Good morning.

The Fast Five → EU, India sign ‘mother of all deals’, Trump becomes the ultimate activist investor, consumer confidence plunges to 12-year low, space firm Redwire stock rockets 28%, and Trump says he's not concerned with dollar’s decline…

📌 A former hedge fund manager who made $274M in profits for his clients says "Yes." How? With something he calls "Skim Codes." You just type the code into a regular brokerage account. No stocks. No crypto. No guessing. He's sent out 52 money-making codes so far, with more coming soon. Go here to see it for yourself » (ad)

Calendar: Full Calendar »

Today:

FOMC Rate Decision, 2:00P

FOMC Press Conference, 2:30P

Tomorrow:

Unemployment Claims, 8:30A

Your 5-minute briefing for Wednesday, Jan 28:

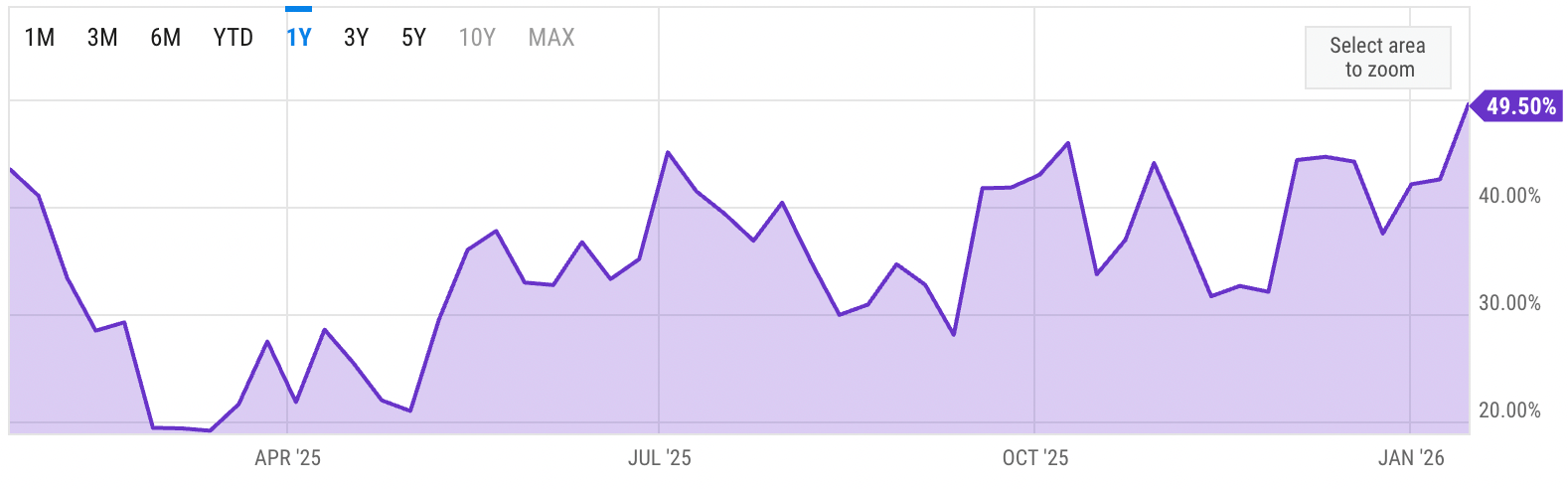

US Investor % Bullish Sentiment:

↓ 43.17% for Week of JAN 22 2026

Previous week: 49.50%

Market Wrap:

Futures near flat with S&P ~flat, Nasdaq 100 +0.2%, Dow -25

Tuesday S&P +0.4% record, Nasdaq +0.9%, Dow -400 on UNH -20%

Today: the Fed decides with a hold expected at 3.5% to 3.75%

Markets still price two cuts by end of 2026

MSFT, META, TSLA report Wed. after the close and AAPL Thu.

