☕️ Good Morning.

US CPI posts smallest back-to-back increases in 2 years, China slams Biden’s order limiting overseas tech investment, Tapestry and Capri announce luxury mega-merger, TV giants clash over NBA/NHL/MLB games as rights up for grabs, and Disney+ loses millions of subscribers as content purge continues…

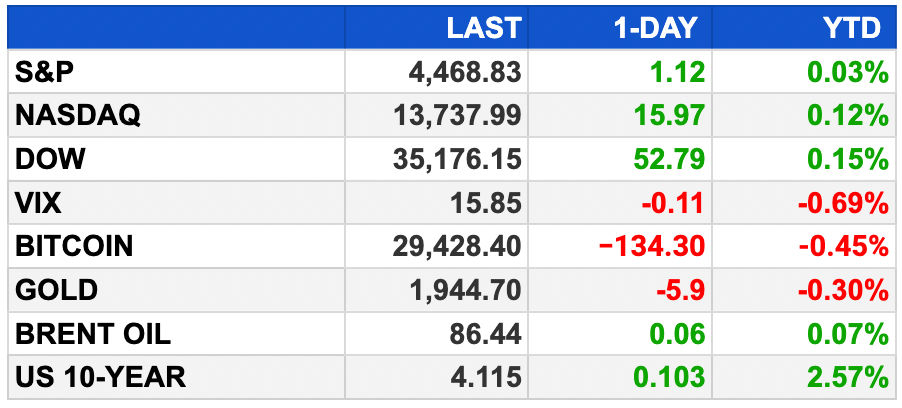

Here’s your market briefing for Friday:

BEFORE THE OPEN BEFORE

As of market close 8/10/2023.

MARKETS:

Dow edges higher with Disney rally and moderate inflation growth.

Dow adds 52.79 points, S&P 500 inches up 0.03%, Nasdaq rises 0.12%.

Earlier session saw indexes climb over 1%, Dow up more than 450 points.

Nasdaq and S&P 500 set for weekly declines of 1.2% and 0.2%; Dow poised for 0.3% gain.

July consumer prices rise 3.2% YoY, slightly below 3.3% economist consensus.

Month-to-month inflation increase of 0.2%, real average weekly earnings unchanged.

Core July CPI, excluding food and energy, up 4.7% YoY, above Fed's 2% target.

Disney surges 4.9%, top Dow performer, announcing price hike for ad-free Disney+.

Disney reports Q3 earnings beat, Wynn Resorts advances 2.6% on strong report.

Over 90% of S&P 500 firms reported Q3 earnings, 80% exceeding Wall Street expectations according to FactSet.

NEWS BRIEFING

US core CPI posts smallest back-to-back increases in two years (more)

Tech investors face ‘new era’ of China restrictions after Biden order limits funding in A.I., chips (more)

China slams Biden’s order limiting U.S. overseas tech investment (more)

US mortgage delinquency rates fall to all-time low (more)

Private lenders take control of more companies as rates surge (more)

China's CellX pilots lab-grown meat production, eyes U.S. market (more)

Disney+ loses millions of subscribers as content purge continues (more)

ESPN to leave Caesars' Las Vegas Studio after PENN agreement (more)

Amazon axes some private label brands as part of wider cost cuts (more)

Disney rises after Hollywood strikes save company $3B (more)

Twitter-turned-X CEO Linda Yaccarino is working to win back brands on Elon Musk’s platform (more)

Maxeon seeks to spend $1.2B building biggest US solar factory (more)

Two robotaxi services seeking to bypass safety concerns and expand in San Francisco face pivotal vote (more)

America’s drivers are racking up record miles but using less gasoline (more)

Paper exams, chatbot bans: Colleges seek to ‘ChatGPT-proof’ assignments (more)

DEALFLOW

Coach owner Tapestry to acquire Michael Kors, Jimmy Choo parent Capri Holdings for $8.5 billion (more)

Blackstone-backed solar company Esdec seeks US IPO at $5 billion value (more)

