Good morning.

The Fast Five → Trump: Japan trade deal reached, meme stock fever is spreading like it’s 2021, Bezos meets Trump at White House, GM profit shrinks after $1.1 billion tariff hit, and SpaceX warns investors Musk could return to politics…

Calendar: (all times ET) - Full Calendar

Today:

Existing home sales, 10:00A

Tomorrow:

Initial jobless claims, 8:30A New home sales, 10:00A

Your 5-minute briefing for Wednesday, July 23:

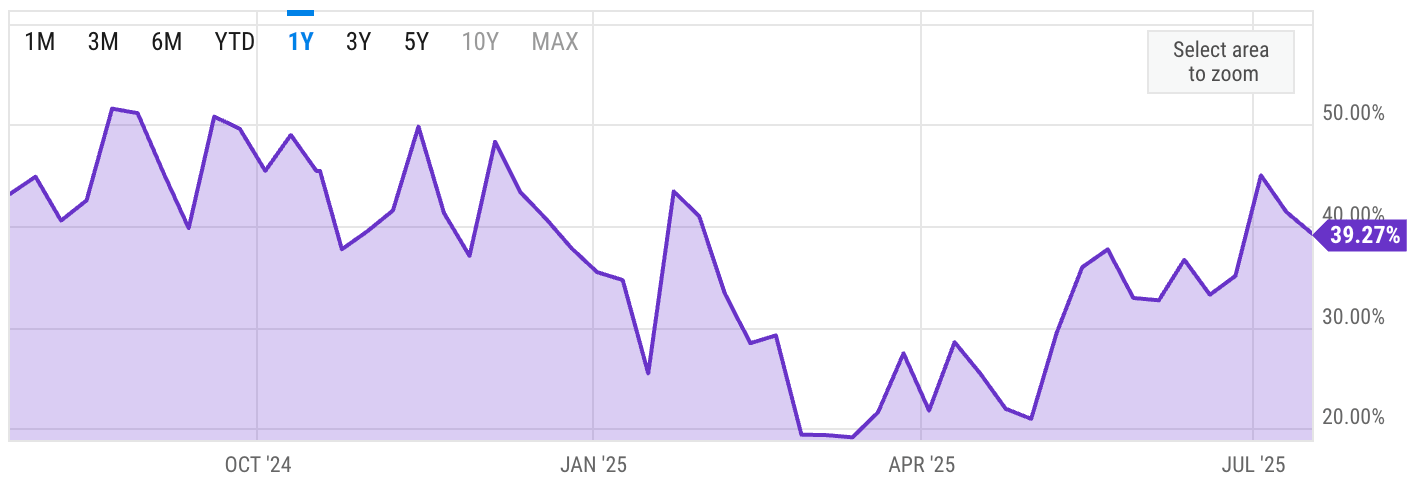

US Investor % Bullish Sentiment:

↓ 39.27% for Week of JUL 17 2025

Previous week: 41.38%

Market Wrap:

Futures steady: Dow +46pts (0.1%), S&P flat, Nasdaq -0.1%

S&P notches 11th record close of 2025

Dow up 180 pts; Nasdaq lags as chip stocks slip

Chipotle & Mattel (PM) on deck

85% of S&P 500 earnings so far have topped estimates

Existing home sales report due this morning

EARNINGS

Here’s what we’re watching this week:

Today: AT&T $T ( ▲ 0.36% ), Chipotle $CMG ( ▼ 1.13% ), Mattel $MAT ( ▼ 0.06% ), T-Mobile $TMUS ( ▲ 0.07% )

Alphabet $GOOGL ( ▲ 4.01% ) - $2.17 eps (+14.8% YoY) on $93.7B revenue (+10.6% YoY)

Tesla $TSLA ( ▲ 0.03% ) - $.44 eps (-15.4% YoY) on $22.7B revenue (-11% YoY)

THU: American Airlines $AAL ( ▲ 1.8% ), Blackstone $BX ( ▼ 3.57% ), Honeywell $HON ( ▲ 1.33% ), Union Pacific $UNP ( ▲ 1.19% )

Buffett Tells Trustee to Put 90% of Money in This One Stock?

In a surprising move, Warren Buffett (the world’s greatest investor, whose firm returned more than 5,000,000% gains), has instructed his trustee to put 90% of his personal money into one stock investment.

Buffett says regular folks should be in this stock, too.

A CPA and member of the Global CFA Institute explains how to use this stock to optimize your holdings.

-Joel Litman

Chief Investment Strategist, Altimetry

HEADLINES

S&P 500 ekes out record close as traders react to latest earnings (more)

US Treasuries gain for fifth day as Bessent supports Powell (more)

Trump announces trade deals with the Philippines, Indonesia (more)

US companies, consumers are paying for Trump's tariffs (more)

US considering removing tax on capital gains on home sales (more)

UN head calls for more green energy projects, fearing AI capacity limits (more)

Trump met with Amazon’s Jeff Bezos at the White House last week (more)

SpaceX warns investors Elon Musk could return to US politics (more)

GM profit shrinks after $1.1 billion tariff hit (more)

Lockheed profit dives 80% on $1.6 billion charge (more)

Stargate advances with 4.5 GW partnership with Oracle (more)

Microsoft poaches more Google DeepMind AI talent as it beefs up Copilot (more)

Amazon to buy startup focused on AI wearables (more)

TOGETHER WITH TIMEPLAST

“Big Plastic” Hates Them

From water bottles to shrink wrap, Timeplast has a $1.3T market opportunity with its patented plastic that dissolves in water. But the clock is ticking to invest. You have until midnight, July 31 to become a Timeplast shareholder as they expand globally.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

DEALFLOW

M+A | Investments

Amazon to acquire Bee – AI wearable startup

Billionaire Ortega buys stake in UK's PD Ports from Brookfield

Lumotive receives investment from Amazon and ITHCA

VC

AbsoluteCare, a company specializing in value‑based integrated health care, raised $135M in equity financing

Yieldstreet, a private markets investment platform, raised $77M in new capital

xLight, a company building lasers for the semiconductor industry, raised $40M in Series B funding

Phlow, a pharmaceutical contract development and manufacturing organization (CDMO), raised $37M in Series C funding

BetterComp, a provider of compensation management software, raised $33M in Series A funding

Delve, an AI agents company, raised $32M in Series A funding

Composio, a learning infrastructure using AI Agents, raised $25M in Series A funding

Asylon, Inc., a provider of robotic perimeter security technology, raised $24M in Series B funding

ValGenesis, a company specializing in digital validation lifecycle management, raised $16M funding

Poseidon, a full-stack decentralized data layer built for AI training workflows, raised $15M in Seed funding

Cooler Heads, a medical device company, raised $11M in Series A funding

Nevoya, an electric trucking carrier, raised $9.3M in Seed financing

ShelterZoom, a document security and digital ownership technology company, raised $6M in funding

CandorIQ, an AI-powered platform for compensation and headcount planning, raised $4.8M in Seed funding

Glīd Technologies, a company pioneering autonomous road-to-rail solutions within the first mile, raised $3.1M in Pre-Seed funding

CRYPTO

BULLISH BITES

🥊 What Trump’s feud with Jerome Powell is really about.

🤖 OpenAI CEO Sam Altman warns of an AI ‘fraud crisis’.

🛍 How dupes turned online shopping upside down.

👞 A men’s guide to the best classic loafers.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.