Good morning.

The Fast Five → Trump agrees to delay tariffs on EU, Tim Cook’s bad year keeps getting worse, Xi mulls new Made-in-China plan, US will control US Steel as part of Nippon deal, and companies turn to AI to navigate Trump tariff turbulence…

📌 President Trump's inner circle has a plan that could radically change how Social Security works. Which is why it's time to protect yourself before the White House makes its move by July 22. (ad)

Calendar: (all times ET) - Full Calendar

Today:

Durable-goods orders, 8:30A

Consumer confidence, 10:00A

Tomorrow:

Minutes of Fed’s FOMC meeting, 2:00P

Your 5-minute briefing for Tuesday, May 27:

US Investor % Bullish Sentiment:

↑ 37.70% for Week of MAY 22 2025

Previous week: 35.93%. Updates Friday.

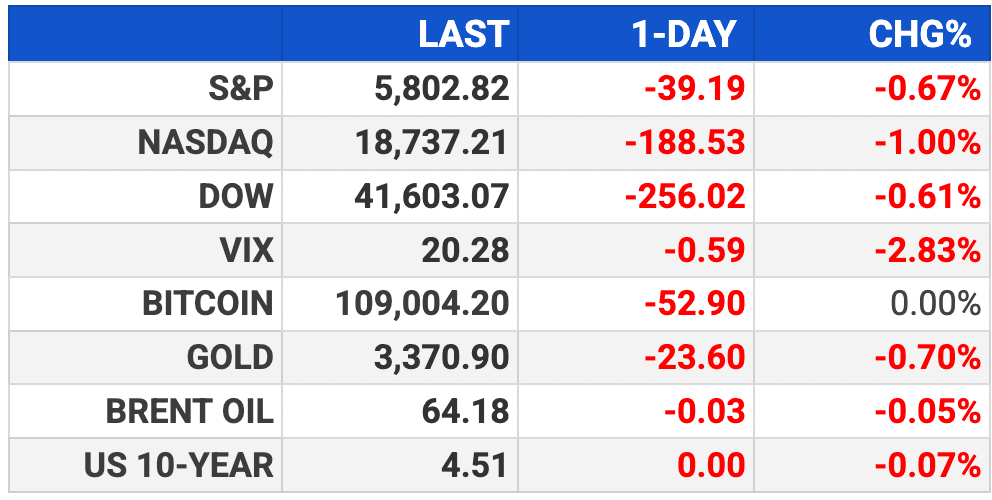

Market Wrap:

European shares rise after Trump delays EU tariff hike to July 9

Stoxx 600 +1%; DAX +1.6%; CAC 40 +1.2%; UK closed

Auto stocks rebound; VW +2.6%, BMW +2%, Mercedes +2%

Zealand Pharma +10% after upbeat Cantor Fitzgerald note

Asia trades mixed; U.S. markets closed for Memorial Day

EARNINGS

Here’s what we’re watching this week:

Wednesday: Abercrombie & Fitch $ANF ( ▲ 0.53% ), Dick's Sporting Goods $DKS ( ▲ 1.72% ), Macy's $M ( ▲ 1.82% )

Nvidia $NVDA ( ▲ 1.02% ) - earnings of $.73 per share (+19.7% YoY) on $43.2B revenue (+66.2% YoY)

Salesforce $CRM ( ▼ 0.07% ) - earnings of $2.55 per share (+4.5% YoY) on $9.7B revenue (+6.6% YoY)

Thursday: American Eagle $AEO ( ▲ 1.24% ), Gap $GAP ( ▲ 1.95% ), Kohl's $KSS ( ▼ 2.49% ), Ulta Beauty $ULTA ( ▼ 1.43% )

Costco $COST ( ▼ 0.26% ) - earnings of $4.24 per share (+12.2% YoY) on $63.1B revenue (+7.8% YoY)

TOGETHER WITH PACASO

The key to a $1.3T opportunity

A new real estate trend called co-ownership is revolutionizing a $1.3T market. Leading it? Pacaso. Led by former Zillow execs, they already have $110M+ in gross profits with 41% growth last year. They even reserved the Nasdaq ticker PCSO. But the real opportunity’s now. Until 5/29, you can invest for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

HEADLINES

US stock futures leap as EU tariff delay bolsters market optimism (more)

Xi mulls new Made-in-China plan despite US call to rebalance (more)

Trump: US will control US Steel as part of Nippon deal (more)

Bond market shudders as tax bill deepens deficit worries (more)

Gold hovers near two-week high on dollar weakness (more)

Euro could become the dollar's alternative, Lagarde says (more)

Oil edges down as potential higher OPEC+ output eyed (more)

Companies turn to AI to navigate Trump tariff turbulence (more)

Nvidia to launch cheaper Blackwell chip for China after US export curbs (more)

Chinese tech giants: how they’re dealing with US chip curbs to stay in AI race (more)

Jony Ive’s OpenAI deal puts pressure on Apple to find next big thing (more)

BYD continues to tumble following price cuts (more)

Xiaomi takes aim at Tesla’s bestselling car in China with its longer-range YU7 (more)

Walmart, Costco, Dollar General lean into gas station business (more)

DEALFLOW

M+A | Investments

OpenAI to acquire AI device startup co-founded by Jony Ive for $6.5B

Putin approves sale of Aggreko's Russian assets to BurService

Peak Technology acquired Jinxbot 3D Printing

Impossible Cloud Network raised investment from NGP Capital at a $470M valuation

Strava, the popular fitness app, raised funding at a $2.2B valuation, with participation from Sequoia Capital and TCV

VC

Fore Biotherapeutics raised $38M in Series D-2 funding, bringing its total Series D to $113M

RevenueCat, a platform for managing app subscriptions, raised $50M in Series C funding led by Bain Capital Ventures

Siro, an AI-powered conversation intelligence platform for in-person sales, raised $50M in Series B funding led by SignalFire

Hedra, a multimodal content generation startup, raised $32M in Series A

OpenFX, a financial infrastructure company, raised $23M in funding

Tarjama, an AI translation company, raised $15M in Series A funding

viAct, an AI impact monitoring platform, raised $7.3M in Series A funding

Optura, a healthcare AI compliance platform, raised $6.5M in seed funding led by Susa Ventures

Carrot, a digital lending platform, raised $4.2M in funding

Every, a media startup, raised $2M in Seed funding

WorkDone, a compliance automation company for healthcare, raised $1.8M in seed funding

Toolmart, a procurement tech platform, raised Seed funding

Wirespeed, a cybersecurity startup, raised an undisclosed amount

CRYPTO

BULLISH BITES

📉 How I shorted $TRUMP coin (and got to have dinner with the President).

🤖 America's manufacturing future still needs foreign robots.

💲 Here’s how much a ‘Made in the USA’ iPhone would cost.

⌚️ TAG Heuer has reissued its classic Monaco watch that Steve McQueen made famous in the 1971 racing movie, Le Mans.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.