Good morning.

The Fast Five → Oil prices are now the stock market's biggest driver, Powell headed for congressional grilling, Tesla stock pops 9% on robotaxi launch, Circle stock extends rally for 3rd day, and Nvidia CEO Huang begins selling shares under $865M plan…

World War III won't start with boots on the ground. It'll start with bots. And Elon Musk's new AI firm could play a big part of it. One little-known company could end up being the backbone of his entire operation. And its stock is still 15X smaller than NVIDIA's. Get our #1 AI stock for 2025 » *

Calendar: (all times ET) - Full Calendar

Today:

Consumer confidence, 10:00A

Powell testifies to House Financial Services Committee, 10:00A

Tomorrow:

New home sales, 10:00A

Your 5-minute briefing for Tuesday, June 24:

US Investor % Bullish Sentiment:

↓ 33.21% for Week of JUN 19 2025

Previous week: 36.67%.

Market Wrap:

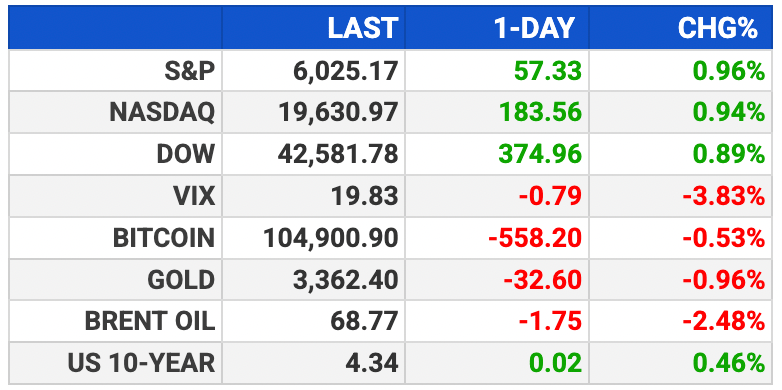

• Dow futures +185 pts (+0.4%); S&P +0.5%, Nasdaq +0.7%

• Dow surged 375 pts Monday; S&P +0.96%, Nasdaq +0.94%

• Trump announces ceasefire timeline for Israel-Iran conflict

• Brent and WTI crude drop 3%+ in extended trading

• No casualties from Iran’s intercepted strike on US base

• Powell testifies today amid growing White House pressure to cut rates

EARNINGS

Light earnings week. Here’s what we’re watching:

Today:

FedEx $FDX ( ▲ 1.39% ) - $5.85 eps (+8.1% YoY), on $21.8B revenue (-1.3% YoY)

Wednesday: General Mills $GIS ( ▼ 0.4% ), Jefferies $JEF ( ▲ 0.49% )

Micron Technology $GIS ( ▼ 0.4% ) - $1.59 eps (+156.4% YoY) on $8.8B revenue (+29.7% YoY)

Thursday: McCormick $MKC ( ▲ 0.02% )

Nike $NKE ( ▼ 0.32% ) - $.12 eps (a notable drop from $.99 eps earned in the year-ago period. Revenue declined 15.1% to $10.7B

91 Hedge Funds are Betting on This $3 AI Stock

With the Iran-Israel war raging... global markets are on edge.

But while most investors panic... the same money is preparing to profit.

Because Elon Musk's new AI startup could soon become a critical asset in national defense.

AI technology is being used to develop autonomous military vehicles, surveillance tools, and strategic threat response systems.

And one tiny company could be the biggest winner of all.

That's why 19 billionaires and 91 hedge funds have piled in.

HEADLINES

Wall St rallies as rate cut hopes outweigh Middle East turmoil (more)

Fed's Bowman open to cutting rates at July policy meeting (more)

Oil tanks as Iran's attack on Qatar base spares key energy assets (more)

Trump confronts potential for high oil prices after strikes (more)

US business activity moderates; inflation pressures building up (more)

May home sales increase very slightly, but prices hit another record high (more)

Big banks might get one of biggest regulatory rollbacks since 2008 (more)

Nvidia CEO Huang begins selling shares under $865 mln plan (more)

Tesla stock pops 9% as Musk touts ‘successful’ robotaxi Austin launch (more)

Circle stock extends rally for 3rd day as stablecoin momentum grows (more)

Hims & Hers stock drops more than 30% after Novo Nordisk breakup (more)

Super Micro shares fall on planned $2 billion convertible debt offering (more)

Trump Media approves $400 million stock buyback (more)

Chewy backer BC Partners seeks to raise $1 billion in block (more)

Goldman Sachs launches AI assistant firmwide (more)

DEALFLOW

M+A | Investments

FTC clears $13.5B Omnicom–Interpublic ad merger with conditions

Spectris snubs KKR for $5.9 billion Advent buyout

ProCap BTC SPAC merger launches Bitcoin treasury firm

VC

Spinwheel, a consumer credit ecosystem company, raised $30M in Series A funding

Snowcap Compute, a superconducting-computing startup, raised $23M in Seed funding

Qualytics, an enterprise data-quality platform, raised $10M in Series A funding

Meridian, an AI-powered deal-management platform, raised $7M in Seed funding

Stackup, a digital asset management platform for crypto operations, raised $4.2M in Seed funding

YieldClub, a mobile crypto savings app, raised $2.5M in pre-Seed funding

CRYPTO

BULLISH BITES

📈 Why billionaires are quietly buying this AI defense stock. *

🤖 OpenAI’s first AI device with Jony Ive won’t be a wearable.

🤑 Young investor demand for alternative assets is reshaping Wall Street's playbook.

📱 Who wants a BlackBerry? Apparently, Gen Z.

🎮 Noted venture capitalist Brad Feld's new game mixes dinosaurs with Asteroids. (Any yes, he built this game himself!)

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.