Good morning.

The Fast Five → Government shutdown live updates, unpleasant news appears to be making investors cheery, prediction markets see shutdown lasting nearly two weeks, gold rallies to record high, and Musk becomes first person to hit $500B net worth…

📌 GOLD ALERT: Extraordinary Upside in ONE Stock (Not a Miner) — Gold has hit all-time highs, breaking $3,800 an ounce - but history shows it could be on the verge of its biggest bull run in over half a century... triggered by a likely major event, eerily similar to what happened in the 1970s. (It's NOT inflation or anything you're likely expecting.) Now, a top analyst says you can capture ALL of the upside without touching a risky miner or a boring ETF. He sees extraordinary potential gains long term with very little risk. See this immediately » ( ad)

Calendar: (all times ET) - Full Calendar

Today:

Unemployment Claims, 8:30A

Tomorrow:

Average Hourly Wages, 8:30A

Unemployment Report, 8:30A

Unemployment Rate, 8:30AA

Your 5-minute briefing for Thursday, Oct 2:

US Investor % Bullish Sentiment:

↑ 41.73% for Week of SEP 25 2025

Previous week: 41.67%

Market Wrap:

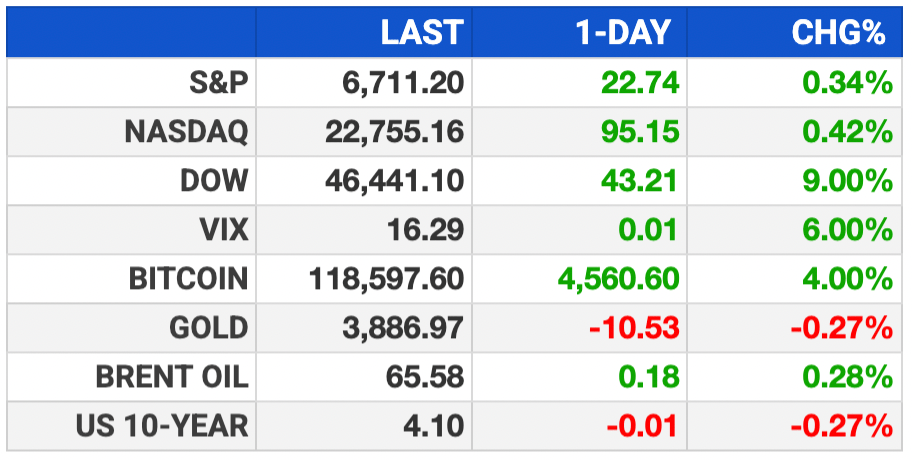

Futures flat: Dow -20, S&P -0.05%, Nasdaq -0.05%.

Major indexes rose Wed; S&P hit record, Nasdaq +0.4%.

Shutdown began Tue; lawmakers still deadlocked.

Senate out Thu; next vote Fri. Bettors see ~2 weeks.

Shutdown risks: Trump threats, data blackout delays jobs report.

Fed seen cutting Oct 29 after weak ADP payrolls.

S&P +3% in Sept vs avg -4.2% last 5 yrs.

EARNINGS

None watched today. Full calendar here »

The Best Case for Gold, Ever—

Gold has shattered records, soaring past $3,800 an ounce...

His research shows it could be triggered by a major event, eerily similar to what happened in the 1970s.

It's NOT inflation, fed rate cut expectations, escalating geopolitical tensions, or anything you're likely expecting.

And Doc believes you must own shares of his top gold stock.

He says you could 10x your money without touching a risky miner or a boring exchange-traded fund.

It's the centerpiece of Doc's full gameplan for this wild market, with extraordinary upside potential. Click here for the full details on this developing gold story.

-Matt Weinschenk

Director of Research, Stansberry Research

HEADLINES

Dow, S&P 500 notch records as Wall Street shrugs at shutdown (more)

US lost 32,000 jobs in September, says payroll processor (more)

Prediction markets see government shutdown lasting nearly two weeks (more)

Gold rallies to record high amid US government shutdown (more)

US gov’t takes 5% stake in Lithium Americas and joint venture with GM (more)

We’ve reached the stage of the bull market that Buffett warned about (more)

US Pfizer deal powers health stocks as drugmakers court Trump (more)

Musk becomes first person to hit $500B net worth (more)

Samsung, SK Hynix market value jumps $37B after OpenAI chip deal (more)

Intel in early talks to add AMD as foundry customer (more)

Amazon launches ‘price-conscious’ grocery brand with products under $5 (more)

Apple halts Vision Pro overhaul to focus on AI glasses (more)

Peloton goes all in on AI in product relaunch (more)

Insurance founders become billionaires in risky Florida market (more)

Flood insurer Neptune raises $368 million in IPO (more)

DEALFLOW

M+A | Investments

BlackRock’s GIP nears $38B takeover of utility group AES

Yahoo nears deal to sell AOL to Italy’s Bending Spoons for $1.4B

VC

Karuna Therapeutics, a clinical neuroscience company, raised $150M in Series D financing

Empower Semiconductor, a company specializing in powering AI-class processors, raised over $140M in Series D financing

Scopely, a mobile games company, raised $60M in funding

Phaidra, a company building AI agents for AI factories, raised more than $50M in Series B funding

Returnalyze, a retail AI-powered Returns Prevention Platform provider, raised a $6M Series A1 funding

Loci, a semantic search startup focused on natural language to data mapping, raised $5M in Seed funding

SolidCore.ai, a risk identification company, raised $4M in Seed funding

Hupside, an original intelligence platform, raised $1.7M in Pre-Seed funding

CRYPTO

Bitcoin regains $117K level as fresh economic data flags weak growth (more)

Crypto stockpiling craze cools after red-hot summer (more)

US Senate hearing on crypto taxes reveals headaches for both industry, IRS (more)

Circle expands $635M tokenized treasury fund to Solana amid RWA growth (more)

Bullish launches in 20 US states after winning NY licenses (more)

BULLISH BITES

🎃 Why October will be more treat than trick for investors.

😔 Why Americans are down on the economy.

📊 We in the economics profession need to look ourselves in the mirror.

🤔 What happens to Social Security payments during a shutdown?

⌚️ Rolliefest 2025, the “Met Gala of watches.”

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.