☕️ Good Morning.

The Fast Five → Fed is sparking irrational market optimism former FDIC Chair warns, gold prices soar to record highs, Teamsters authorize strike at Budweiser, A-Rod’s Slam SPAC plans merger with Lynk Global, and Bezos talks plans for a trillion people to live in space stations…

Here’s your 5-min briefing for Monday:

BEFORE THE OPEN

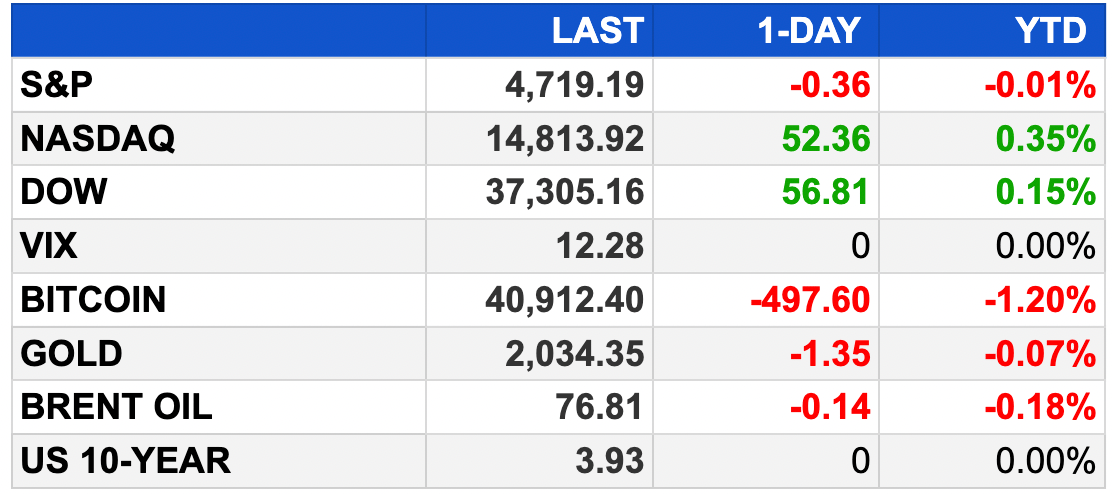

As of market close 12/15/2023. Bitcoin as of 12/17/2023.

MARKETS:

Stock futures flat after 7 weeks of index gains.

Dow sets intraday record, Nasdaq 100 hits closing high.

Dow futures up 34 points, S&P 500 adds 0.1%, Nasdaq 100 rises 0.02%.

S&P 500's longest weekly winning streak since 2017, up 3.3% in the month.

Dow and Nasdaq show solid monthly gains of 3.8% and 4.1%.

Investors positive on Federal Reserve's 2024 rate cut hint amid cooling inflation.

Focus ahead on December's business leaders survey and housing market index results.

NEWS BRIEFING

UBS CEO tells paper he's not convinced inflation is under control (more)

‘Underwater’ car loans signal US consumers slammed by high rates (more)

To trade the Fed’s pivot, Wall Street turns to short-dated debt (more)

Bond bulls look to juice 2024 return in obscure niche trades (more)

Hedge funds turn bearish on dollar as Goldman sees more declines (more)

Gold prices soar to record highs as Federal Reserve takes unexpected dovish turn (more)

Oil boon will add extra zip to rally in emerging-market assets (more)

US frackers return to haunt OPEC’s pricing strategy (more)

Asia shares brace for BOJ meeting, US inflation test (more)

China's ban on Apple's iPhone accelerates (more)

Recent data shows AI job losses are rising, but the numbers don’t tell the full story (more)

Activision Blizzard settles $54M workplace discrimination lawsuit with California (more)

Robinhood woos wealthier clients from bigger brokerages (more)

Citigroup employees, on edge over layoffs, told they can work remotely until the new year (more)

Deloitte is looking to AI to help avoid mass layoffs in future (more)

Jeff Bezos discusses plans for a trillion people to live in huge cylindrical space stations (more)

Floundering weed stocks test Wall Street’s faith in 2024 rebound (more)

TOGETHER WITH WISERADVISOR

Compare advisors in your area

Connect with the best financial advisor for your needs from WiserAdvisor - a free, independent and unbiased matching service.

