Good morning.

The Fast Five → Elon Musk’s SpaceX acquires xAI ahead of mega IPO, Trump cuts India tariffs in deal, stocks jump to kick off February, Strategy is unraveling, and gold and silver rebound after historic wipeout…

📌 IPO of the Decade? How to claim your stake in SpaceX with $500 » (ad)

Calendar: Full Calendar »

Today:

JOLTS Job Openings, 10:00A

Tomorrow:

Non-Farm Employment, 8:15A

ISM Services PMI, 10:00A

Your 5-minute briefing for Tuesday, Feb 3:

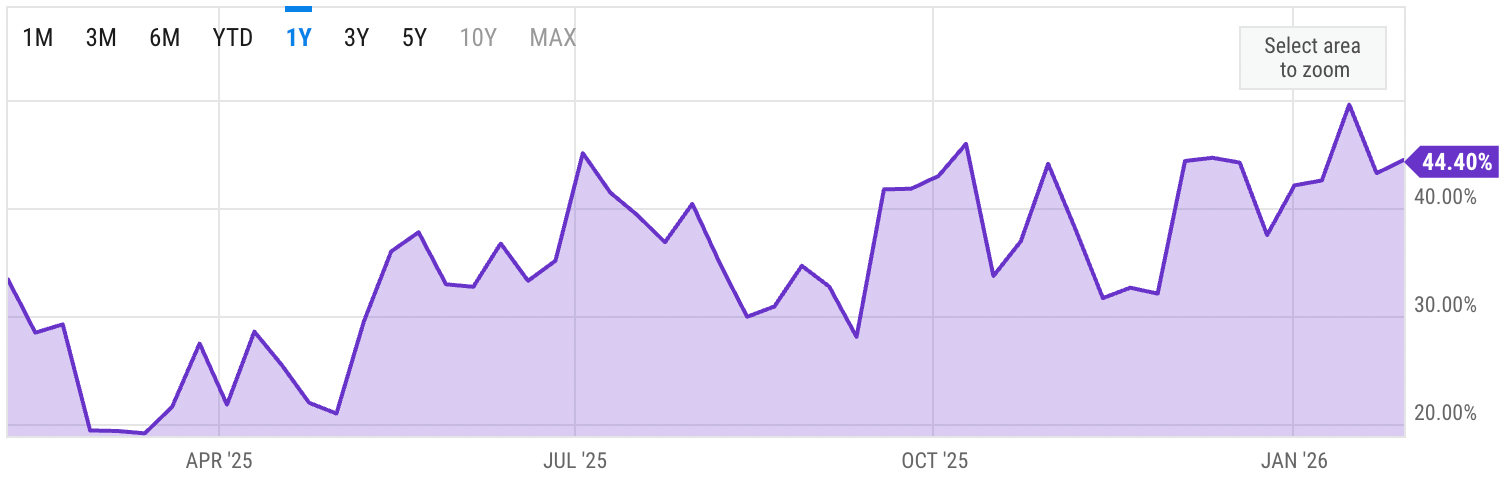

US Investor % Bullish Sentiment:

↓ 44.40% for Week of JAN 29 2026

Previous week: 49.50%

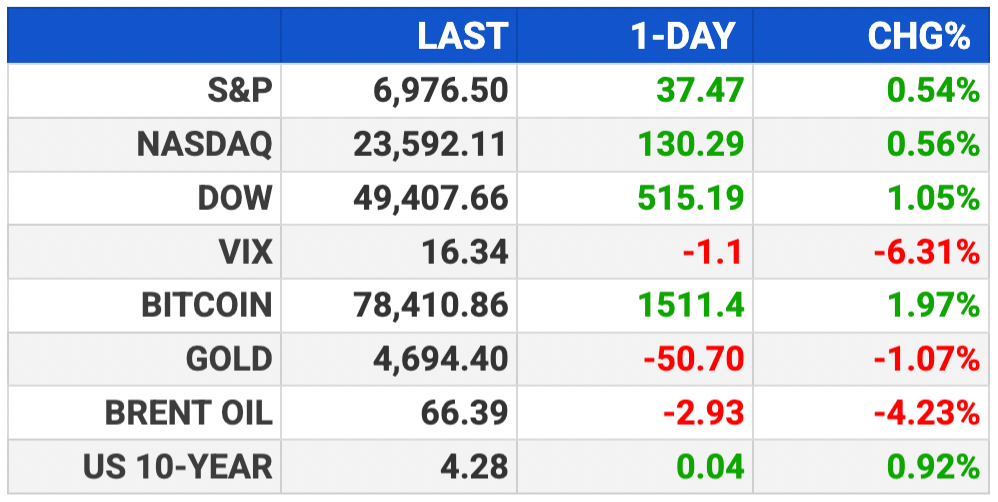

Market Wrap:

