Good morning.

The Fast Five → Odysseus becomes first US spacecraft to land on moon in over 50 years, Reddit files to list IPO after two years on the sidelines, SEC filing shows Sam Altman is Reddit's third-largest shareholder, Goldman pushes back bet on interest-rate cut to June, and Nvidia fires up AI mania.

Full briefing ahead, but first a message from Market Rebellion…

Join Fast Money’s Jon & Pete Najarian for Rebel Launchpad - a dynamic bundle of introductory classes, webinars, and one-on-one coaching. Right now for a limited time, get → 1-Year Access for only $99 ($900 value)

Your 5-minute briefing for Friday, February 23:

BEFORE THE OPEN

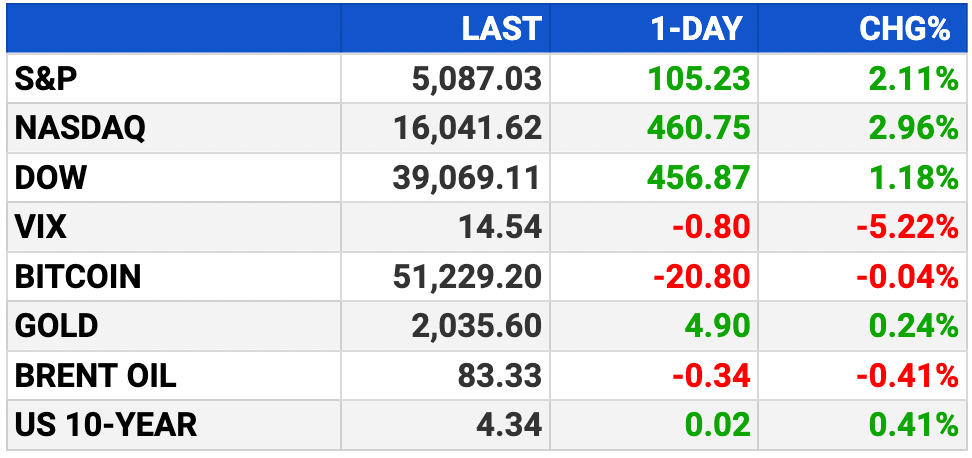

As of market close 2/22/2024.

Pre-Market:

Market Recap:

Futures stable after S&P 500, Nasdaq surge

Dow up 0.06%, S&P 500 gains 0.05%, Nasdaq slips 0.02%

Block soars 13%, Carvana climbs 23% after hours

Nvidia fuels rally, S&P jumps 2.11%, Nasdaq 2.96%

Dow hits record, S&P nears 2021 peak

Majority S&P sectors positive, utilities sole loser

All indexes set for winning week: S&P 1.6%, Nasdaq 1.7%, Dow 1.1%

Warner Bros Discovery, Bloomin' Brands earnings eyed today

EARNINGS

HEADLINES

Biden manufacturing rule could wipe out up to 1 million jobs (more)

Tax evasion by millionaires and billionaires tops $150 billion a year, says IRS chief (more)

Goldman pushes back bet on first Fed interest-rate cut to June (more)

Stocks hit new records as Nvidia fires up AI mania (more)

Fidelity manager dumps nearly all Treasuries on growth optimism (more)

AT&T outage triggered by company work on network expansion (more)

Reddit in AI content licensing deal with Google (more)

Sam Altman is Reddit's third-largest shareholder, SEC filing reveals (more)

Nvidia identifies Huawei as top competitor for the first time in filing (more)

Nvidia’s surge puts CEO Huang on cusp of cracking world’s 20 richest (more)

Mercedes-Benz backs off plan to only sell EVs by 2030 (more)

Capital One acquisition has $1.4B breakup fee if rival bid emerges (more)

JPMorgan CEO Dimon sells about $150 million of his shares, SEC filing says (more)

Fund says it cracked the code on T-Bills without tax bills (more)

TOGETHER WITH MARKET REBELLION

Join Fast Money’s Jon & Pete Najarian—

Your Market Rebellion journey starts here.

Hit the ground running with true Market Pro’s and get a dynamic bundle of introductory classes, webinars, and one-on-one coaching valued at more than $900.

