Good morning.

The Fast Five → Trump nominates Kevin Warsh as new Fed Chair, gold and silver extend sell-off after historic plunge, Wall St divide in tech stock performance after earnings, banks, crypto leaders to meet on landmark Clarity Act, and SpaceX wants to put 1 million data centers into orbit…

Calendar: Full Calendar »

Today:

ISM Manufacturing PMI, 10:00A

Tomorrow:

JOLTS Job Openings, 10:00A

Your 5-minute briefing for Monday, Feb 2:

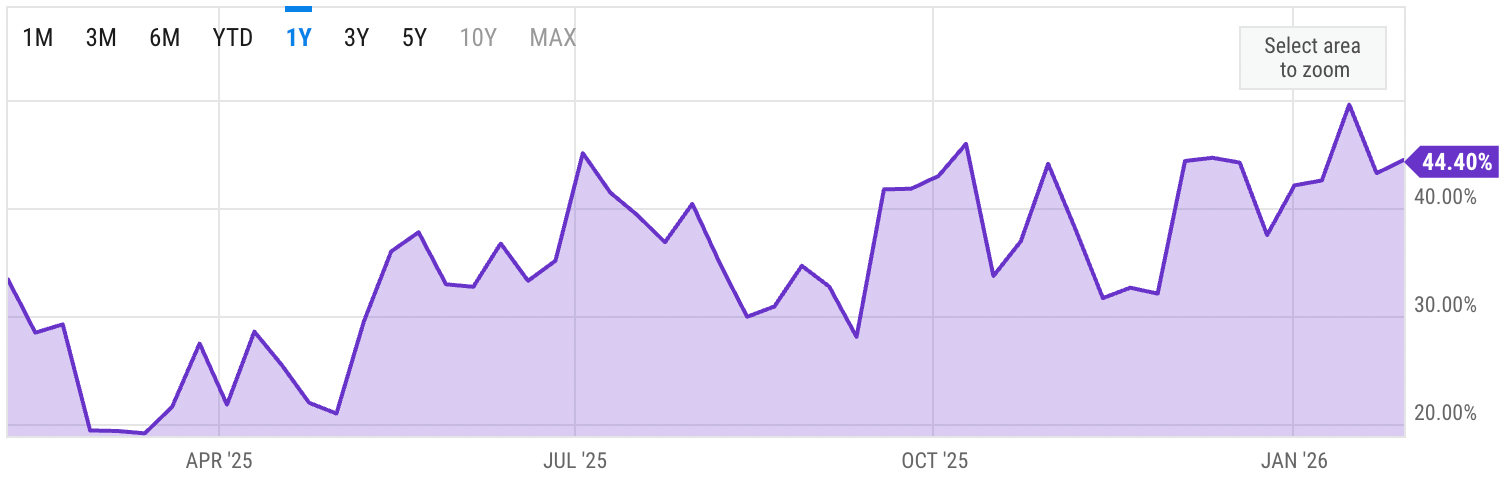

US Investor % Bullish Sentiment:

↓ 44.40% for Week of JAN 29 2026

Previous week: 49.50%

Market Wrap:

Futures fell Dow -143, S&P -0.6%, Nasdaq 100 -1%

Bitcoin sank below $80K and last traded near $76K

Nvidia hit after reports its $100B OpenAI plan stalled

This week has 100+ S&P earnings including Amazon, Alphabet, Disney

Friday’s jobs report is due with 55K payrolls expected

Stocks slid Friday after Trump named Kevin Warsh as Fed chair nominee

EARNINGS

Here’s what we’re watching this week:

Today: Palantir $PLTR ( ▼ 3.43% )

*Walt Disney $DIS ( ▼ 1.11% ) - $1.58 EPS (-10.2% YoY), on $25.6B revenue (+3.6% YoY)

TUE: Chipotle CMG, *PayPal $PYPL ( ▲ 5.76% ), *PepsiCo $PEP ( ▲ 2.05% ), *Pfizer $PFE ( ▲ 1.54% )

WED: *AbbVie $ABBV ( ▲ 2.08% ), *Eli Lilly $LLY ( ▲ 4.86% ), *Uber $UBER ( ▼ 4.25% ), *Yum! Brands $YUM ( ▲ 1.91% )

Alphabet $GOOGL ( ▼ 1.11% ) - $2.64 eps (+22.8% YoY) on $111.5B revenue (+15.5% YoY)

THU: *Estee Lauder $EL ( ▼ 1.06% ), *KKR $KKR ( ▼ 8.89% ), *Peloton $PTON ( ▼ 6.35% ), *Roblox $RBLX ( ▲ 0.69% ), Strategy $MSTR ( ▼ 5.6% ), *Tapestry $TPR ( ▼ 2.62% )

Amazon $AMZN ( ▼ 2.3% ) - eps of $1.95 (+4.8% YoY) on $211.2B revenue (+12.5% YoY)

Financial Reckoning 2026

A massive crisis is brewing as FOUR major market forces converge.

One former hedge fund manager says it could be far worse than the dot-com crash… or the 2008 financial crisis.

Mag Seven losses of up to 80-90% are possible.

- a sponsored message from The Opportunistic Trader -

HEADLINES

Dow, S&P, Nasdaq futures sag ahead of week defined by Fed pick, jobs data (more)

Speaker Johnson: ‘Confident’ government shutdown will end by Tuesday (more)

Trump welcomes China, India investment in Venezuela oil (more)

Xi spells out yuan reserve currency goal (more)

Chinese speculators set the stage for gold and silver crash (more)

Dollar rallies most since may as Trump taps warsh (more)

Oil prices fall by 3% on US-Iran de-escalation (more)

Wall Street sees divide in tech stock performance after earnings reports (more)

Nvidia’s Huang: OpenAI investment was ‘never a commitment’ (more)

Oracle to raise up to $50B in 2026 for cloud buildup (more)

SpaceX wants to put 1 million solar-powered data centers into orbit (more)

Apple’s historic quarter doesn’t change the need for AI reckoning (more)

China's BYD vehicle sales fall for fifth month in a row (more)

Target's new CEO is thrown into crisis mode on day one (more)

DEALFLOW

M+A | Investments

Check back tomorrow

VC

Redwood Materials, a company recycling lithium-ion batteries, raised $425M in Series E funding

Primmune Therapeutics, a therapeutics company, raised $8.6M in additional Series B funding

DexMat, a conductive material company, raised over $5M in Seed funding

CRYPTO

BULLISH BITES

📊 An investor’s guide to the boom (and bust) in gold and silver.

💵 Microsoft's $381B rout exposes dark side of the AI binge.

☄️ Prediction markets have a fake news problem.

🍿 'Melania' earns a surprising $7M, best non-music documentary debut in a decade.

DAILY SHARES

Have feedback or a suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.