Good morning.

The Fast Five → Stock markets are on a worldwide record-hitting spree, Biden called out for hypocrisy over China tariffs, US and TikTok seek fast-track ruling by Dec 6, Microsoft set to unveil its vision for AI PCs tomorrow, and Iran’s President killed in helicopter crash…

Calendar: (all times ET)

WED, 5/22: | Minutes - Fed’s May FOMC meeting, 2:00p |

THU, 5/23: | Initial jobless claims, 8:30a |

FRI, 5/24: | Durable-goods orders, 8:30a |

Your 5-minute briefing for Monday, May 20:

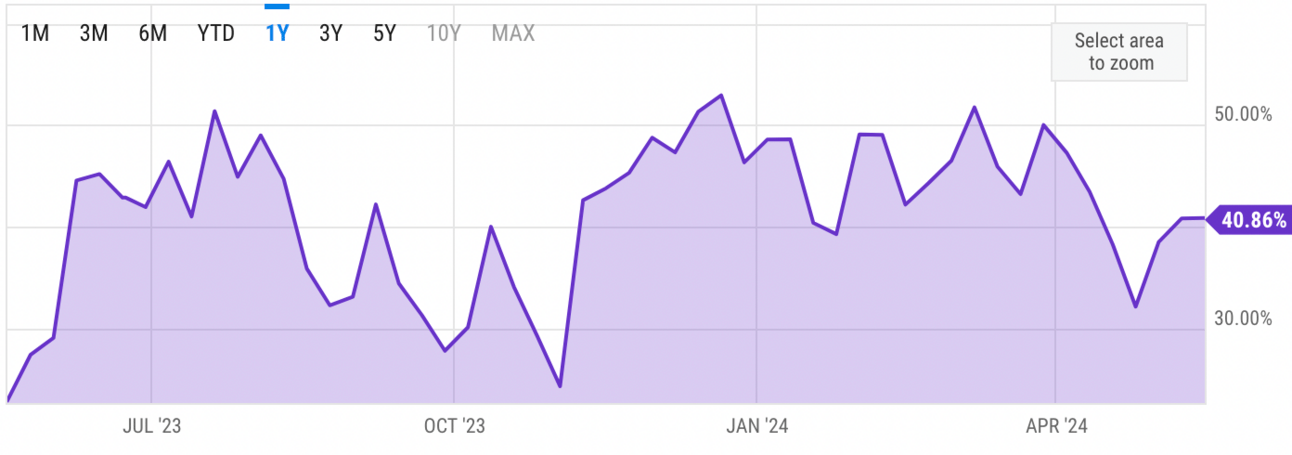

US Investor % Bullish Sentiment:

40.86% for Wk of May 16 2024 (Last week: 40.82%)

Market Recap:

Stock futures slightly up Sunday night.

Dow futures rose <0.1%, S&P and Nasdaq marginally higher.

Dow closed above 40,000 Friday, first time ever.

AI spotlight: Microsoft Build, Nvidia Q1 results.

Earnings: Palo Alto Networks, AutoZone, Target, Intuit, Ralph Lauren.

Fed minutes Wednesday.

Key data: home sales, jobless claims, durable goods orders.

EARNINGS

What we’re watching this week:

Toll Brothers (TOL) - expecting $4.14 EPS on $2.5B revenue

Wednesday: Snowflake (SNOW)

Target (TGT) - earnings expected to be flat at $2.05 EPS (YoY) on $24.5B revenue (-1.6% YoY)

Nvidia (NVDA) - earnings of $5.57 (vs last year of $.98 EPS). Revenue is expected to jump to $24.6B from the $6.5B reported one year ago

Full earnings calendar here

HEADLINES

Iran’s President and Foreign Minister killed in helicopter crash (more)

Slowing inflation primes G-7 Central banks for June (more)

US regulators reconsider capital hike for big banks (more)

US, TikTok seek fast-track ruling by Dec. 6 on potential ban (more)

Oil steadies after weekly advance as geopolitical risks flare (more)

Asian stocks rise after US gains (more)

China’s housing rescue is too small to end crisis (more)

Musk, Indonesian health minister, launch Starlink for health sector (more)

Microsoft set to unveil its vision for AI PCs at Build developer conference (more)

Sony and Apollo move ahead with Paramount bid process but reticent about earlier plan (more)

Media giants lean on sports as Hollywood strikes still loom over content slates (more)

Bezos’ Blue Origin resumes space tourism with latest launch (more)

Goldman Sachs looks to expand private equity credit lines as dealmaking picks up (more)

Mercedes workers in Alabama reject union, dealing setback to UAW (more)

The Biggest Financial Risk Facing America in 2024 (ad)

Elon Musk has warned about it.

Billionaire Sam Zell said, "I can't imagine anything more disastrous to our country."

Billionaire Ray Dalio said, "We are going to be in a different world."

- please support our sponsor -

DEALFLOW

M+A | Investments

Nippon Steel executive to visit US to meet stakeholders of US Steel deal (more)

Bank of America to buy WaFd's loan portfolio for $2.9B (more)

Bain Capital to boost Japan real estate team as prospects grow (more)

EQT in talks to buy Keywords Studios for £25.50/Share (more)

Quadrant to sell Australian confectioner Darrell Lea (more)

Brazil Oil Juniors 3R, Enauta agree on $1.2B deal (more)

Telefonica, H.I.G. among suitors for Spain’s Avatel (more)

G2Xchange, a software solutions company for government contractors, acquired GovAIQ, an innovator in AI technologies and used for the government contracting sector (more)

Atraverse Medical, a medical device company, raised $12.5M in Seed funding (more)

Kudos, a AI-powered smart wallet service that optimizes consumer rewards on purchase, raised $10.2M in Series A funding (more)

Hunter Douglas acquires Azenco Outdoor (more)

Quantic Electronics buys M Wave Design (more)

Fort Point-backed SIG purchases RHB (more)

Expanso, a distributed compute company, received a strategic investment from Samsung Next (more)

Brookfield plans to invest $500M in Leap Green (more)

VC

Yendo, a provider of a vehicle-secured credit card, raised $165M in debt financing (more)

Allied OMS, a management services organization for oral and maxillofacial surgery practices, closed a $116M credit facility (more)

GoodShip, a provider of a platform for freight network orchestration and procurement, raised $8M Series A funding (more)

Angel AI, an AI platform that provides age-appropriate internet experiences for children aged 5-12, raised $4.75M in Seed funding (more)

CRYPTO

Crypto industry rallies behind House bill as It heads toward final vote (more)

Bitcoin developers are touting ‘programmability’ as the catalyst for the next rally (more)

Fund managers brace for SEC rejection of Ether-ETF applications (more)

SHIB to get more scarce as key exchange expands to Shibarium (more)

BULLISH BITES

🌴 Cali Forever: Why tech billionaires are trying to create a new California city.

🚨 Investor Alert: Don't miss this biotech “sweet spot” *

💥 Boom: There are now 15 centi-billionaires (the most ever) with a combined net worth of $2.2 trillion.

🍔 Good Eats: The world’s cheapest Michelin-starred meals.

🍣 Tradition: Sushi chefs pay up to $20,000 for these stainless steel sushi knives.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.