Blackstone raises record $7B to finance clean-energy push (more)

Berry Global said to weigh options for $2B nonwovens unit (more)

Check Point buys Perimeter 81 for $490M to enhance its security tools for hybrid and remote workers (more)

IBM completes acquisition of Apptio (more)

Tech24 acquires Pronto Repairs (more)

Allegro MicroSystems acquires Crocus Technology for $420M (more)

ToxStrategies buys Modality Solutions (more)

CloudMellow acquires Idea Marketing Group (more)

Newterra acquires Environmental Site Solutions (more)

Arcfield buys Strategic Technology Consulting (more)

Telltale acquires Flavourworks (more)

Rootly, a provider of an incident management platform, raised $12M in Series A funding (more)

Native Pet, a St. Louis, a clean label ingredient pet supplement company, raised $11M in Series B funding (more)

Renewa, an infrastructure investor in the renewable energy industry, secured $450M of committed capital (more)

Monetizr, an advertising experience platform provider, raised $4M in funding (more)

Fizz, a provider of a social media platform exclusively available for college students, raised $25M in Series B funding (more)

Trove, a company specializing in branded resale and trade-in for brands and retailers, raised $30M in Series E funding (more)

Wint Water Intelligence, a water management and leak-prevention solutions for construction, commercial, residential and industrial applications, raised $35M in Series C funding (more)

Virtualitics, Inc., an artificial intelligence and data exploration company, raised $37M in Series C financing (more)

BioFlyte, a biothreat detection firm with a new class of fieldable biological threat collection, detection, and identification solutions, raised $5.4M in funding (more)

Boston Micro Fabrications, a company specializing in manufacturing solutions for precision applications, raised $24M in Series D funding (more)

Serve Robotics, an autonomous sidewalk delivery company, raised $30M in funding (more)

Healthmap, a health management company focused on kidney disease, raised $100M in funding (more)

Rightfoot, a provider of a zero-login consumer-permissioned data product, raised $15M in Series A funding (more)

Nature Coatings, a biochemicals company transforming waste materials into bio-based, safe, and renewable solutions, raised $2.45M in funding (more)

Middleware, an AI-powered cloud observability platform provider, raised $6.5M in Seed funding (more)

Osano, a provider of a data privacy management software platform, raised $25M in Series B funding (more)

Dentognostics, a research-driven technology company, secured investments from Dental Innovation Alliance and Dental365 (more)

Capstan Medical, a developer of minimally invasive technology for heart valve disease, raised $31.4M in Series B funding (more)

ADARx Pharmaceuticals, Inc., a clinical stage biotechnology company developing next generation RNA therapeutics, closed a $200M Series C financing (more)

CRYPTO

Sam Altman's eyeball-scanning Crypto project Worldcoin is having an identity crisis (more)

Circle says $1B in cash serves as buffer while market share declines (more)

Bitcoin miner marathon’s quarterly loss narrows, revenue jumps (more)

PayPal sees stablecoin generating revenue from payment flows (more)

BULLISH BITES

📱 Getting Into Y Combinator Is Tougher Than It’s Ever Been…

Amid the flood of big tech layoffs, entry to Y Combinator has become the most competitive it’s ever been. Silicon Valley’s premier business incubator has received 44,000 applications so far this year, the most ever, and the acceptance rate for its summer batch was less than 1%, the lowest in the organization’s history... (continue reading)

👕 3 Friends Pooled $3,000 to Sell T-shirts — They've Brought in Over $250 Million Since 2019…

When Bartlett and a couple friends pooled $3,000 to launch men’s apparel brand True Classic in 2019, he’d never sold clothing before. But the idea behind True Classic, affordable shirts built to flatteringly fit the everyman, seemed to resonate with people. At first, confidence was the key to Ryan Bartlett’s success. Then, it was nearly his downfall...

Know someone who would enjoy this?

What did you think about today's briefing?

Thank you for reading. Have any suggestions for MarketBriefing? We’d love to hear it! Share your suggestions here… -mb