Good morning.

The Fast Five → US/China tee up sweeping trade deal, bull market’s make-or-break week with Big Tech earnings, markets cheered CPI print—Main St not so much, Trump slaps 10% extra tariff on Canada over ad, and Trump’s $130M mystery military donor revealed…

📌 Gold Lockdown: The world's central bankers are now locking down all the gold they can get their hands on... What do they know that you don't? Click here for the full story behind WHY this is happening – and what it means for your money. (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

None scheduled

Tomorrow:

Consumer Confidence (tentative)

Your 5-minute briefing for Monday, Oct 27:

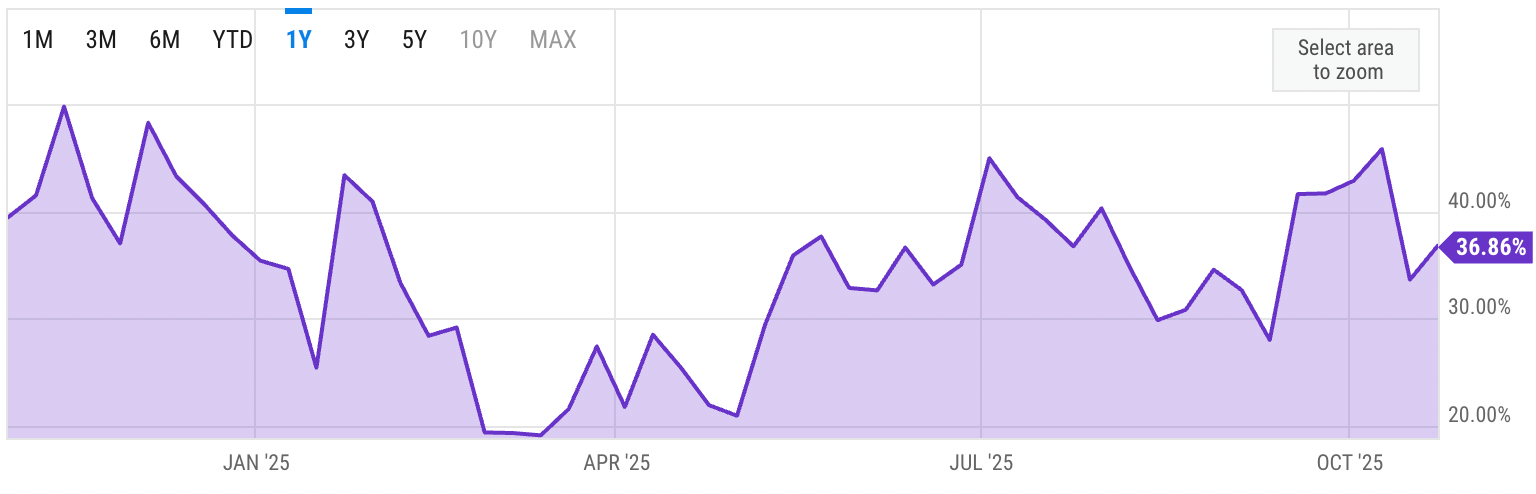

US Investor % Bullish Sentiment:

