☕️ Good Morning.

Most Fed officials agreed to skip June hike - minutes show, meet Meta’s new Twitter competitor, Soros Foundation cuts 40% of staff 1 month after empires handed over to son, Goldman Sachs loses top M&A ranking for the first time in 5 years, and SVB to sell investment bank back to founder for $100M…

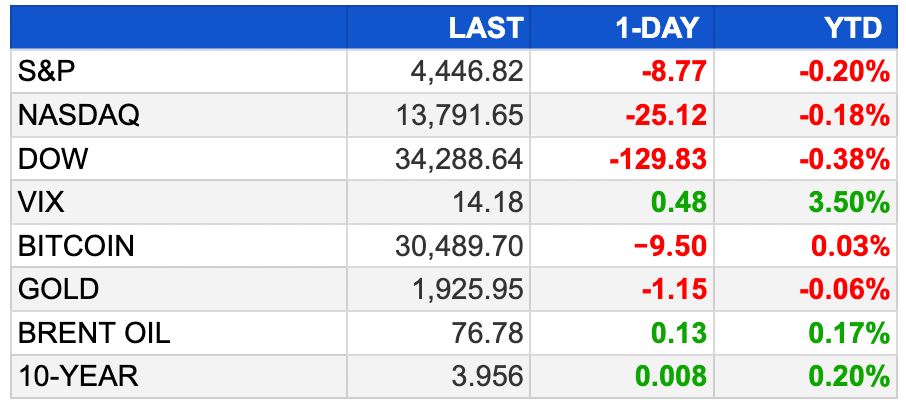

Here’s your market briefing for today:

BEFORE THE OPEN

As of market close 7/5/2023.

Markets:

Stock futures largely unchanged after Wall Street's losing session…

Dow futures down 27 points (0.08%); S&P 500 and Nasdaq-100 futures remained flat.

JetBlue shares dipped in extended trading after ending northeast U.S. partnership with American Airlines; focuses on Spirit Airlines instead.

Wall Street resumed trading after Fourth of July break, recording modest losses; Dow lost 129.83 points (0.38%), S&P 500 dipped 0.2%; both snapped three-day win streaks; Nasdaq down 0.18%.

Fed's June meeting minutes reveal majority support for more rate increases; no hike this round.

Traders predict an almost 89% chance of rate hike this month according to CME Group’s FedWatch tool.

Short trading week continues Thursday with fresh economic data including ADP private payrolls data, initial jobless claims, S&P Global services PMI, and ISM services PMI.

EARNINGS

What we’re watching this week:

Today: Levi Strauss (LEVI)

Friday: AZZ (AXX)

Next week’s calendar here

NEWS BRIEFING

'Almost all' Fed officials agreed to skip June hike (more)

Spread between 2- and 10-year Treasuries at deepest inversion since '81 (more)

Saudi Arabia, Russia deepen oil cuts, sending prices higher (more)

US factory slump deepens; construction spending surges (more)

Goldman Sachs loses top M&A ranking for first time in five years (more)

Samsung profit likely lowest in more than 14 years as chip glut persists (more)

Meet Threads, Meta's new ‘Twitter Killer’ (more)

TikTok media gaining subscribers from French riots (more)

Tesla's valuation set to rise over $50 billion after Musk's EV price cuts boosted deliveries to an all-time high (more)

Chevy Rolls out electric version of a classic model (more)

ChatGPT's explosive growth shows first decline in traffic since launch (more)

Goldman Sachs Is in talks to exit Apple partnership (more)

Musk, Zuckerberg lead a $852 billion surge among world’s richest people (more)

Apple cuts vision pro goals after production issues (more)

Microsoft judge grills US regulator on user harm from Activision merger (more)

Tyson will stop using its ‘no antibiotics ever’ label on chicken (more)

DEALFLOW

Mars to buy healthy food maker Kevin's Natural Foods (more)

Monster close to buying rival Bang Energy For $362 million (more)

OMERS, APG to buy Dutch meters business Kenter in $764 mln deal (more)

Australia's United Malt agrees to $1B takeover offer from France's InVivo (more)

Planeteer Capital launches (more)

L3Harris explores sale of $1 billion avionics unit (more)

Boxhub raises $12.4M in Series A funding (more)

Slang.ai raises $20M in funding (more)

Alcott Enterprises acquires Shadow Systems (more)

Donaldson acquires Univercells Technologies (more)

Flywheel raises $54M in Series D funding (more)

Redpanda Data raises $100M in Series C funding (more)

Revcast closes $3M seed funding (more)

Nuvocargo raises $36.5M in Series B funding (more)

CRYPTO

BlackRock CEO Declares Bitcoin An “International Asset” (more)

Class Action Vs. Ripple: Judge Allows US XRP Investors To Pursue Securities Claims (more)

Crypto Miners Are Selling Bitcoin With Prices Near One-Year High (more)

Singapore's MAS Orders Crypto Firms to Keep Customer Assets in a Trust by Year-End (more)

Ethereum-Based Yield Powerhouse Pendle Finance Expands to BNB Chain (more)

SHARES

Know someone who would enjoy this?

What did you think about today's briefing?

Enjoy your day and see you tomorrow -mb