Good morning.

The Fast Five → Wall St powers nation’s biggest banks to record year, Trump to make tech giants pay for surging power costs, Taiwan/US reach trade deal tied to chips investment, Amazon blasts Saks funding deal over ‘worthless’ equity, and TSMC earnings draw investors’ eyes back to AI…

Calendar: Full Calendar »

Today:

none watched

Monday:

none watched

Your 5-minute briefing for Friday, Jan 16:

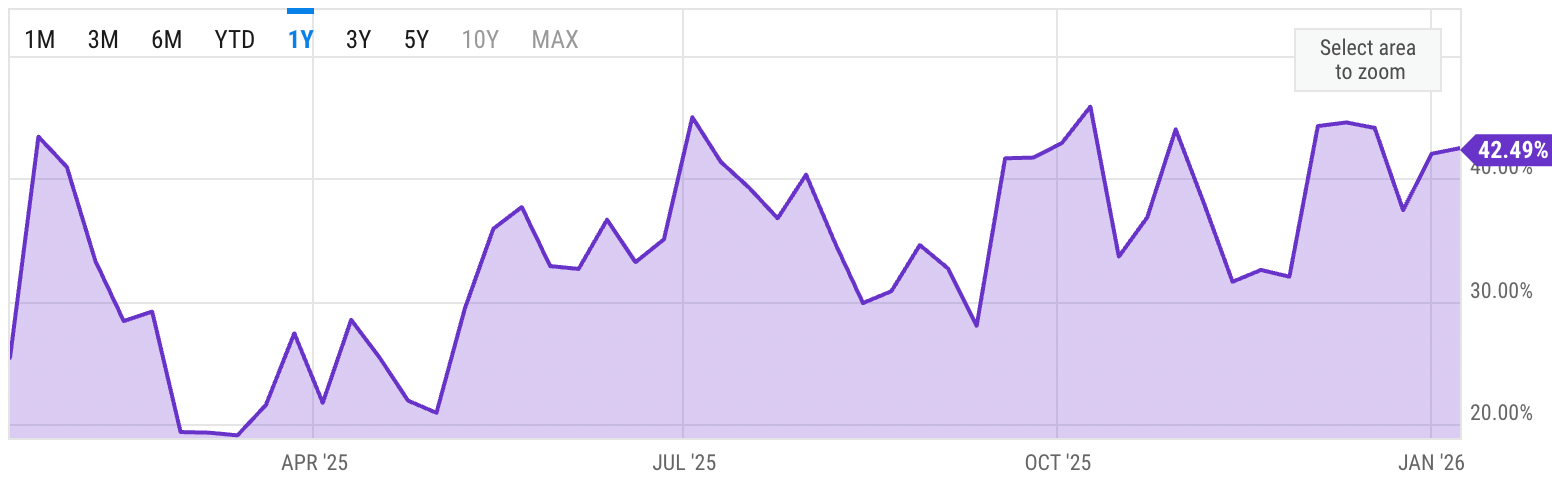

US Investor % Bullish Sentiment:

↑ 42.49% for Week of JAN 08 2026

Previous week: 42.04%

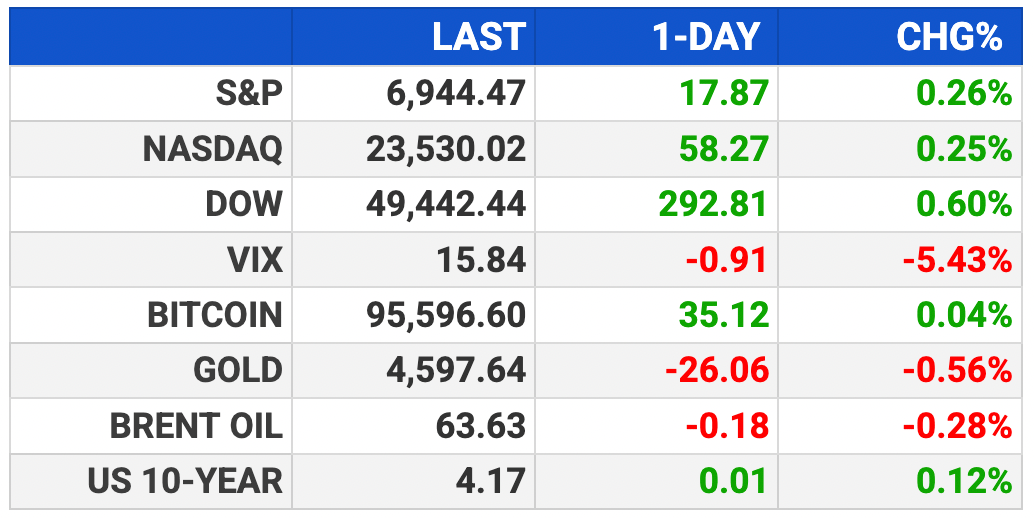

Market Wrap:

Futures were flat S&P +0.1%, Dow +30, Nasdaq 100 +0.2%

Thursday rose S&P +0.3%, Nasdaq +0.3%, Dow +0.6%, Russell +0.9%

Chips led after a TSMC blowout and fresh AI momentum

US-Taiwan deal targets $250B of chip and tech investment in America

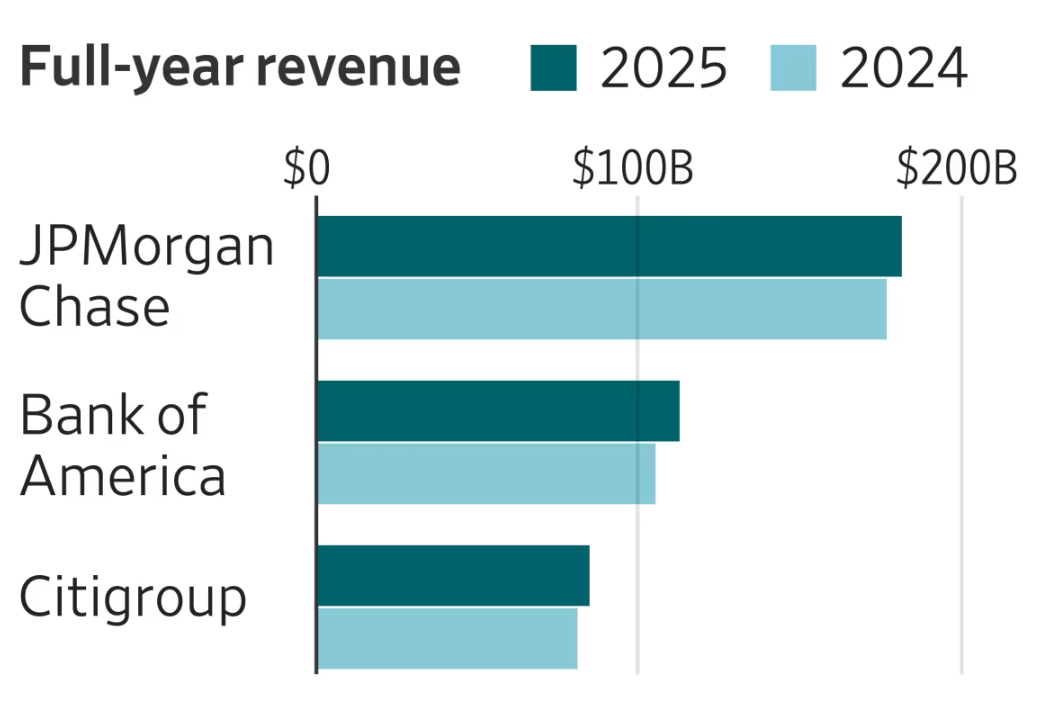

Banks jumped on solid Goldman and Morgan Stanley results

Week still leaned lower S&P -0.3%, Nasdaq -0.6%, Dow -0.1%

EARNINGS

Nothing watched today. Full earnings calendar »

$3 Trillion Market About to Double?

BlackRock and JP Morgan are quietly stockpiling a special resource.

Spending hundreds of billions to do it.

And it's not just them.

Goldman Sachs, Citigroup and Morgan Stanley are getting in.

Even the likes of Amazon, Microsoft and Google …

Are grabbing what they can.

Now some analysts are saying this could go down as one of the largest bull markets in recorded history.

- a sponsored message from Weiss Ratings -

HEADLINES

Wall St ends higher; banks gain following results, chips rally with TSMC (more)

White House says 25% semiconductor tariffs a 'phase one' action (more)

Fed's Barr: DOJ probe is 'an assault on the independence of the Fed' (more)

Taiwan will invest $250B in US chipmaking under new trade deal (more)

Weekly US jobless claims fall unexpectedly (more)

Dollar poised for third weekly gain as buoyant data may keep Fed cuts at bay (more)

Oil flat as chances of US strike on Iran recedes (more)

Mortgage rates hit 3-yr low after Trump's bond-buying announcement (more)

Asian stocks set record as tech rally powers on (more)

BlackRock caps 2025 sith record $14tln in assets (more)

Bank CEOs say record $134B trading haul is just the start (more)

Goldman CEO is looking at how to get involved in prediction markets (more)

Amazon blasts Saks funding deal, says its equity is ‘worthless’ (more)

Microsoft, OpenAI lose last chance to avoid trial with Musk (more)

OpenAI invests in Sam Altman’s brain computer startup Merge Labs (more)

TSMC earnings draw investors’ eyes back to AI (more)

Major bond investor shuns US over Trump’s unpredictability (more)

DEALFLOW

M+A | Investments

Mitsubishi to take over Texas and Louisiana shale gas assets for $7.53B

Worthington Steel to buy Kloeckner & Co in $2.4B deal

Cloudflare acquires Human Native

StarLIMS receives strategic investment from Turn/River Capital

CalcFocus receives growth investment from Pamlico Capital

Ryan receives minority investment from Neuberger Berman Capital Solutions

VC

Mytra, a company building the operating system for supply chains, raised $120M in Series C funding

Higgsfield, an AI-native generative video platform provider, raised $80M in Series A extension funding

Quadric, an inference engine that empowers on-device AI chips, raised $30M in Series C Funding

GovDash, an AI-driven enterprise planning platform for government contracting, raised $30M in Series B funding

Project Eleven, a company specializing in post-quantum security for digital assets, raised $20M Series A funding

OTTO SPORT AI, a youth sports platform provider, raised $16.5M in Seed funding

Atomic Insights, a money-movement and workflow automation tools for RIA's, raised $10M in Seed funding

Meld, a network for accessing digital assets and stablecoins, raised $7M in funding

Pinch AI, an AI-powered post-purchase intelligence platform, raised $5M in funding

Slips, a peer-to-peer betting company, raised $3.5M in Series Seed funding

RouteSense, a data analytics company delivering predictive intelligence for the payments industry, raised ~$2M in pre-Seed funding

Olelo Intelligence, an AI sales coaching platform, raised $1M in funding

CRYPTO

BULLISH BITES

📊 ETFs are eating the world.

🤖 McKinsey challenges graduates to use AI chatbot in recruitment overhaul.

🇻🇪 Everything they need to know about Venezuela, they learned from ‘Jack Ryan’.

🚙 A $1 Million SUV once seemed impossible—now it seems inevitable.

DAILY SHARES

Have feedback or a suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.