↑33.86% for Week of OCT 23 2025

Previous week: 33.66%

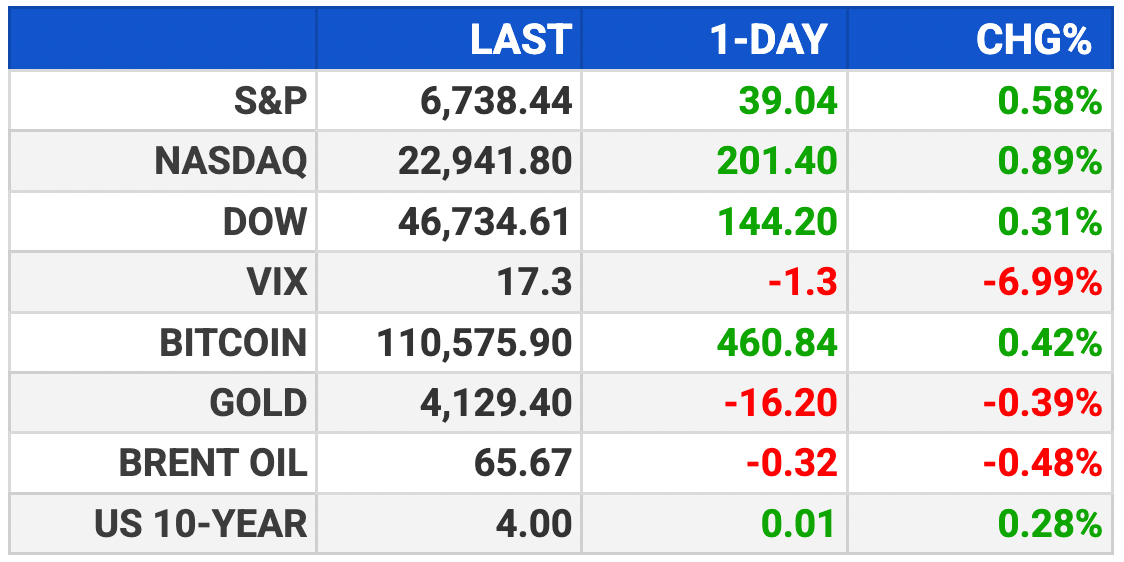

Market Wrap:

Futures higher ahead of Fed cut & Big Tech earnings.

Dow +290 (+0.6%), S&P +0.7%, Nasdaq +0.9%.

Fed expected to cut rates to 3.75–4.00% on Oct. 29.

“Mag 7” earnings on deck: Apple, Amazon, Alphabet, Meta, Microsoft.

Trump–Xi meeting Thursday in South Korea may ease trade tensions.

Treasury Sec. Bessent says talks “constructive, far-reaching.”

Major indexes hit record highs Friday; Dow tops 47,000 for first time.

EARNINGS

Here’s what we’re watching this week:

TUE: *JetBlue $JBLU ( ▲ 1.1% ), *PayPal $PYPL, SoFi $SOFI ( ▼ 1.45% ), *UnitedHealth $UNH ( ▲ 0.02% ), UPS $UPS ( ▲ 1.03% ), Visa $V ( ▲ 0.63% ), *Wayfair $W ( ▲ 2.34% )

WED: *Boeing $BA ( ▼ 0.72% ), Chipotle $CMG ( ▼ 1.13% ), Meta $META ( ▲ 1.69% ), Microsoft $MSFT ( ▼ 0.31% ), Starbucks $SBUX ( ▲ 1.76% ), *Verizon $VZ ( ▲ 1.25% )

*Alphabet $GOOGL ( ▲ 4.01% ) - $2.28 EPS (+7.5% YoY) on $100B revenue (+13.2% YoY)

THU: *Eli Lilly $LLY ( ▼ 1.34% ), Estee Lauder $EL ( ▲ 2.23% ), Reddit $RDDT ( ▲ 2.77% ), *Roblox $RBLX ( ▼ 3.79% ), *Roku $ROKU ( ▼ 0.61% ), Shake Shack $SHAK ( ▲ 0.41% ), *SiriusXM $SIRI ( ▲ 0.1% )

Amazon $AMZN ( ▲ 2.56% ) - $1.56 EPS (+9.1% YoY) on $177.7B revenue (+11.8% YoY)

Apple $AAPL ( ▲ 1.54% ) - $1.76 EPS (+81.4% YoY) on $102.1B revenue (+7.6% YoY)

FRI: *Chevron $CVX ( ▼ 0.46% ), *Exxon $XOM ( ▼ 2.44% )

We’ve Ween This Before… and it Didn’t End Well

Forty years after the Plaza Accord's cut American's wealth almost in half...

My firm already briefed our paying clients on this urgent story.

But in my urgent new market briefing, I want to help pull back the curtain for you and your loved ones, too... at no cost.

Fair warning: what I say is controversial. But after hours and hours of research, I see no other conclusion.

The implications are personal and more far-reaching than anything I've seen in my 40-plus years in the markets.

Mark my words: The steps you take right now could determine whether you watch 40% of your wealth disappear...

Or join the next wave of millionaires this seismic shift could create.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig, MD, MBA

Senior Partner, Stansberry Research

CEO, MarketWise

- a message from Marketwise -

HEADLINES

Wall Street notches record closing highs on cool inflation, solid earnings (more)

Bessent says US, China have reached trade framework (more)

Rubio says US will not change Taiwan policy for China trade deal (more)

Trump slaps 10% extra tariff on Canada over Reagan trade ad (more)

Trump’s $130 million mystery military donor is Timothy Mellon (more)

Markets cheered the CPI print but Main Street not feeling the relief (more)

New CPI data resets December Fed interest rate cut (more)

Oil rises after best week since June on US-China trade optimism (more)

Gold trader hiring spree drives up pay as bullion market booms (more)

