☕️ Good Morning.

The Fast Five → Apple’s 2-day slide nears $200 billion, China seeks to broaden iPhone ban, 46% of 401(k) investors admit to being clueless about their investments, Walmart lowers starting pay, and former FTX exec to forfeit $1.5 billion pleading guilty…

Here’s your MarketBriefing for Friday:

BEFORE THE OPEN

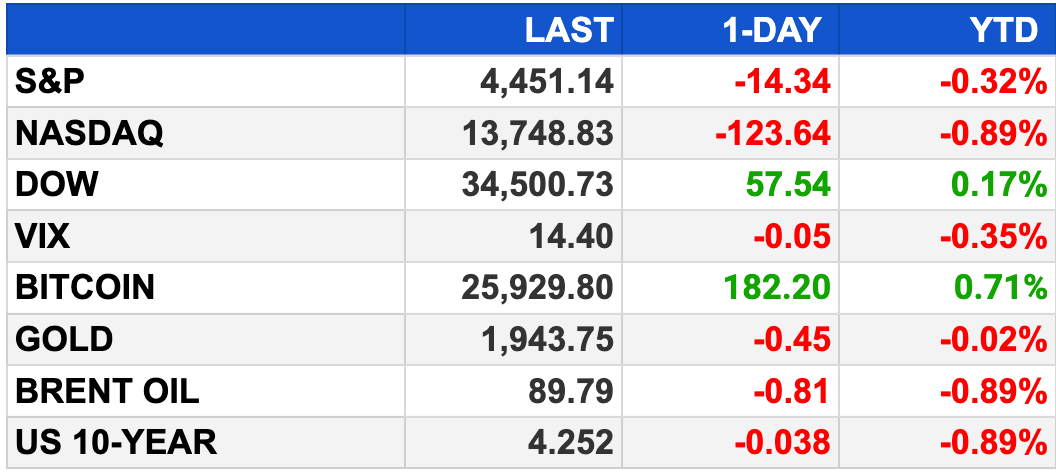

As of market close 9/7/2023.

MARKETS:

Nasdaq down 0.89% on Fed rate concerns

S&P 500 slipped 0.32%; Dow up 0.17%

Apple shares fell 2.9% due to China's iPhone ban.

Tech and semiconductor stocks lagged

Weekly jobless claims below expectations (216,000 vs. 230,000).

Strong labor market raises Fed rate hike fears

93% expect rate pause in September; 43% chance of November hike

Earnings: C3.ai down 12.2%, ChargePoint missed revenue, down 10.9%

NEWS BRIEFING

China seeks to broaden iPhone ban to state firms, agencies (more)

Biden bets on emerging markets as Xi snubs G20 (more)

Disney’s $218 billion rout not enough for dip buyers (more)

Sports league caps maker New Era prepares for IPO (more)

GM’s 16% pay hike offer ahead of strike deadline rejected as ‘insulting’ by UAW (more)

Ford raised pay for thousands of workers just before union contract expires (more)

Walmart lowers starting pay structure for entry-level store workers (more)

Blockbuster weight loss drugs Wegovy and Ozempic are being tested to treat addiction and dementia (more)

Morgan Stanley to launch AI chatbot to woo wealthy (more)

SoftBank backs autonomous long-haul trucking firm started by ex-Ford self-driving executives (more)

Stripe, Shopify, H&M spend $7M on carbon removal from 12 new companies via Frontier (more)

Tesla to install charging stations at 2,000 Hiltons in North America (more)

Investors to sneak a peek at largest buyout debt since Twitter (more)

AI-generated Drake song up for Grammy nomination (more)

Everyone’s talking about the Global South - but what is it? (more)

Was this briefing forwarded to you? (Sign up here.)

DEALFLOW

KRK is said to plan Kokusai Electric IPO at $2.7B value (more)

Wilson tennis racket maker Amer Sports files for US IPO (more)

Ritz-Carlton yacht collection targets $400 million fundraise (more)

Astara Capital Partners, LP, a middle market private equity firm, closed its inaugural fund, Astara Capital Partners Fund I, at $312M (more)

Ampla, a startup offering financial solutions to consumer brands, received a $258M credit facility (more)

Mariana Oncology, a fully integrated, next-generation radiopharmaceuticals company, raised $175M in Series B financing (more)

Younite-AI, a provider of AI and XR software solutions, received a private equity investment from Bocap (more)

Easop, a provider of an equity compensation solution for global teams, secured investments from a Cooley’s fund, and HR tech focused VC SemperVirens (more)

NeuroFlow, a provider of a behavioral health SaaS platform, received an investment from Concord Health Plans (more)

Accela, a provider of cloud solutions for government, received a strategic growth investment from Francisco Partners (more)

Certa, a provider of a third-party management platform for global third-party management across procurement, compliance, ESG, and legal, raised $35M in Series B funding (more)

Clara Analytics, a provider of artificial intelligence (AI) technology for insurance claims optimization, raised $24M in Series C funding (more)

Momofuku Goods, a provider of restaurant-grade pantry essentials, raised $11.5M in funding (more)

Testaify, a provider of an AI-driven software testing platform, raised $650K in funding (more)

Noetik, an AI drug discovery company, raised $14M in Seed funding (more)

Trident Digital Group, a digital asset lender, raised $8M in Seed funding (more)

M & A:

Microsoft Xbox Chief ‘confident’ on closing Activision deal (more)

I Squared-backed Star Leasing agrees to buy New Jersey rival CTL (more)

Blackstone, Thomson Reuters raise £2 billion in LSE offering (more)

Kushner’s Saudi-backed Affinity to acquire stake in Israeli firm (more)

Thoma Bravo to buy NextGen Healthcare in $1.8B deal (more)

Tenable (Nasdaq: TENB), an exposure management company, acquired Ermetic, a cloud-native application protection platform (CNAPP) company and provider of cloud infrastructure entitlement management (CIEM), for $240M (more)

SafeBase, a provider of a platform that helps security teams automate the security review process and accelerate sales deals, acquired Stacksi, a provider of an AI-powered security questionnaire automation platform (more)

Laborie Medical Technologies, a diagnostic and therapeutic medical technology company, acquired Urotronic, a medical device company, for up to $600M (more)

Munetrix, a provider of a performance analytics platform that consolidates siloed K-12 data into actionable insights, acquired Eidex, a K-12 data visualization company (more)

CRYPTO

BULLISH BITES

🍎 Apple Event 2023: What Is Expect From the ‘Wonderlust’ iPhone 15 Reveal → TechCrunch

🗽 This Is the True Scale of New York's Airbnb Apocalypse → Wired

🏚 ‘House-rich’ Americans are Sitting on Nearly $30 Trillion in Home Equity. Here’s How to Tap It → CNBC

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee! ☕️

Have any suggestions for MarketBriefing? We’d love to hear it.

Share your thoughts here -mb