Good morning.

The Fast Five → Palantir, MicroStrategy, Axon Join Nasdaq 100, Bitcoin surges above $106,000, Broadcom hits trillion-dollar valuation, T-Mobile announces $14 billion share buyback, and Happy 400th birthday to the world’s oldest bond…

💰 While everyone’s still counting their money from this first AI boom … Nvidia and countless others have moved on to the next stage » *

Reader Sentiment: What's your short-term outlook on the market?

🟩🟩🟩🟩🟩🟩 📈 BULLISH 77% (Last week: 82%)

🟨🟨⬜️⬜️⬜️⬜️ 📉 BEARISH 23% (Last week: 18%)

Results from Sunday’s poll

Comments:

📈 “Bullish, not on the whole market but on certain sectors: gold silver metals, nuclear energy, etc. - and also small cap”

📉 “Incoming administration policies will be highly inflationary. Rates will rise; the dollar will soar; trade deficit will skyrocket”

📈 “Bullish until Trump cracks appear”

📉 “Gap period in marker performance where sentiment overtakes fundamentals and churn is the order of the day”

📈 “Trump”

Calendar: (all times ET) - Full calendar

Today:

Empire State manufacturing survey, 8:30 am

Tomorrow:

US retail sales, 8:30 am

Industrial production, 9:15 am

Home builder confidence, 10:00 am

Your 5-minute briefing for Monday, December 16:

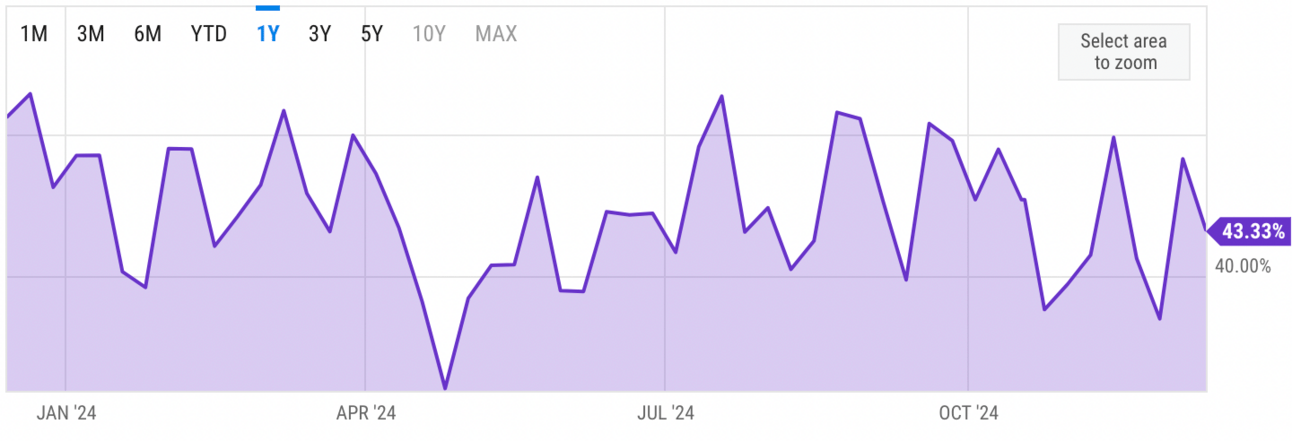

US Investor % Bullish Sentiment:

↓ 43.33% for Week of December 12 2024

Previous week: 48.33%. Updates every Friday.

Market Wrap:

Dow fell for a 7th session (-0.2%), marking its longest losing streak since 2020.

S&P 500 flat; Nasdaq up 0.12% to 19,926.

Weekly: Dow -1.8%, S&P -0.6%, Nasdaq +0.3%.

Broadcom soared 24%, hitting $1T market cap on AI growth (+220% YoY).

Nvidia (-2%) and Meta (-1%) weighed on tech.

Wall Street awaits a catalyst as indices remain range-bound.

EARNINGS

Here’s what we’re watching this week: Full Calendar »

Micron Technology (MU) - earnings of $1.77 per share (vs a loss of $.95 per share in the year-ago period) on $8.7B revenue

FedEx (FDX) - earnings of $3.95 per share (-1% YoY) on $22.1B revenue (-0.2% YoY)

Nike (NKE) - earnings of $.64 per share (-37.9% YoY) on $12.2B revenue (-9.1% YoY)

HEADLINES

Bull market hits an early December soft patch (more)

Economists trim rate cut estimates on fear of Trump inflation surge (more)

Dollar hovers near 3-week high before Fed (more)

Gold holds two-day decline ahead of expected rate cut (more)

Oil eases from highest in week (more)

Hedge funds turn more bullish on gasoline (more)

Asia wary of Fed rate future, China data disappoints (more)

Broadcom hits trillion-dollar valuation on forecasts for AI demand (more)

Nippon Steel’s plan B now in focus as $14 Billion US deal falters (more)

T-Mobile announces $14 bln share buyback program (more)

Amazon workers authorize strike at company's first unionized warehouse (more)

Social Security retirement age set to change in 2025 (more)

Happy 400th birthday to the world’s oldest bond (more)

TOGETHER WITH LONG ANGLE

Long Angle: A Vetted Community for High-Net-Worth Entrepreneurs and Executives

Private, vetted community offering confidential discussions and education

Entrepreneurs and executives, 30–55 years old, with $5M to $100M net worth

Preferential access to top-tier alternative investments

DEALFLOW

M+A | Investments

Bonobos owner nears deal for wedding-dress brand Vera Wang (more)

Billionaire Justin Ishbia weighs bid for MLB’s Minnesota Twins (more)

Textor said to weigh selling Eagle Football stake to Sportsbank (more)

Together AI, an AI acceleration cloud provider, acquired CodeSandbox, a startup specializing in cloud devboxes (more)

LiveFreely, a digital health technology company, acquired Sompo Horizon, a caregiving benefits provider (more)

Upbound Group, Inc. (UPBD), a tech and data-driven company specializing in accessible financial products, acquired Brigit, a financial health technology company (more)

LoopMe, a tech company using AI to improve brand advertising results, acquired Chartboost, a mobile advertising and monetization platform, from Zynga (more)

VC

Archer Aviation, an aviation technology company, raised additional $430M in additional equity capital (more)

Zest AI, a leader in AI lending technology, received a $200M growth investment from Insight Partners (more)

Cartesia, a developer of real-time multimodal intelligence for every device, raised $22M in funding (more)

Alessa Therapeutics, a clinical-stage drug development company, raised $15M in Seed funding (more)

CRYPTO

BULLISH BITES

📈 Next Wave: Is your portfolio prepared for AI 2.0? *

👍 2025 in Tech: Who’s in and who’s out.

💼 Going, Going: Amazon and the endangered future of the middle manager.

🤖 Sorry, Mad Men: AI is coming for advertising.

🤫 Shhh: The closely guarded secrets of Manhattan doormen.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.