☕️ Good Morning.

The Fast Five →, wider war could tip world economy into recession, Dimon warns now may be the most dangerous time in decades, Blackrock clients pull $13 billion from long-term funds, and Rite Aid files for bankruptcy…

Here’s your 5-minute MarketBriefing for Monday:

BEFORE THE OPEN

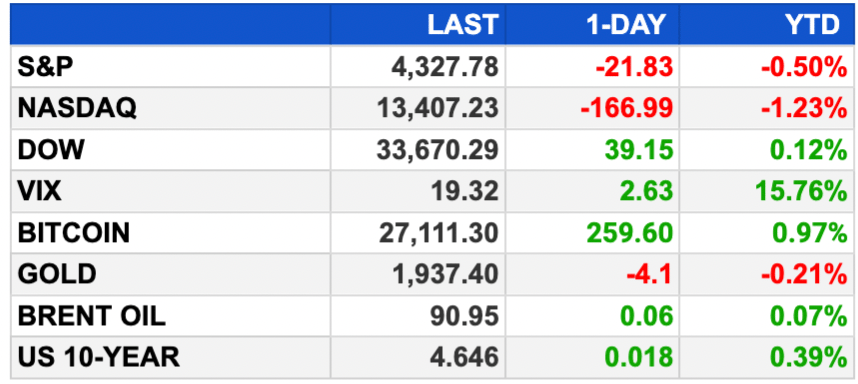

As of market close 10/13/2023. Bitcoin as of 10/15/2023.

MARKETS:

Stock futures edge higher ahead of busy earnings week.

S&P 500 posts second consecutive positive week.

Nasdaq dips slightly, oil prices surge due to Israel-Hamas conflict.

Major financial firms report positive earnings.

Israel anticipates ground invasion in Gaza, Schumer vows military aid.

Earnings season ramps up with Johnson & Johnson, Bank of America, Netflix, and Tesla. Charles Schwab reports earnings before the bell.

Empire State Index for October due out today.

EARNINGS

Here’s what we’re watching this week:

Monday: Charles Schwab (SCHW)

Tuesday: Bank of America (BAC), Goldman Sachs (GS), Johnson & Johnson (JNJ)

Wednesday: Netflix (NFLX), TESLA (TSLA)

NEWS BRIEFING

Israel War Latest:

Hedge funds get new SEC mandate for reporting short sales (more)

Wall St week ahead investors zero in on health of consumer with retail sales, earnings (more)

Yellen says U.S.-backed IMF funding increase is "pretty likely" (more)

BlackRock clients pull $13 billion from long-term funds (more)

Big Tech’s profit machine is propping up S&P 500 earnings (more)

Biden praises Kaiser Permanente labor agreement after worker strike: ‘Collective bargaining works’ (more)

Stellantis, Ford furlough another 1,250 workers because of UAW strike (more)

Rite Aid files for bankruptcy as liabilities pile up (more)

US to tighten curbs on China’s access to advanced chip (more)

Citigroup CEO plans to remove five management layers in reorganization (more)

Quiet cutting: How power in U.S. offices may be shifting back to bosses (more)

‘Miracle drug’ euphoria: experts warn widespread use of weight loss drugs faces major hurdles (more)

Pfizer cuts guidance on weakening demand for Covid antiviral Paxlovid (more)

Tesla fights $230M fee sought by attorneys who sued over board pay (more)

Israeli billionaire quits Harvard board after school’s response to Hamas attacks (more)

Stanford’s $40.9 billion fund tops elite rivals with 4.4% return (more)

TOGETHER WITH THE MOTLEY FOOL

Get unlimited access to Motley Fool Stock Advisor

DEALFLOW

Main Street Health, a value-based healthcare organization, raised $315M in funding (more)

Zolve, a cross border fintech company helping immigrants across the world gain access to financial services, secured a warehouse debt facility of up $100M from Community Investment Management (CIM) (more)

Canopy Servicing, a loan servicing startup, raised $15.2M in Series A1 funding at a $35 million pre-money valuation (more)

Alpaca, a provider of a brokerage platform for stock and crypto trading, received an investment of $15M from SBI Group (more)

Relay.app, a company providing workflow automation products, raised $3.1M in additional funding (more)

PickNik Robotics, an unstructured robotics company, raised $2M in pre-seed funding (more)

ABS Capital, a growth equity firm investing in software and tech-enabled B2B businesses, closed a GP-led secondary transaction centered around two of its portfolio companies, LabConnect, Inc., and Viventium Software (more)

LaPhair Capital Partners, a minority-led, influencer-backed and performance driven venture capital fund, launched Alpha Fund I, targeting $100M (more)

M & A:

Microsoft completes $69 Billion Activision Blizzard purchase (more)

British clothing group Next has agreed to buy FatFace in a deal valuing the fashion chain at $140M (more)

Stagewell (NASDAQ: STGW), a company combining culture-moving creativity with technology for marketing, acquired Left Field Labs, a digital agency at the intersection of technology and human-centric design (more)

Mphasis (NSE: MPHASIS), an IT solutions provider specializing in cloud and cognitive services, acquired Silverline, a provider of a digital transformation consultancy and Salesforce partner (more)

WellSky, a health and community care technology company, acquired Corridor, an end-to-end tech-enabled services platform focused on addressing the post-acute care industry’s toughest challenges, from HealthEdge Investment Partners (more)

Was this briefing forwarded to you? (Sign up here.)

CRYPTO

BULLISH BITES

🤥 Carl Icahn Bet on the 'Big Short 2.0.' Now He Says the Game Was Rigged → WSJ

🤖 How Generative AI is Creeping Into EV Battery Development → TechCrunch

💪 VC Billionaire Marc Andreessen on Tesla and SpaceX: They ‘Probably Would Have Gone Under’ with Anyone Besides Elon Musk → Fortune

🚀 Bumble CEO: Here Are the $20 ‘Crazy Hacks’ I used to Grow My App Into a $1.9 Billion Company → CNBC

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have any suggestions for MarketBriefing? We’d love to hear it.

Share your thoughts here or email us -mb