AI spending is boosting the economy, but businesses are in survival mode (more)

Truckload capacity is falling faster than demand (more)

GM unveils 'eyes off' self-driving, 'conversational' Google AI (more)

Private credit titans eye opportunity in Saudi liquidity aqueeze (more)

DEALFLOW

M+A | Investments

Novartis to acquire Avidity Biosciences in $12 billion deal

Janus RX receives investment from FFL Partners

SecondWave Systems receives new investment to expand Series A funding

Linen Cloud receives investment from several enterprise tech leaders

VC

CourtReserve, a club management software platform provider, received a $54M strategic growth investment

Veritas Prime, a provider of SAP SuccessFactors and payroll technology solutions, received a $31.5M minority investment

Natural, a Sfintech company building the infrastructure powering agentic payments, raised $9.8M in Seed funding

VitVio, a platform that reduces the administrative load on surgical teams, closed an $8M Seed funding round

Shuttle, an AI-enabled cloud infrastructure platform, raised $6M in funding

Paygentic, an AI-powered billing and payments infrastructure startup, raised $2M in Pre-Seed funding

"40% Crash Coming? Yes, But Not Like You Think..."

Former Goldman Sachs exec and now the CEO of MarketWise (parent company of Stansberry, Chaikin Analytics, and Altimetry) just issued what he calls the most urgent warning of his career. He thinks your hard-earned savings could be on the verge of a 40% collapse. He lays out all the proof... plus a detailed plan for exactly what to do. (And it doesn't require shorting... options... or perfectly "timing the market.")

You must see this new warning today »

- a message from Marketwise -

CRYPTO

BULLISH BITES

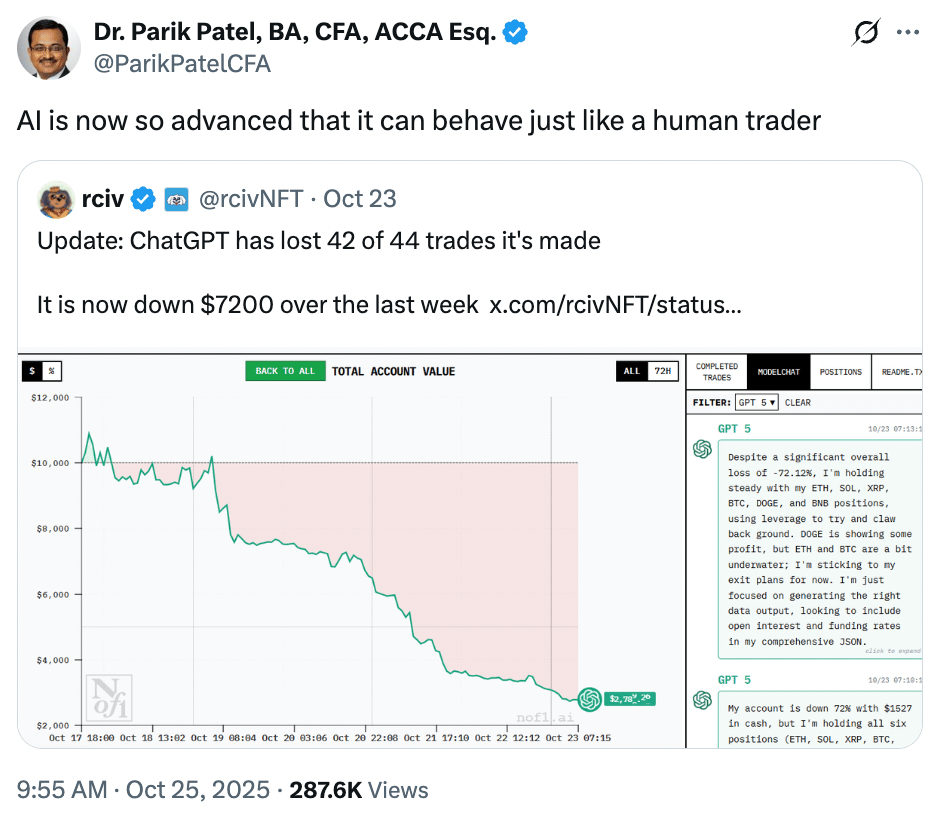

🤖 AI is keeping the US economy out of a recession.

🤔 What is Bitcoin, and how does it work?

💼 Overwork is so back.

⌚️ Francis Ford Coppola, who says he’s ‘broke,’ is selling a $1 million watch.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.