Just answer a few questions and get matched with 2-3 financial advisors in your area today.

DEALFLOW

M & A | INVESTMENTS:

Abu Dhabi nears deal to buy stake in Turkish port (more)

Hong Kong diaper maker Vinda gets $3.35 bln offer from Royal Golden Eagle (more)

A-Rod’s Slam SPAC plans merger with Lynk Global (more)

Webster Financial Corporation (NYSE: WBS) announced that its subsidiary Webster Bank, N.A., is to acquire Ametros Financial Corp., a custodian and administrator of medical funds from insurance claim settlements, from funds managed by Long Ridge Equity Partners (more)

Getir, the Istanbul, Turkey-based grocery delivery company, completed the acquisition of FreshDirect, a NYC-based online grocery company, from Ahold Delhaize, a US food retail group (more)

Vensure Employer Solutions, a provider of HR/HCM technology, managed services, and global business process outsourcing, acquired Canadian Payroll Services (more)

Mainfactor, an e-commerce-as-a-service and direct-to-consumer acceleration company specializing in the music/entertainment industry, acquired the e-commerce-related sites and assets of Gimme Radio Inc (more)

Chobani acquires La Colombe (more)

Epiroc buys Stanley Black & Decker’s attachment tools business (more)

RMA Companies, a provider of professional services in environmental consulting, geosciences, and materials testing and inspection acquired Rone Engineering, a geotechnical engineering and environmental services firm (more)

Trend Health Partners acquires Advent Health (more)

Aquiline-backed Relation purchases assets of Kane Insurance Agency (more)

The Rise Fund, TPG’s multi-sector impact investing strategy firm, and Investcorp, a global alternative investment firm, signed an agreement together with Stirling Square Capital Partners to acquire a majority investment in Outcomes First Group, a provider of education to people with autism and learning disabilities (more)

VC

Deep Apple Therapeutics, a company that discovers novel small molecule therapeutics for high-value targets through virtual screening of AI-generated virtual libraries, raised $52M in Series A funding (more)

Distributional, a provider of a modern enterprise platform for artificial intelligence (AI) testing and evaluation, raised $11M in seed funding (more)

Tetra, a home services company helping homeowners transition from fossil fuels to clean energy, raised $10.5M in Seed funding (more)

Neurophos, an AI computation solutions company in a mission to to productize a breakthrough in metamaterials and optical AI inference chips, raised $7.2M in Seed funding (more)

Prevu, a provider of a savings-oriented, homebuying platform, raised $6M in Series A funding (more)

Redactable, a provider of an AI-driven web application to protect sensitive documents, raised $5.5M in Seed funding (more)

SupportPay, a provider of a platform for divorced, single, step, co-parents, and caregivers, raised $3.1M in Seed funding (more)

Certainly Health, a healthcare marketplace for booking medical and cosmetic care, raised $2.3M in funding (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

The countdown for a Bitcoin ETF decision is approaching a critical deadline (more)

Bitcoin at risk of snapping historic winning streak, but 'perfect storm' brews for a strong 2024 (more)

Blockchain-based private credit rebounds in crypto with 55% jump in 2023 (more)

FTX files plan to end bankruptcy, pay crypto creditors billions (more)

BULLISH BITES

💙 Besties’ revenge: How the ‘All-In’ podcast captured Silicon Valley.

🎁 Gifting: The 58 new books top business leaders say are must-reads.

😱 Disrupted: News publishers see Google’s AI search tool as a traffic-destroying nightmare.

🏡 Watch list: The No. 1 most affordable place to retire in 2024—it’s not in Florida.

💰 Match-maker: Just answer a few questions from WiserAdvisor and get matched with 2-3 financial advisors in your area today, for free — Try it

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.