Good morning.

The Fast Five → Apple announces largest buyback in US history, Sony, Apollo make $26 Billion cash offer for Paramount, Wall Street confused and divided over rate cuts this year, US v. Google antitrust trial concludes, and Peloton CEO steps down along with 15% of staff…

Calendar: (all times ET)

Today: | Unemployment report, 8:30a |

Your 5-minute briefing for Friday, May 3:

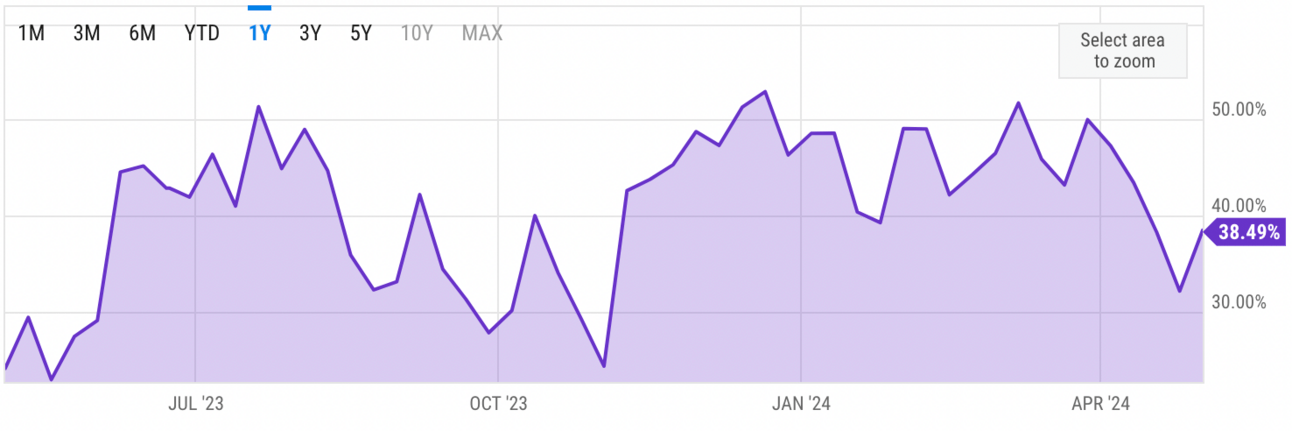

US Investor % Bullish Sentiment:

38.49% for Wk of Apr 25 2024 (Last week: 32.13%)

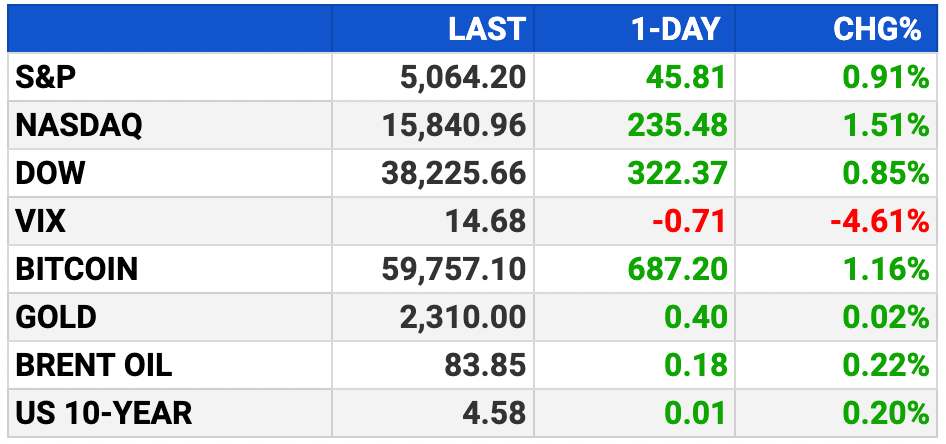

Market Recap:

Stock futures rise ahead of April jobs report.

Dow up 0.6%, S&P 500 up 0.3%, Nasdaq 100 up 0.6%.

Apple climbs 6% on earnings, announces $110B buyback.

Amgen soars 14% on stellar earnings, Cloudflare drops 14%.

