Good morning.

The Fast Five → Market reaction to Trump's first day, Trump plans to enact 25% tariffs on Mexico, Canada, Trump to declare national energy emergency, crypto-frenzied weekend makes first family billions of dollars, and Gensler out and pro-crypto Mark Uyeda named SEC Chair…

📈 The $20 Stock Powering NVIDIA, TESLA, and Microsoft

The biggest AI firms in the world...

All rely on this single company.

And right now, you can get in for only $20 - but not for long.

Click here for the ticker »

- from Behind The Markets

Calendar: (all times ET) - Full Calendar

Today:

None scheduled

Tomorrow:

US leading economic indicators, 10:00A

Your 5-minute briefing for Tuesday, January 21:

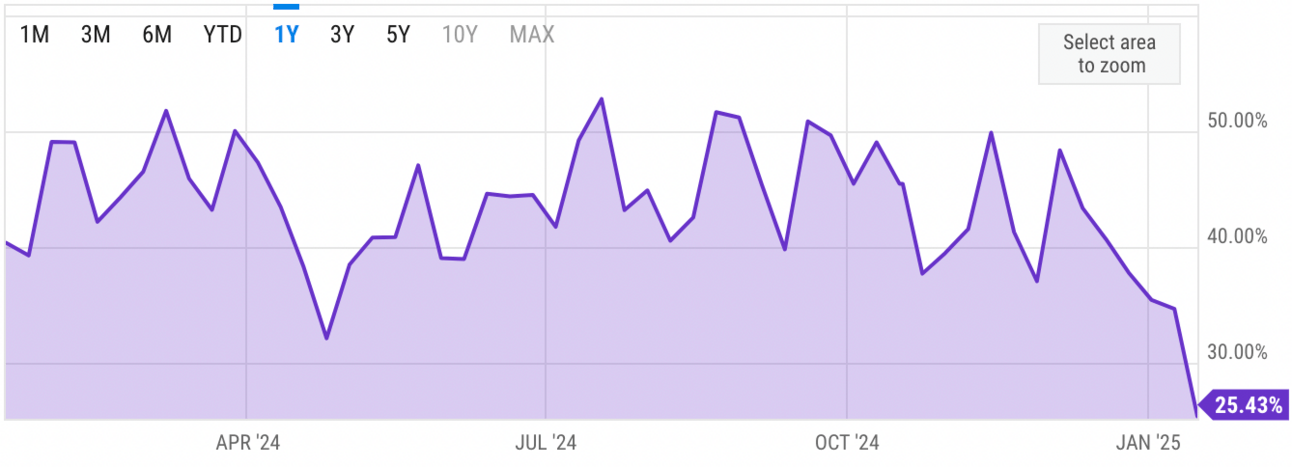

US Investor % Bullish Sentiment:

↓ 25.43% for Week of January 16 2025

Previous week: 34.67%. Updates every Friday.

Market Wrap:

Futures dipped as Trump floated 25% tariffs on Mexico, Canada.

S&P 500, Nasdaq ticked lower; Dow flat post-holiday session.

Markets rose on Trump’s swearing-in, then reversed on tariff talk.

Trump declared an energy emergency, pledged pro-business policies.

Wall Street eyes next Trump moves after last week’s market rally.

EARNINGS

Here’s what we’re watching:

Netflix (NFLX) - earnings to double on YoY basis to $4.21 per share, on $10.1B revenue (+14.8% YoY)

GE Vernova (GEV) - expected earnings of $2.37 per share on $10.7B revenue

Friday: Verizon (VZ)

American Express (AXP) - earnings of $3.05 per share (+16.4% YoY) on $17.2B revenue (+8.7% YoY)

HEADLINES

Trade, tariffs, energy - market reaction to Trump's first day (more)

Stanley Druckenmiller says ‘animal spirits’ are back in markets because of Trump with CEOs ‘giddy’ (more)

Trump to declare national energy emergency, expanding his legal options to address high costs (more)

Biden’s sweeping AI order scrapped by Trump in regulatory reset (more)

Bitcoin hits record, dollar falls on Inauguration Day (more)

China stocks, yuan cautiously firm after Trump delays tariffs (more)

Crypto-frenzied inauguration weekend makes first family billions of dollars (more)

Inauguration brings the world's billionaire elites en masse to DC (more)

TikTok restoring U.S. service after Trump provided ‘assurance’ (more)

AI mania takes over Davos as the world’s biggest firms tout their offerings (more)

Costco union representing 18,000 workers authorize nationwide strike (more)

TOGETHER WITH KLONDIKE

Is oil and gas missing from your portfolio?

With Klondike Royalties, you could gain from established oil and gas assets. Each royalty offers potential returns from real production, managed by deeply experienced operators. Add a piece of the energy sector to your portfolio.

Read the Offering information carefully before investing. It contains details of the issuer’s business, risks, charges, expenses, and other information, which should be considered before investing. Obtain a Form C and Offering Memorandum at invest.klondikeroyalties.com.

DEALFLOW

M+A | Investments

Core Sound Imaging, a medical imaging platform, received a $80M Growth investment from PSG (more)

Healthfuse, a revenue cycle vendor management company, received an investment from InTandem Capital (more)

Omega Systems, a provider of managed information tech and cybersecurity services, received an investment from Revelstoke Capital (more)

SwiftComply, a provider of water and wastewater compliance software, received an investment from M33 Growth (more)

CareGenix Solutions, a provider of virtual healthcare services, received a growth funding package from Decathlon Capital Partners (more)

VC

Stoke Space, a company building a reusable medium-lift rocket, raised $260M in Funding (more)

Instabase, an applied AI solution for unstructured data, raised $100M in Series D funding (more)

Umoja Biopharma, a clinical-stage company specializing in vivo cell therapies, raised $100M Series C financing (more)

Quantifind, an AI-powered financial crime intelligence company, raised $22M in funding (more)

Leap, a platform for physical retail, raised $20M in funding (more)

Pipe17, an AI-powered composable order operations, raised $15.5M in funding (more)

Coram AI, a LLM-powered video security company, raised $13.8M in Series A funding (more)

IntusCare, a provider of predictive analytics solutions for geriatric care, raised $11.5M in follow-on financing (more)

Nilus, a proactive AI-powered treasury management platform, raised $10M in funding (more)

Teal Health, a women's health company, raised $10M in Seed funding (more)

CRYPTO

The crypto world is already mad at Trump (more)

Trump's crypto-frenzied inauguration weekend makes first family billions of dollars richer (more)

Bitcoin fades from highs after no crypto mentions during Trump's inauguration speech (more)

Bitcoin reserve clamor among US states risks being no more than just noise (more)

BULLISH BITES

🇺🇸 Trump casts shadow on Davos.

💰 Manhattan trophy offices are suddenly back in vogue.

🚁 Critics really like the second season of "Severance."

🍩 Why wealthy men love these $1,000 pants that feel ‘like pajamas’.

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.