Good morning 🇺🇸

The Fast Five → Latest on Charlie Kirk shooting, Oracle's 'truly awesome' quarter crowns it as major AI player, Trump's claim of 'no inflation' falls flat with Americans, Goldman set to see busiest IPO week in years, and Amazon’s Zoox jumps into US robotaxi race…

📌 If you have any money in US dollars… go here to learn how to prepare for "Trump's new dollar" — Because this could be the biggest change to our financial system in 54 years. President Trump even called it: "The greatest revolution in financial technology since the birth of the internet itself." Get the details here. (ad)

Calendar: (all times ET) - Full Calendar

Today:

Consumer Price Index, 8:30A Unemployment Claims, 8:30A

Tomorrow:

Consumer Sentiment, 10:00A

Your 5-minute briefing for Thursday, Sept 11:

US Investor % Bullish Sentiment:

↓ 32.69% for Week of SEP 04 2025

Previous week: 34.60%

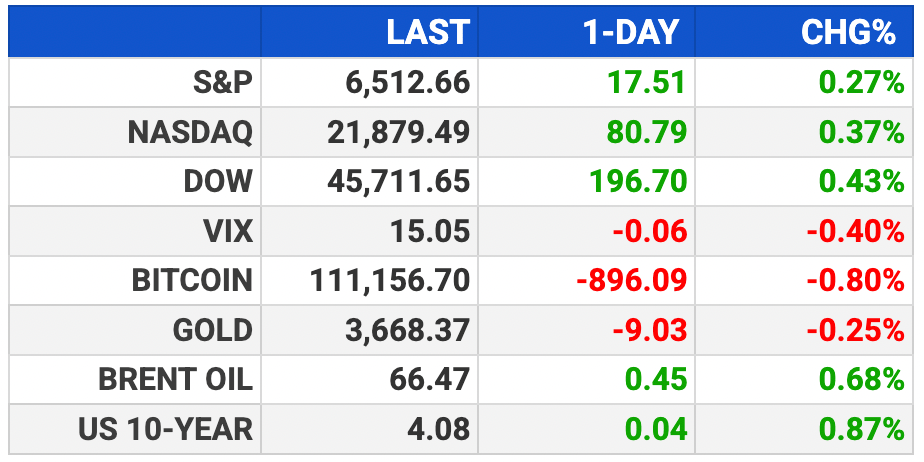

Market Wrap:

S&P futures flat; Dow futures -2; Nasdaq -0.1%

S&P hit another record close, driven by Oracle’s surge

Oracle soared 36%, best day since 1992, adding $244B in market cap

AI stocks Broadcom, AMD, Micron also rallied on Oracle optimism

CPI due 8:30A ET today; forecast +0.3% MoM, +2.9% YoY; Core +3.1%

On deck: Jobless claims, budget data; Kroger & Adobe earnings

EARNINGS

Here’s what we’re watching this week:

Today: *Kroger $KR ( ▼ 0.13% )

Adobe $ADBE ( ▲ 1.35% ) - $5.18 eps (+11.45 YoY) on $5.9B revenue (+9.3% YoY)

This New Tech Projected to Grow 3x Faster than AI

Forget AI.

President Trump's new law #S.1582 unlocks a new tech that could trigger a $21 trillion financial revolution.

President Trump himself called it a "big innovation"…

And said that it represents "American brilliance at its best."

Go here to see the details because the market for this tech…

…is projected to grow more than 3x FASTER than AI in the coming years.

- a message from Brownstone Research -

HEADLINES

S&P 500 and Nasdaq notch record closes as Oracle soars on AI optimism (more)

Cooler US producer inflation hints at softening demand (more)

Wholesale prices unexpectedly declined 0.1% in August (more)

Labor Inspector General initiates review of BLS ‘challenges’ (more)

Trump floats 100% tariffs on China, India to squeeze Russia (more)

Goldman set to see busiest IPO week in years, CEO Solomon says (more)

Oracle's 'truly awesome' quarter crowns it as major AI player (more)

GameStop stock rises as earnings top estimates, company buys Bitcoin (more)

Potbelly surges on acquisition by convenience store operator RaceTrac (more)

Robinhood aims social platform at Reddit's WallStreetBets (more)

Klarna valued at nearly $20 billion as shares jump in NYSE debut (more)

Hedge fund traders on a bad streak are the hottest recruits around (more)

Chipotle to expand to Asia through joint venture (more)

Amazon’s Zoox jumps into U.S. robotaxi race with Las Vegas launch (more)

DEALFLOW

M+A | Investments

Novartis to acquire Tourmaline Bio for $1.4 billion

Phillips 66 buys remaining stake in major US refineries from Cenovus for $1.4B

Exxon Mobil buys a Kentucky battery-materials factory

Applied Systems acquires Cytora

Magnite acquires streamr.ai

Anglo American to merge with Teck Resources (~$53B)

VC

QuEra, a developer of advanced neutral-atom quantum computers, expanded its $230M Series B financing round

Harbor Health, a primary and specialty care clinic group and health insurance company, raised $130M in new funding

Speedchain, a global provider of modern commercial card programs and expense management solutions, raised $111M in equity and debt financing

Higgsfield, an AI-native video reasoning engine, raised $50M in Series A funding

Palm Tree Crew, a global entertainment, hospitality and investment holding company, raised $20M in Series A funding

Sapphire Technologies, a manufacturer of power generation equipment, raised $18M in Series C financing

LightSpun, an AI-powered dental insurance administration platform, raised $13M in Series A funding

Runware, a performance and price-focused AI-as-a-Service provider, raised $13M in Seed funding

Nuclearn, an AI platform designed specifically for nuclear operations, raised $10.5M in Series A funding

Cassidy, a context-powered AI automation platform for enterprises, raised $10M in Series A funding

Sphinx, a company building AI for data, raised $9.5M in Seed funding

Metal, an AI platform built for private market investors, raised $5M in funding

MCatalysis, a deep tech company focused on the fuels and chemicals sector, raised an undisclosed amount in Seed funding

CRYPTO

BULLISH BITES

🚀 No one saw Oracle’s explosive growth coming.

✈️ Travel platforms embrace AI to avoid being replaced by AI.

🏓 Miami’s latest craze isn’t pickleball but padel.

🧳 For the true Tesla fanboy: luggage

NO MEMES TODAY

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.