EARNINGS

Here’s what we’re watching this week:

Today: AT&T, $T ( ▲ 1.93% ), Progressive $PGR ( ▼ 0.19% ), Starbucks $SBUX ( ▼ 2.78% ), Meta Platforms $META ( ▼ 2.81% ), Microsoft $MSFT ( ▼ 3.21% ), Tesla $TSLA ( ▼ 2.91% )

GE Vernova $GEV ( ▲ 0.16% ) - eps of $3.12 (+80.3% YoY) on $10.22B (-3.2% YoY)

THU: Blackstone $BX ( ▼ 6.23% ), Mastercard $MA ( ▼ 5.77% )

Apple $AAPL ( ▲ 0.61% ) - EPS of $2.67 (+11.3% YoY) on $138.45B revenue (+11.8% YoY)

FRI: Chevron $CVX ( ▲ 0.53% ), Exxon Mobile $XOM ( ▲ 2.36% ), Verizon $VZ ( ▲ 0.87% )

A MESSAGE FROM THE OPPORTUNISTIC TRADER

A Former Hedge Fund Insider Just Unveiled Money-Making Codes

Larry Benedict ran a top 1% fund and made $274 Million in profits.

Now, he's sharing the money-making codes they used…

You can punch these codes into an ordinary brokerage account and potentially "skim" $6,361 or more today.

- a sponsored message from The Opportunistic Trader -

HEADLINES

S&P 500 marks closing record as corporate earnings roll in (more)

Fears grow of rising US inflation (more)

Consumer confidence plunges to 12-year low (more)

Dollar slides as Trump says he's not concerned with decline (more)

Gold jumps over 3% to record peak as uncertainty fuels safe-haven bids (more)

Oil futures surge 3% a barrel as winter storm slams US output (more)

Return of Venezuelan crude could cut US fuel oil imports (more)

Homebuyers are backing out of deals at the fastest pace in nearly a decade (more)

Citi sees bigger Yen rally depending on shift back to Japan bonds (more)

Prediction markets put strong odds on BlackRock's Rieder as next Fed chair (more)

Space firm Redwire stock rockets 28% after joining $151B contract for Trump’s ‘Golden Dome’ (more)

UnitedHealth forecasts first revenue drop in nearly four decades (more)

UPS to eliminate 30k more jobs as Amazon volume cuts accelerate (more)

DEALFLOW

M+A | Investments

China's Anta Sports snares 29% Puma stake for $1.8B, rules out full takeover

Mirum Pharmaceuticals completes acquisition of Bluejay Therapeutics

VC

Ricursive Intelligence, an AI Lab focused on building self-improving systems, raised $300M in Series A funding

4DMedical Limited, a software-based respiratory imaging technology, raised over $100M in new institutional placement

Mesh, a crypto payments network, raised $75M in Series C funding

Summize, an AI Contract Lifecycle Management software, raised $50M in funding

TRexBio, a clinical-stage biotech company, raised $50M in funding

Flora, a creative technology company, raised $42M in Series A funding

Memcyco, a real-time digital risk protection platform, raised $37M in Series A funding

Compa, a provider of AI-driven compensation intelligence solutions, raised $35M in Series B funding

Fiddler AI, an enterprise AI observability and security platform, raised $30M in Series C funding

Fulcrum, an AI platform for insurance brokerages, raised $25M in combined Seed/Series A funding

Gridline, a platform for private market investing in the wealth channel, raised $18.5M in Series a funding

Opendate, an all-in-one platform for booking, ticketing, and marketing live events, raised $14M in Series A funding

Fortitude Biomedicines, Inc., a developer of immune cell targeting biologics, raised $13M in Seed financing

Concourse, an AI agent platform for finance teams, raised $12M Series A funding

Chamelio, a legal intelligence platform, raised $10M in Seed funding

Jelou, a platform for building AI agents in messaging apps, raised $10M in Series A funding

Risotto, an autonomous AI ITSM agentic platform, raised $10M in Seed funding

SpotDraft, an AI-powered contract lifecycle management platform, raised $8M in Series B extension funding

CVector, an AI solution that empowers industrial companies with real-time recommendations, raised $5M in Seed funding

Midship, an AI-native platform automating Sarbanes-Oxley testing and internal audit workflows, raised $4.15M in Seed funding

Nerd Apply, a privacy-first platform for outcome-driven college counseling, raised $3.2M in Seed funding

Navidence, a tech company defining health data, raised an undisclosed amount in Seed funding

CRYPTO

BULLISH BITES

📈 The gold rally is the new bet against Trump.

🤖 Faster-drying paint and better-smelling soap: AI tries product development.

🤑 The world's 10 richest families.

🙏 A parent’s only wish: ‘I just want to sit in my car and scroll’.

DAILY SHARES

Have feedback or a suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.