💰 There's a time-tested way to protect your wealth against inflation. Download your free guide »

Courtesy of American Alternative Assets

Good morning.

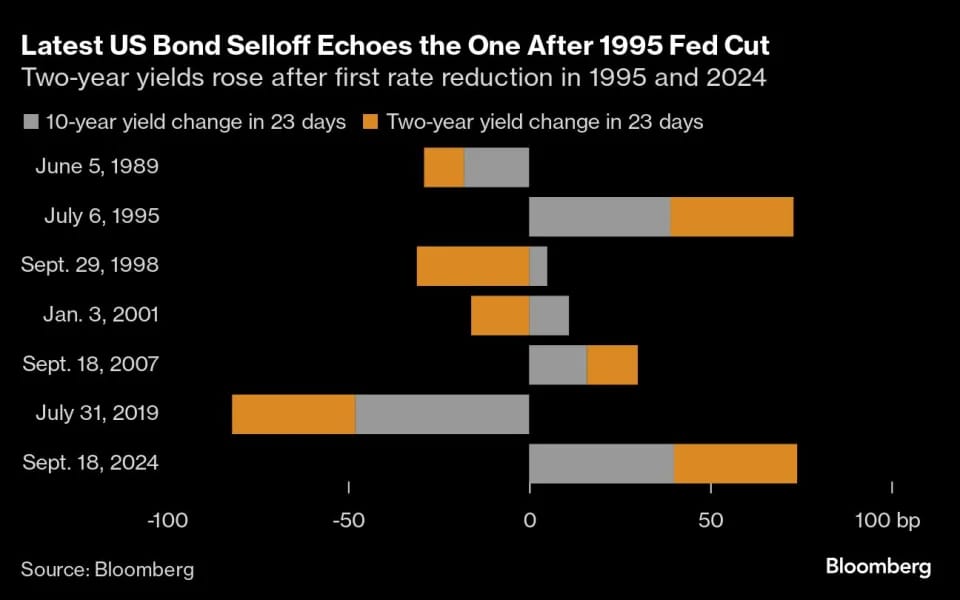

The Fast Five → Treasuries plunge like it’s 1995, Apollo, SoftBank eye giant AI fund, Starbucks suspends 2025 guidance after another sales slump, Anthropic’s new AI model can control your PC, and Paul Tudor Jones sees a market reckoning after the election…

🚨 Time to sell NVDA?

From Chaikin Analytics

Calendar: (all times ET) - Full calendar here

Today:

Existing home sales, 10:00 am

Fed Beige Book, 2:00 pmTomorrow:

Initial jobless claims, 8:30 am

New home sales, 10:00 am

Your 5-minute briefing for Wednesday, October 23:

US Investor % Bullish Sentiment:

↓ 45.45% for Week of October 18 2024

Last week: 49.01%. Updates every Friday.

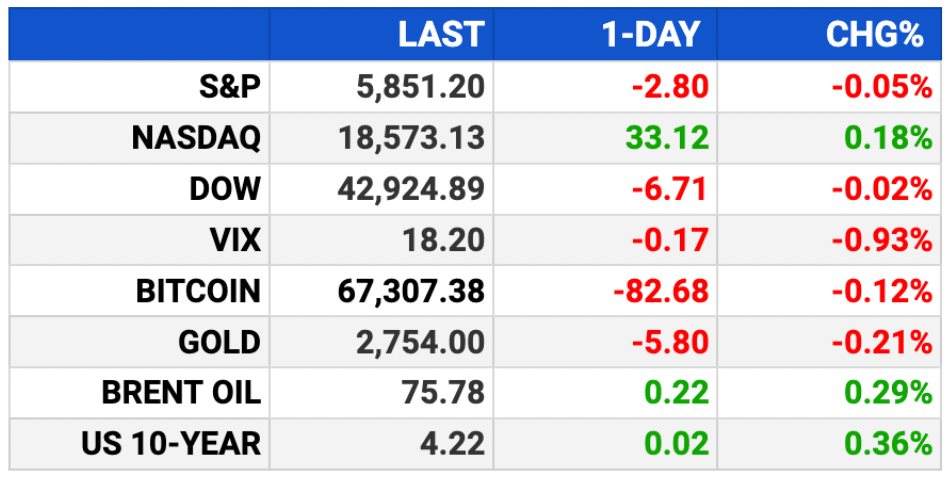

Market Wrap:

Stock futures fall after S&P's back-to-back losses.

S&P futures -0.1%, Dow off 126 points (-0.3%), Nasdaq -0.1%.

McDonald’s drops 6% due to E. coli outbreak. Starbucks falls 4% on weak sales.

10-yr Treasury yield tops 4.2%, pressuring stocks.

Earnings: AT&T, Coca-Cola, Boeing before bell; Tesla, IBM after close.

EARNINGS

What we’re watching this week:

Tesla (TSLA) - earnings of $.58 cents per share (-2.1% from the year-ago period) on $25.3B revenue (+14.7% YoY)

See full earnings calendar here.