🔥 Market Briefing Limited Time Offer→ $900+ worth of training for $99

Get started now »

~ please support our sponsors ~

DEALFLOW

M+A | Investments

Woodside to sell $1.4B stake in gas project to Jera (more)

ADNOC's $30B chemicals deal with Austria's OMV stalls (more)

Teck Resources expects to close coal unit sale to Glencore by Q3, CEO says (more)

EQT taps banks for $15B exit of school chain Nord Anglia (more)

Delinea, a provider of solutions that extend Privileged Access Management, acquires Fastpath, a company specializing in Identity governance, admin, and identity access rights (more)

Tufin, a company specializing in network/cloud security policy automation, acquired AKIPS, a provider of network monitoring solutions for enterprises (more)

Blue Wire, a media company that allows independent podcasters to monetize their content, received a growth funding package from Decathlon Capital Partners (more)

Banneker-backed Eyelit Technologies purchases Optessa (more)

Charger Investment Partners buys SBG from Blue Point (more)

LLCP acquires USA Water (more)

ArcLight Fund VII purchases Lordstown (more)

Lightsource bp, a solar energy and energy storage company, completed a $348M financing package (more)

Xevant, a provider of healthcare analytics and technology solutions, received a follow-on investment from HCAP Partners and Tech Council Ventures (more)

Arevon Energy, Inc., a renewable energy developer/owner/operator, secured over $1B in financing commitments for its Eland 2 Solar-plus-Storage Project in California (more)

Healthly, a company that prioritizes primary care, support services, and preventative medicine, received funding from Corbel Capital Partners (more)

Diamond Builders, a manufacturer prefab modular buildings, received an investment from LO3 Capital alongside Tamarix Equity Partners (more)

Capital Square Partners invests in Trianz (more)

Sandbrook Capital commits up to $460M to rPlus Energies (more)

HGGC invests in Rimkus (more)

CIVC invests in Highstreet (more)

VC

Antora Energy, a leader in zero-emissions industrial heat and power, raised a $150M Series B funding round (more)

Clumio, a company specializing in data backup and recovery for public cloud, raised $75M in Series D funding (more)

Fabric, a developer of a care enablement system, raised $60M in Series A funding (more)

Uhnder, a provider of commercial digital radar chips and software, raised $50M in Series D funding (more)

Synadia Communications announced it has closed a $25 million Series B financing round (more)

Crisp, a collaborative commerce company, raised total of $50M in new capital through a $20M Series B extension round and up to $30M in debt financing (more)

PermitFlow, a company that simplifies the construction permitting process, raises $31M in Series A funding (more)

Highway 9 Networks, a provider of a mobile cloud for delivering cloud-native mobility and services for the AI-driven enterprise, raised $25M in funding (more)

Carewell, an online retailer focused on providing family caregivers with tools and resources, raised $24.7M in Series B funding (more)

Pozitivf, provider of a fertility clinic network, raised $20M in funding (more)

dub, provider of a copy-trading platform, raised $17M in Seed funding (more)

Elve, a provider of millimeter wave amplifier technology, raised $15M in Series A funding (more)

Helius, a vertically integrated developer platform that helps high-performance crypto applications build on Solana, raised $9.5M in Series A funding (more)

Conservation Labs, provider of an AI platform that decodes audio data to reduce carbon emissions, energy, water usage, raised $7.5M in Series A funding (more)

Clairity Technology, a company developing systems for carbon dioxide removal, raised $6.75M in Seed funding (more)

Inco, a developer of a confidentiality layer for Ethereum and other networks, raised $4.5M in funding (more)

VectorShift, a generative AI application development platform, raised $3M in Seed funding (more)

Elektra Health, a digital health platform that helps women navigate the menopause journey, raised $3.3M in new financing (more)

Singularity, a provider of a compliant institutional DeFi access layer, raised $2.2M in funding (more)

Firsthand, a company enabling brands and publishers to build and distribute AI agents raised a Seed funding round of undisclosed amount (more)

unybrands has closed its Series B funding round that provides flexibility for future acquisitions and organic growth initiatives (more)

CRYPTO

BULLISH BITES

🧐 Shady-trade: Husband snooping on wife’s M&A work gets Insider Trading charge.

🪐 Investing in Space: Former NASA official explains ‘shots on goal’ approach to cargo moon landings

🛍 Lefties: Zara's secret weapon in fast-fashion fight against Shein.

🏁 ‘Burning Man for rednecks’: Inside King of the Hammers, the gnarliest off-road race of the year.

🇺🇸 Featured: New drug could help end obesity in America (Behind the Markets)

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.