Good morning.

The Fast Five → Trump announces $500 billion AI infrastructure investment, SEC launches Crypto Task Force, Trump token plummets, BofA CEO says financial industry will jump into crypto payments if allowed, and Trump stirs tariff pot with fresh threats on EU and China…

📈 America’s Next AI Energy Solution Superstar »

- from Weiss Research

Calendar: (all times ET) - Full Calendar

Today:

US leading economic indicators, 10:00A

Tomorrow:

Initial jobless claims, 8:30A

Your 5-minute briefing for Wednesday, January 22:

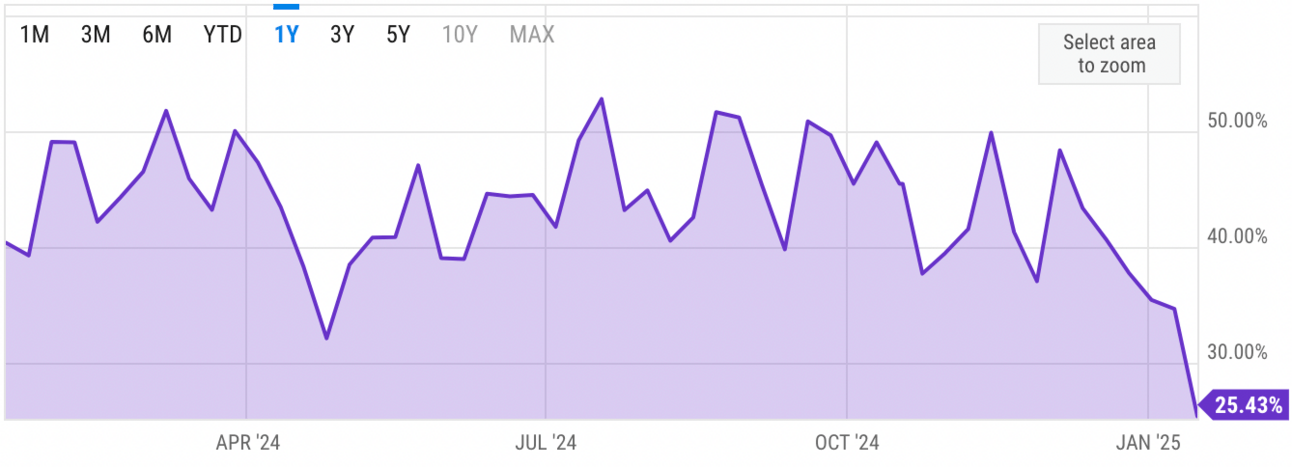

US Investor % Bullish Sentiment:

↓ 25.43% for Week of January 16 2025

Previous week: 34.67%. Updates every Friday.

Market Wrap:

S&P +0.2%, Nasdaq +0.5%, Dow flat after strong post-Inauguration rally.

Trump eyes 10% China tariff by Feb. 1; markets cautious.

Trump unveils $500B AI venture with OpenAI, Oracle, Softbank. Oracle +4% after hours.

Netflix +14% on 300M subs. United Airlines +3% on strong earnings.

Earnings ahead: P&G, J&J, Halliburton, GE Vernova.

EARNINGS

Here’s what we’re watching:

GE Vernova (GEV) - expected earnings of $2.37 per share on $10.7B revenue

Friday: Verizon (VZ)

American Express (AXP) - earnings of $3.05 per share (+16.4% YoY) on $17.2B revenue (+8.7% YoY)

HEADLINES

Trump's first day in office gets mixed reception from US stocks (more)

Trump stirs tariff pot with fresh threats on EU, Feb 1 China deadline (more)

US fiscal path unsustainable despite improved budget forecasts (more)

Ray Dalio says cutting budget deficit is crucial to stabilize the bond market (more)

Dollar drifts lower as traders ponder tariff plans (more)

Gold jumps to 11-week peak amid Trump policy uncertainty, soft dollar (more)

Space stocks surge with ‘broad excitement’ about sector (more)

Trump token plunges, bitcoin pulls back from inauguration day record of $109K (more)

Trump memecoin frenzy spawns ETF bid in test of SEC boundaries (more)

BofA CEO says financial industry will jump into crypto payments if allowed (more)

Goldman picks leaders to run Wall Street engines in revamp (more)

Eric Schmidt’s family office invests in 22 AI startups (more)

Trump pardons Silk Road creator Ross Ulbricht (more)

TOGETHER WITH MASTERWORKS

Billionaires wanted it, but 66,737 everyday investors got it first… and profited

When incredibly rare and valuable assets come up for sale, it's typically the wealthiest people that end up taking home an amazing investment. But not always…

One platform is taking on the billionaires at their own game, buying up and offering shares of some of history’s most prized blue-chip artworks for its investors. In just the last few years, those investors realized representative annualized net returns like +17.6%, +17.8% and +21.5% (among assets held 1+ year).

It's called Masterworks. Their nearly $1 billion collection includes works by greats like Banksy, Picasso, and Warhol, all of which are collectively invested in by everyday investors. When Masterworks sells a painting – like the 23 it's already sold – investors reap their portion of any profits.

It's easy to get started, but offerings can sell out in minutes.

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

DEALFLOW

M+A | Investments

Blackstone to buy NYC’s Kimpton Hotel Eventi for $175M (more)

Mobile-office giant Willscot fielding private equity interest (more)

Generali, BPCE agree to join forces in 'very ambitious' asset management deal (more)

Redwire Corporation, a company specializing in space (more)

BP Environmental Services, a commercial waste and jobsite services company, received an investment from Firmament (more)

Precog, a company specializing in AI-driven ETL solutions, received an investment from Venture Guides (more)

Evertrak, a manufacturer of composite railroad ties for the North American railroad industry, received a strategic investment from Sumitomo (more)

VC

Render, a cloud application platform, raised $80M in Series C funding (more)

Mitiga, a Cloud and SaaS security startup, raised $30M in Series B Funding (more)

LeapXpert, a responsible business communication company, raised $20M in Series B funding (more)

Men in Blazers Media Network, a soccer media network, raised $15M in Series A funding (more)

Gravity, an enterprise carbon accounting and energy management platform, raised $13M in Series A funding (more)

Belfry, a platform for physical security providers, raised $12M in Series A funding (more)

MoneyHash, a payment orchestration platform operating in the Middle East and Africa, raised $5.2M in Pre-A funding (more)

StepChange Labs, a provider of a tech monitoring platform, raised $4M in seed funding (more)

BPR Hub, a cloud-based compliance management system for manufacturing companies, raised $2.6M in Seed funding (more)

r4, a defense tech solution that simplifies the procurement and management of non-production software licenses, raised $1M in Seed funding (more)

NovoLINC, a thermal tech startup spun out of Carnegie Mellon University, raised an undisclosed amount in Seed funding (more)

FileCloud, a provider of secure content collaboration solutions, received a growth investment from Level Structured Capital (more)

MoxiWorks, a real estate sales and marketing software provider, raised an undisclosed amount in additional capital (more)

🚀 Our No. 1 Way to Profit from Crypto Boom (under $1) »

- from Stansberry Research

CRYPTO

BULLISH BITES

🤖 Scale AI CEO to Trump: ‘America must win the AI war’.

🇺🇸 Trump pardons Silk Road creator Ross Ulbricht.

🤝 Startup founders flooded inauguration parties hopeful for dealmaking.

🍾 Champagne sales sink because people don’t want to celebrate.

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.