Good morning.

The Fast Five → Trump has no plans to remove Fed Chair Powell, “AI’s growth is just getting started”, BRICS have no interest in weakening USD, trading platform eToro plans IPO, and Palantir, Anduril sign partnership for AI training in defense…

📈 Investor Alert: What billionaires and Wall Street are selling now »

From Stansberry Research

Reader Sentiment: What's your short-term outlook on the market?

🟩🟩🟩🟩🟩🟩 📈 BULLISH 82% (Last week: 79%)

🟨⬜️⬜️⬜️⬜️⬜️ 📉 BEARISH 18% (Last week: 21%)

Results from Sunday’s poll

Comments:

📈 “End of year. New president. Change coming”

📈 “Money will move from European stocks to US stocks”

📈 “Seasonal strength coupled with breakout sector momentum, especially in AI and Bitcoin”

📉 “With inflation not changing greatly and people's wages not increasing, spending will decrease”

📈 “Trump's excitement will last for a few months”

Calendar: (all times ET) - Full calendar

Today:

Wholesale inventories, 10:00 am

Consumer inflation expectations, 11:00 am

Tomorrow:

Nonfarm productivity, 8:30 am

Unit labor costs, 8:30 am

Your 5-minute briefing for Monday, December 9

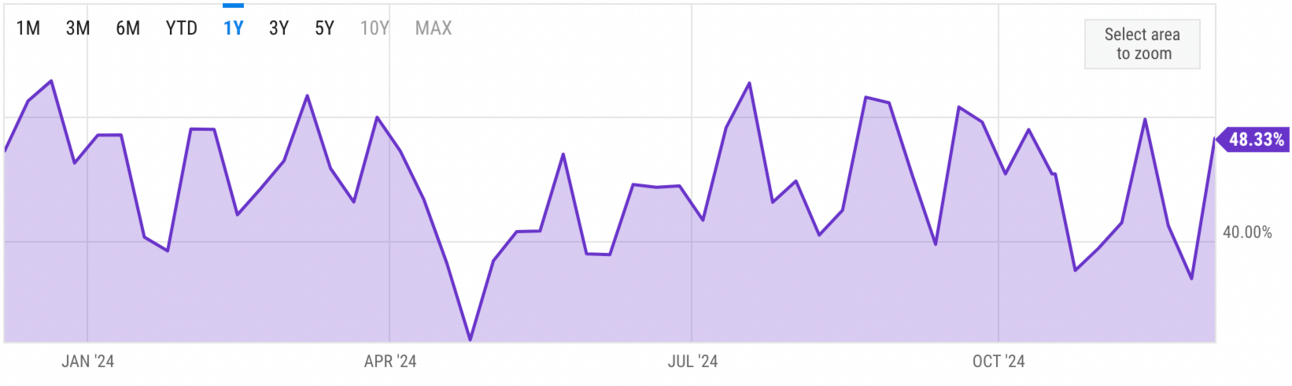

US Investor % Bullish Sentiment:

↑ 48.33% for Week of December 05 2024*

Previous week: 41.29%. Updates every Friday.

Market Wrap:

Futures steady ahead of key inflation data this week.

S&P, Nasdaq up 0.96% and 3.34% last week; Dow down 0.6%.

CPI report Wednesday: Nov. inflation expected at 0.3% (MoM), 2.7% (YoY).

Fed likely to cut rates Dec. 18; CME tool shows 85% odds.

Oracle earnings due Monday after the close.

EARNINGS

Here’s what we’re watching today. Full Calendar »

Today: Oracle (ORCL)

Toll Brothers (TOL) - earnings of $4.34 per share (+5.6% YoY) on $3.2B revenue (+5.0% YoY)

Tuesday: GameStop (GME)

Wednesday:

Adobe (ADBE) - earnings of $4.67 per share (+9.4% YoY) on $5.5B revenue (+9.8% YoY)

Thursday: Costco (COST)

Broadcom (AVGO) - earnings of $1.39 per share (+25.2% YoY) on $14.1B revenue (+51.3% YoY)

HEADLINES

S&P rises to a record close Friday, posts third straight winning week (more)

US House to vote on $3 billion to remove Chinese telecoms equipment (more)

BRICS have no interest in weakening USD, Indian foreign minister says (more)

Gold rises after PBOC resumes buying and Syria aids haven demand (more)

Oil edges up as rising Mideast tensions offset demand fears (more)

Traders brace for more volatility on Korea’s political stalemate (more)

Yuan, Euro rout points to losses for emerging-market currencies (more)

Walmart, Amazon holiday spending rise as Target, Best Buy stumble (more)

Super Micro Computer gets extension to file delayed annual report (more)

Palantir, Anduril sign partnership for AI training in defense (more)

BYD on track to top 2024 sales goal and outsell Ford, Honda (more)

FROM STANSBERRY RESEARCH

Wall Street Warns: Stocks Could Be "Dead Money" For Next 10 Years

Despite recent rallies, big banks such as JP Morgan, Goldman Sachs, GMO, and Apollo Global Manage are warning that stocks could now be dead money - for the next 10 years.

At the same time, well-connected billionaires like Warren Buffett have been selling off US stocks at an alarming rate.

Today, one of America's most trusted market experts is stepping forward to explain what's really going on behind the scenes of this bull market - and why, even if you're sitting on large gains right now, you could soon face losses of 50% or more if you do nothing.

DEALFLOW

M+A | Investments

Advertising firms Omnicom and Interpublic nearing merger that would reshape industry (more)

Novo wins EU approval for deal to acquire Catalent Plants (more)

Aviva set to buy Direct Line to create $21 billion British insurer (more)

CVC said to explore takeover of German software firm CompuGroup (more)

Green Rebates, an incentive management company for the horticulture industry, acquired Synergy, a company delivering energy rebates to indoor horticulture customers (more)

Uniphore, a company specializing in Enterprise AI, acquired data companies ActionIQ and Infoworks (more)

Huron (HURN), a professional services firm, acquired AXIA Consulting, a provider of supply chain-focused consulting and technology solutions (more)

SmartBear, a provider of software quality and visibility solutions, acquired QMetry, a comprehensive AI-enabled digital quality platform (more)

VC

CRYPTO

BULLISH BITES

🚨 Investor Alert: Why are billionaire investors now worried – and selling? *

🚀 Bezos vs. Musk: Space tycoons with dueling visions for humanity's survival.

👀 Watching: The four startups from YC’s Fall batch that enterprises should pay attention to.

💡 Insight: A sociologist shines a light on traders, flash boys and online adtech.

🎁 Gift Idea: The "Rich Guy Jacket."

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.