HEADLINES

Wall St closes little changed while investors digest yields, earnings (more)

US remains engine of global growth in latest IMF forecasts (more)

Paul Tudor Jones sees a market reckoning on spending after the election (more)

US allocates $196M for natural gas pipeline modernization (more)

Oil settles up 2% as Middle East war rages, supplies tighten (more)

IRS announces bigger estate and gift tax exemption for 2025 (more)

Flying air taxis move closer to takeoff with issuing of FAA rule (more)

Starbucks suspends 2025 guidance after another sales slump (more)

Philip Morris is a growth stock again as shares hit all-time high on Zyn boom (more)

Anthropic’s new AI model can control your PC (more)

OpenAI hires ex-White House official as chief economist (more)

FROM CHAIKIN ANALYTICS

Time to Sell NVDA?

50-yr Wall Street legend weighs in —

Nearly 1 million people around the world follow 50-year Wall Street veteran Marc Chaikin for his surprisingly accurate stock predictions.

And in the aftermath of the biggest tech selloff since 2022...

He says:

"While I predict a select few tech stocks will roar back from here – and

potentially soar triple digits – one AI company's day in the sun has come

to an end. You must get off this sinking ship - now.”

- sponsored message -

DEALFLOW

M+A | Investments

J.M. Smucker to sell Voortman Cookies to buyout firm CapVest (more)

Insignia buys Veritone’s podcast agency for up to $104M (more)

Thomson Reuters, a global content and tech company, acquired Materia, an agentic AI assistant for the tax, audit and accounting profession (more)

Garmin acquired Lumishore, a company that designs and manufactures high-performance above and underwater LED lighting systems for boats (more)

FreeWill, a social-good enterprise at the nexus of philanthropy and estate planning, acquired Grant Assistant, an AI-based platform designed to improve the grant proposal process (more)

CardFlight, a SaaS payment technology company, received a growth investment from WestView Capital Partners (more)

NEPC, an investment consultant and outsourced chief investment, received a strategic investment from Hightower (more)

Formic Technologies Inc., a startup company that designs, develops, and maintains industrial robots, received an investment from Mitsubishi Electric Corporation (more)

Orbital Materials, a proprietary AI platform that incubates advanced materials and climate technologies, received an investment from NVentures (more)

VC

AvenCell, a Watertown, MA-based clinical-stage cell therapy company, raised $112M in Series B funding (more)

Redaptive, an Energy-as-a-Service provider, raised $100M in funding (more)

Globality, a company specializing in AI-driven sourcing and procurement, raised $47M in Series D-1 and Series D-2 funding (more)

Reality Defender, a deepfake and AI-generated media detection platform, announced that its Series A fundraising has been expanded to $33M (more)

Pantheon AI, an AI-enabled proptech company, exited stealth mode and announced it had secured $25M in funding (more)

TollBit, a real-time solution for digital publishers to license their content and get paid immediately, raised $24M in Series A funding (more)

TollBit, a real-time solution for digital publishers to license their content per use and get paid immediately, raised $24M in Series A funding (more)

Passkey Therapeutics, a developer of synergistic multifunctional therapeutics, raised $20M in Seed funding (more)

WarrCloud, an automated warranty processing platform, raised $20M in Series B Funding (more)

CrewAI, a multi-agent platform, raised $18M in total funding (more)

BiltOn, a construction operations & risk management software provider, closed a $15M Series B funding round (more)

HealthEx, a global consumer platform for healthcare to unlock data access, raised $14M in Seed and Series A funding (more)

Paccurate, a packing intelligence platform for parcel shippers, raised $8.1M in Series A funding (more)

Azura, a company developing an interfacing layer for decentralized finance, raised $6.9M in Seed funding (more)

Tour24, a self-guided tour company, raised $5M in Series B funding (more)

Agentech, an AI support workforce for insurance claims, raised $3M in Seed funding (more)

Universal Fuel Technologies, a sustainable fuel production company, raised $3M in Seed funding (more)

Optiwise.ai, an AI assistant designed for the Walmart Marketplace, raised $2.4M in Seed funding (more)

Monark Markets, a fintech startup that embeds private market investments within traditional brokerage platforms, raised $2.2M in Seed funding (more)

Lumenuity, a developer of optical technology that enhances the zoom capabilities of smartphone cameras, raised $1.2M in Seed funding (more)

CRYPTO

BULLISH BITES

🚨 Sell Alert? Wall Street slashes NVDA holdings *

💼 Pursuits: The Washington Post looks at what Kamala Harris' campaign is doing to "win back” Silicon Valley.

🍎 Interview: The Wall Street Journal asks Tim Cook to elaborate on the four-word motto that guides his every decision at Apple.

🖋 Fine Art: Behind the scenes at the London Pen Show, one of the only places in the world where you can confer with a nibmeister.

🤣 LOL: TikTok, SNL style.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.