Good morning.

The Fast Five → Markets are celebrating the ceasefire, why markets are so calm, Nvidia record high is close in sight, oil tumbles for a second day, and Powell throws cold water on a rate cut in July…

Tesla's about to prove everyone wrong... again. Back in 2018, when Jeff Brown told everyone to buy Tesla…The "experts" said Elon was finished and Tesla was headed for bankruptcy. Now they're saying the same thing, but Jeff has uncovered Tesla's next breakthrough. See why Tesla's about to prove everyone wrong... again. *

Calendar: (all times ET) - Full Calendar

Today:

New home sales, 10:00A

Tomorrow:

Initial jobless claims, 8:30A

Durable-goods orders, 8:30A

Your 5-minute briefing for Wednesday, June 25:

US Investor % Bullish Sentiment:

↓ 33.21% for Week of JUN 19 2025

Previous week: 36.67%.

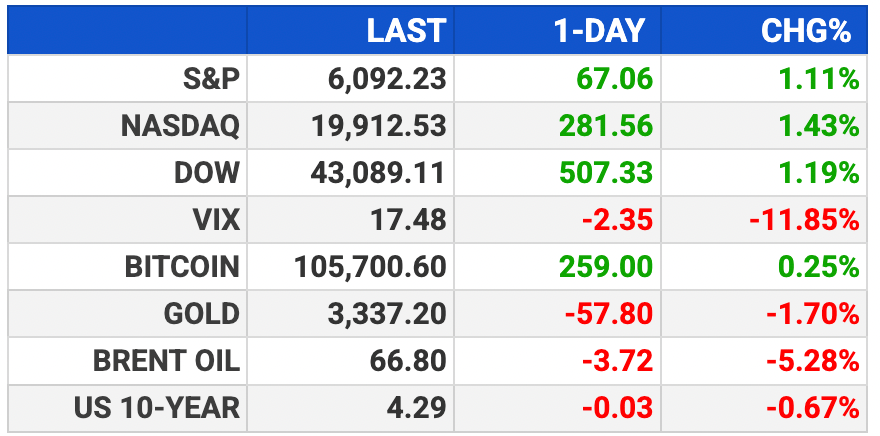

Market Wrap:

• S&P futures flat; Dow -13 pts, Nasdaq slightly higher after Tue rally

• Dow surged 500+ pts; Nasdaq 100 closed at record high, as oil plunged 6%

• Oil selloff tied to optimism around Israel-Iran ceasefire

• Powell testifies to Senate today; new home sales data due

• Earnings: General Mills, Paychex, Micron in focus

EARNINGS

Light earnings week. Here’s what we’re watching:

Today: General Mills $GIS ( ▼ 0.4% ), Jefferies $JEF ( ▲ 0.49% )

Micron Technology $GIS ( ▼ 0.4% ) - $1.59 eps (+156.4% YoY) on $8.8B revenue (+29.7% YoY)

Thursday: McCormick $MKC ( ▲ 0.02% )

Nike $NKE ( ▼ 0.32% ) - $.12 eps (a notable drop from $.99 eps earned in the year-ago period. Revenue declined 15.1% to $10.7B

“The End of Elon Musk?”

Don't make him laugh.

Jeff Brown has been hearing this same tired story for years, and he's been proven right time and time again.

And now, while the media focuses on Tesla's "demise," he's uncovered an AI breakthrough that's about to make Elon's doubters eat their words yet again.

According to his research, if you listen to the media and miss out on Elon's newest breakthrough, it's going to cost you the fortune of a lifetime.

- from Brownstone Research -

HEADLINES

Wall St rallies, S&P 500 nears record high as Middle East tensions cool (more)

Wall Street bull calls for another 10% rally in S&P 500 by end of 2025 (more)

Why markets are so calm, and what a post-nuclear Iran could offer Wall St (more)

Oil tumbles for a second day, loses 6% as ceasefire eases supply concerns (more)

Gold falls 2% as ceasefire weighs on safe-haven appeal (more)

US consumer confidence weakens on job market worries (more)

Home price hikes are slowing more than expected (more)

US current account surges to record high in first quarter (more)

Investment groups call for passive income exemption from tax bill (more)

BlackRock’s Fink backs ‘MAGA’ accounts (more)

Nvidia reaches highest levels since January, record high close in sight (more)

Cathie Wood’s Ark trims Circle stake after netting big windfall (more)

Amazon bringing same-day delivery to ‘millions’ of rural customers (more)

Mastercard forms stablecoin pacts with Paxos, PayPal, Fiserv (more)

DEALFLOW

M+A | Investments

Aledade acquires More Michigan Value‑Based Care Ops

Enzo Biochem to be acquired by Battery Ventures

Domaine acquires Code

NPHub receives $20M growth investment from Edison Partners

VC

Digital Asset, the blockchain technology company behind the Canton Network, raised $135M in funding

Waltz, a platform streamlining residential real estate financing for foreign-national investors, raised $50M in funding

Arine, an AI-driven medication intelligence company, raised $30M in Series C funding

Eventual, a company building AI infrastructure for multimodal data, raised $20M in Series A funding

Paraform, a marketplace built for elite recruiters, raised $20M in Series A funding

Delphi, a company creating AI digital minds to help people scale communication, raised $16M in Series A funding

Chronicle Studios, an entertainment studio, raised $11M in Seed funding

Skyramp, an AI-driven testing and debugging tool for engineering teams, raised $10M in Seed funding

Empo Health, a healthcare technology company, raised $7M in funding

Gemist, a jewelry-tech startup, raised $6M in seed funding

Pangram, a technology detecting text created by AI, raised $4M in Seed funding

Jobright, an AI-native job platform providing Jobright Agent, raised $3.2M in funding

CubeNexus, a Techstars-backed spatial data intelligence company, raised $650K in Pre-Seed funding

CRYPTO

BULLISH BITES

🚀 Tesla's about to prove everyone wrong... again. *

🎉 Zuckerberg "Recruiting Party" continues with $100 Million pay packages.

🧍🏻♂️ Silicon Valley’s ‘tiny team’ era is here.

😀 And the award for the happiest city in the US goes to...

🛥 This yacht rocks.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.