zzzs: Welcome to the ’sleepcation’.

📚 Welcome to Books, For Men™

DAILY SHARES

Have feedback or a suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.