S&P 500 gains 0.91%, Dow up 0.85%, Nasdaq rises 1.51%.

Markets poised for negative weekly close despite gains.

Today: April nonfarm payrolls; economists predict 240,000 jobs added.

EARNINGS

HEADLINES

Wall Street confused and divided over how many times the Fed will cut rates this year (more)

Gold heads for worst weekly run since February on rate outlook (more)

Hong Kong tech rallies, Yen hits three-week high (more)

Huawei secretly backs US research, awarding millions in prizes (more)

Peloton CEO to step down, company to lay off 15% of staff (more)

US v. Google antitrust trial concludes with closing arguments (more)

Baltimore bridge insurer reportedly set to write $350 million check (more)

Nio soars more than 20% as EV deliveries more than double in April (more)

Blackstone taps vast source of cash in $1 Trillion credit push (more)

Wells Fargo says US scrutinizing Zelle complaints behind scenes (more)

Toyota, Tata Motors positioned to benefit from hybrid auto boom (more)

DEALFLOW

M+A | Investments

Novartis buys Mariana Oncology, paying $1B upfront (more)

Freshworks acquires Device42 for $230M (more)

SVB Financial to sell VC business SVB Capital (more)

British payments group Epos Now explores possible stake sale (more)

ECP in advanced talks to acquire Atlantica Sustainable (more)

Cin7, an inventory and order management software provider, acquired Inventoro, a provider of AI-driven sales forecasting and replenishment optimization solutions (more)

Accenture (ACN) acquires Parsionate, a data consultancy specialized in data products and modern data foundation services (more)

Accenture (ACN) acquires Soko, a creative agency that develops brand stories with deep impact in society (more)

Guesty, property management software for the short-term rental and hospitality industry, acquired Rentals United, provider of a cloud platform to promote properties across multiple listing sites (more)

Breck Partners purchases NPX One from Atlas (more)

Marsh McLennan Agency purchases AC Risk Management (more)

Permira acquires majority position in BioCatch from Bain Capital (more)

Carlisle purchases MTL from GreyLion Partners (more)

PSP-backed Ntiva invests in The Purple Guys (more)

VC

HighVista Strategies, an asset management firm pursuing, closed its Private Equity Fund X, at $675M (more)

Altruist, a custodian for independent RIAs, raised $169M in Series E funding (more)

Transcarent, a healthcare platform provider, raised $126M in Series D funding (more)

Karius, Inc., a leader in genomic diagnostics for infectious disease, raised $100M in Series C funding (more)

Securitize, a company specializing in tokenizing real-world assets, raised $47M in funding (more)

Indicium, a data and AI consultancy, raised a $40M investment from Columbia Capital (more)

StrongDM, a zero trust privileged access management (PAM) company, raised $34M in Series C funding (more)

Mimic, a ransomware defense company, emerged from stealth with a seed round of funding of $27M (more)

GroundGame.Health, a provider of a social impact solution that fulfills unmet social and care needs, raised $17M in funding (more)

Livara Health, a value-based musculoskeletal management company, raised $15M in Series B funding (more)

Monocle, a promotion platform provider, is emerging from stealth mode supported by a $7.5M seed funding (more)

Apex, an AI security company, emerged from stealth with $7M in seed funding (more)

Danti, an Earth data search engine provider, raised $5M in Seed funding (more)

Birdwingo, a provider of a financial education and investment platform, raised €1.2M in funding (more)

DefenseStorm, a provider of cyber risk solutions to financial institutions, raised an undisclosed amount in Series C-1 funding (more)

Any news or data you wish was included in your briefing?

…just hit reply and tell us!

CRYPTO

BULLISH BITES

🥱 A good thing: Why banks these days are so excited about being boring.

💣. Fallout: They thought they were joining an accelerator — instead they lost their startups.

💰 Take control: This No-Cost Wealth Management Guide from Goldencrest isn't just advice – it's your survival kit in this economic battlefield. Download your no-cost guide here »*

👜 Too late? From luxury rack to sales bin — how Gucci fell off the catwalk.

🏎 Next level: Ferrari Unveils $423,000 Sports Car With 1960s Bloodline

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.