Futures rose S&P +0.2%, Nasdaq +0.4%, Dow +11

Monday rallied Dow +515, S&P +0.5%, Nasdaq +0.6%

Palantir +6% and Teradyne +20% after strong outlooks

Nvidia fell 3% as OpenAI investment plans faced doubts

Bitcoin hit its lowest since April and metals stayed weak

This week has 100+ S&P earnings with AMD, Pfizer, Amazon, Alphabet

EARNINGS

Here’s what we’re watching this week:

Today: Chipotle CMG, *PayPal $PYPL ( ▲ 5.76% ), *PepsiCo $PEP ( ▲ 2.05% ), *Pfizer $PFE ( ▲ 1.54% )

WED: *AbbVie $ABBV ( ▲ 2.08% ), *Eli Lilly $LLY ( ▲ 4.86% ), *Uber $UBER ( ▼ 4.25% ), *Yum! Brands $YUM ( ▲ 1.91% )

Alphabet $GOOGL ( ▼ 1.11% ) - $2.64 eps (+22.8% YoY) on $111.5B revenue (+15.5% YoY)

THU: *Estee Lauder $EL ( ▼ 1.06% ), *KKR $KKR ( ▼ 8.89% ), *Peloton $PTON ( ▼ 6.35% ), *Roblox $RBLX ( ▲ 0.69% ), Strategy $MSTR ( ▼ 5.6% ), *Tapestry $TPR ( ▼ 2.62% )

Amazon $AMZN ( ▼ 2.3% ) - eps of $1.95 (+4.8% YoY) on $211.2B revenue (+12.5% YoY)

Elon Musk's New Device Could Launch Biggest IPO of the Decade

Many folks who’ve used it are raving online, calling it…

“A game-changer”... an “amazing product”... and “amazing technology.”

Even the White House installed this tech recently.

Legendary tech investor Jeff Brown predicts this technology is going to help Elon build his next trillion-dollar business…

Launch the biggest IPO of the decade... and make a lot of people rich in the process.

- a sponsored message from Brownstone Research -

HEADLINES

Stocks jump to kick off February (more)

Commodity markets face fresh volatility (more)

Friday’s jobs report delayed due to partial government shutdown (more)

Gold and silver rebound after historic wipeout (more)

Metals traders lose at least $144M as ‘hat’ flees China (more)

Oil plunges as Iran risks ease and commodities selloff deepens (more)

The first big oil and gas deal of 2026 just happened (more)

Disney beats Wall Street expectations (more)

Palantir jumps after stronger-than-expected sales outlook (more)

Tesla, US automakers under threat by Chinese joint ventures (more)

The crypto-hoarding Strategy is unraveling (more)

Vanguard drops average fee to just 0.06% with latest cuts (more)

OpenAI launches Codex app to gain ground in AI coding race (more)

Anthropic joins the AI rush into Formula 1 (more)

DEALFLOW

M+A | Investments

SpaceX acquires xAI as Musk looks to unify AI and space ambitions

ESAB to acquire Eddyfi Technologies for $1.45B

Arcesium acquires Limina

Devon, Coterra will merge to create $58B US shale giant

Knexus receives majority investment from DC Capital Partners

The Forge Companies receives investment from TA Associates

Epikast receives investment from Kos

MCCi receives investment from Incline Equity Partners

VC

Waymo valued at $126B in latest $16B funding round

VulcanForms, an integrated digital metal manufacturing platform, raised $220M in new funding

Varo Bank, an all-digital nationally chartered bank in the US, raised $123.9M in Series G funding

Fieldguide, an agentic AI-native platform for audit and advisory, raised $75M in Series C funding

GrubMarket, an AI-powered tech enabler for the American food supply chain industry, raised $50M in Series H funding

Poetiq, an AI system for LLMs optimization, raised $45.8M in Seed funding

Prometheum, a digital assets market infrastructure, raised add’l $23M in funding

Linq, a communication layer for AI agents, raised $20M in Series A funding

Plug, a marketplace built for buying and selling electric vehicles, raised $20M in Series A funding

Prenosis, a biology-based tech company for integrated diagnostics and therapeutics, raised $20M in Series A funding

PranaX Corporation, a biotech company focused on regenerative biologics, raised $17M in Series A funding

Loop AI, an enterprise AI platform for the restaurant and retail back office, raised $14M in Series A funding

When, a workforce transitions platform, raised $10.2M in Series A funding

Breezy, an AI OS built for residential real estate professionals, raised $10M in Pre-Seed funding

CloudForge, an AI sales and procurement platform, raised $3.95M in funding

Branded Realities Inc., a developer of AR and AI fan engagement experiences, raised $1.6M in Seed funding

BizTrip AI, an AI-powered travel management technology, raised $1.5M in Pre-Seed funding

Zettabyte, a developer of AI computing and GPU infrastructure software, raised funding of undisclosed amount

CRYPTO

BULLISH BITES

🤡 Want to feel dumb? Try picking stocks.

📉 Why even a hint of ‘Sell America’ rattles global markets.

🤠 AI comes to rodeo, setting up a cowboy culture clash.

🥜 '“Peanut Butter Raises” are on the rise.

DAILY SHARES

Have feedback or a suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.