Good morning.

The Fast Five → Nvidia beats expectations but fails to impress, Berkshire Hathaway closes above $1 trillion market value, 401(k) millionaires reaches record high, labor union disapproval hits 57-year low, and Telegram CEO charged with allowing criminal activity…

📉 The stock market is high, but a crash is coming—here’s why »

A message from Behind The Markets

Calendar: (all times ET) - Full calendar here

Today: Initial jobless claims, 8:30 AM

Tomorrow:

PCE index, 8:30A

Consumer sentiment, 10:00AA

Your 5-minute briefing for Thursday, August 29:

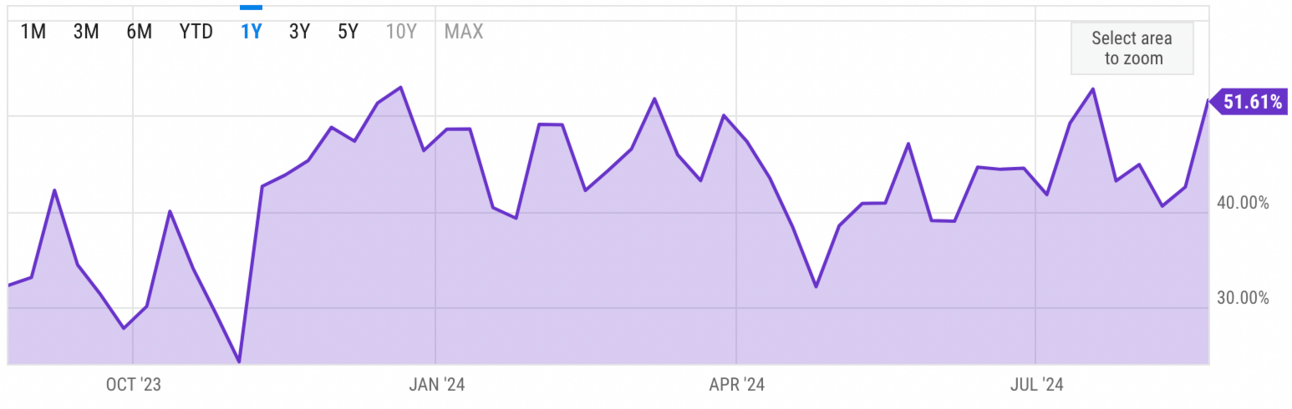

US Investor % Bullish Sentiment:

↑51.61% for Wk of August 22 2024

Last week: 42.54%. Updates every Friday.

Market Wrap:

Nasdaq futures -1.2% after Nvidia's results fall short.

Nvidia shares fell 7% despite strong earnings and guidance.

Salesforce +3.5% on strong earnings and raised outlook.

CrowdStrike -3.8% after lowered outlook despite earnings beat.

Nasdaq -1.12%, S&P -0.6%, Dow -159 points.

Nvidia now 7% of S&P 500.

July PCE price index out Friday.

EARNINGS

Here’s what we’re watching this week:

Ulta Beauty (ULTA) - earnings of $5.52 per share (-8.3% YoY) on $2.6B revenue (+4% YoY)

Full earnings calendar here.

HEADLINES

Supreme Court keeps Biden student-loan relief plan on hold (more)

SEC requires monthly reports on investment fund holdings (more)

Fed sets large bank capital levels after stress tests (more)

US cities post higher unemployment and many suffer a wage squeeze (more)

Libya's oil blockade widens as factions vie to control central bank (more)

US companies return to currency options to hedge election, macro risks (more)

401(k) millionaires reaches record high (more)

Labor union disapproval hits 57-year low (more)

Telegram CEO charged with allowing criminal activity (more)

Super Micro shares fall 19% on filing delay (more)

OpenAI in talks to raise funding that would value it at more than $100B (more)

Feuding founders of Two Sigma hedge fund step down (more)

FROM OUR PARTNER

Survive the Upcoming Stock Market Crisis

If you still haven't downloaded our brand new report: "Midnight in America"...

...Make sure to download it ASAP before this link expires.

J.P. Morgan is calling this "the most predictable crisis in history."

Very rarely will you have the opportunity to protect your wealth before the market crashes...

LIMITED TIME: Download "Midnight in America" NOW >>>

- sponsored message from Behind The Markets -

DEALFLOW

M+A | Investments

US pipeline operator ONEOK inks two deals for $5.9B (more)

Nippon Steel looks to woo US union with extra $1.3B (more)

DraftKings agrees to acquire in-game betting site Simplebet (more)

Qatar in talks on possible purchase of Rosneft stake in German refinery (more)

Indian rice exporter GRM Overseas buys stake in Rage Coffee (more)

Cantata Health Solutions, a provider of healthcare tech solutions, acquired Geisler IT Services, a solution enabling MCOs to collaborate with service providers (more)

Routeware, a provider of integrated tech solutions for the waste and recycling industry, acquired Wastech, Inc., the owner of the RUBICONSmartCity and RUBICONPro platforms (more)

VC

Cribl, a data engine company for IT, raised $319M in Series E funding, at $3.5B valuation (more)

Parry Labs, a defense tech company that develops open architecture mission solutions, closed an $80M first funding round (more)

nOps, an AI platform for businesses to manage and optimize their cloud usage on Amazon Web Services, raised $30M in Series A funding (more)

Comun, a neobank that provides modern banking solutions to US immigrants, raised $21.5M in Series A funding (more)

Space and Time, a blockchain data warehouse developer, raised $20M in Series A to funding (more)

Bland AI, a platform automating phone calls for the enterprise using hyper-realistic AI agents, raised $16M in Series A funding (more)

Aerflo, a portable carbonation device that instantly transforms still into sparkling water, raised $10M+ in venture capital (more)

Wethos AI, an AI team optimization company, raised $7.5M in Seed funding (more)

Chainbound, a startup building infrastructure and networking tools for blockchains, raised $4.6M in seed funding (more)

Pangeam, provider of a B2B SaaS workplace intelligence platform, raised $4.25M in Seed funding (more)

Ancilia Biosciences, Inc., a biotech company using CRISPR to create bacterial therapies against destructive viruses, raised $4.2M in funding (more)

Curio Digital Therapeutics Inc., a company treating postpartum depression, raised a double digit funding round (more)

CRYPTO

BULLISH BITES

📈 Free Report: How to survive upcoming stock market crisis *

💰 Welcome News: The SEC just made life a little easier for smaller VCs.

🇺🇸 Survey: The American Dream feels out of reach for most.

😎 ‘NEETs’: Why some young adults are disconnected from the job market.

🏍 Futuristic: A motorcycle straight out of The Jetsons.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.